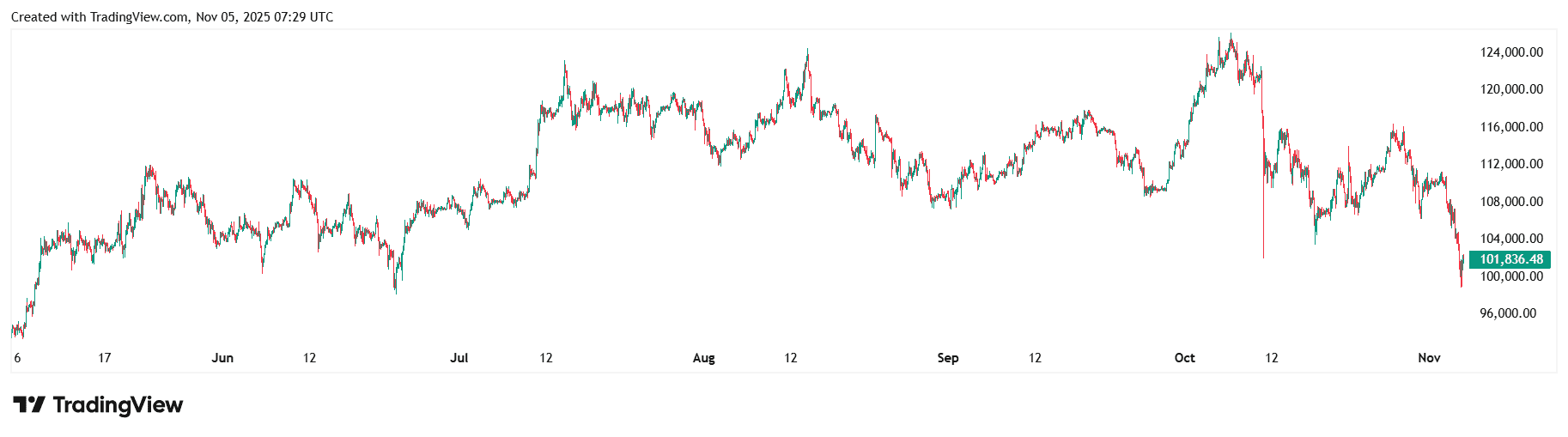

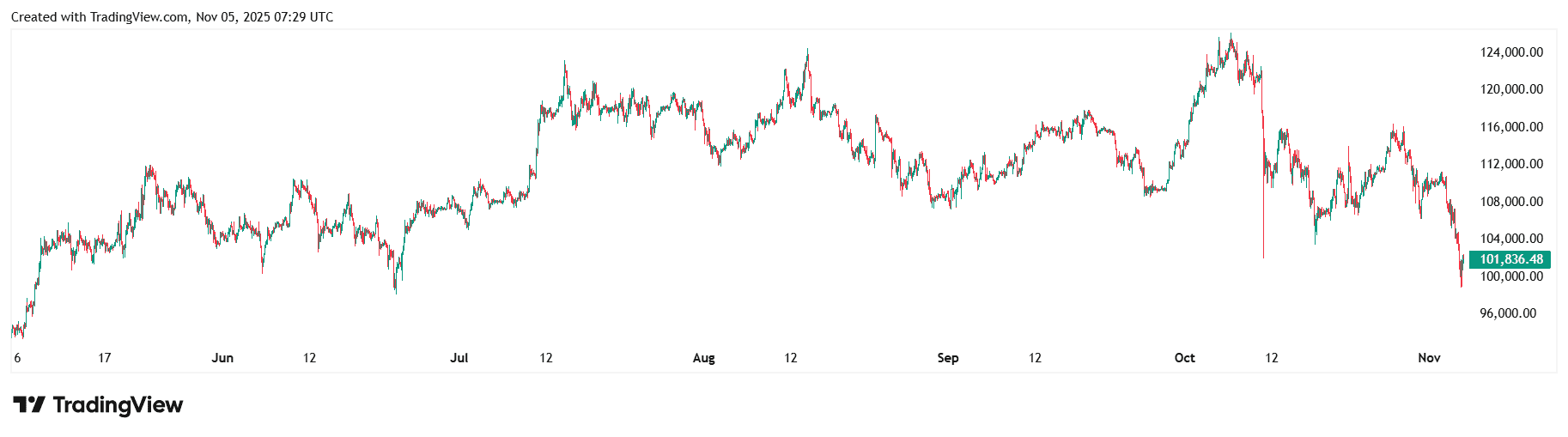

On the night of November 5, 2025, the bitcoin price fell to $98,966 at the moment, according to TradingView. The exchange rate collapsed below the $100,000 level for the first time since late June 2025.

At the time of writing, the price has partially recovered. The asset is trading above $101,000 and has consolidated in this range.

Following bitcoin, other assets also experienced a drawdown. Ethereum stands out among them, which fell by almost 5% over the day.

The daily volume of liquidations exceeds $1.77 billion. These are mostly long positions, as traders were counting on the market recovery after the correction on November 4.

The Fear and Greed Index fell 16 points overnight, reflecting traders’ pessimism:

The current collapse is likely a continuation of a downtrend fueled by a number of factors. These include the Fed’s cautious stance on further policy easing, falling demand among institutional holders, and asset sales by large holders.

This one, in particular, was pointed out by Wincent CEO Paul Howard in a commentary for CoinDesk. According to him, the excitement around ETFs and DATs that was seen in the summer of 2025 has died down. Meanwhile, large holders continue to sell assets, creating selling pressure with nothing to absorb.

The expert believes that the current trend could even lead to a new bear market, and this is broadly consistent with bitcoin’s four-year cycle.