The Incrypted editorial team has prepared another digest of the week’s main events in the Web3 sphere. In it, we will tell you about the allegation of manipulation of liquidation data on CEX, including Binance, the maximum FUD on the crypto market, the false issue of 300 trillion PYUSD, the unethical launch of e-hryvnia, and much more.

Main News

Bitcoin

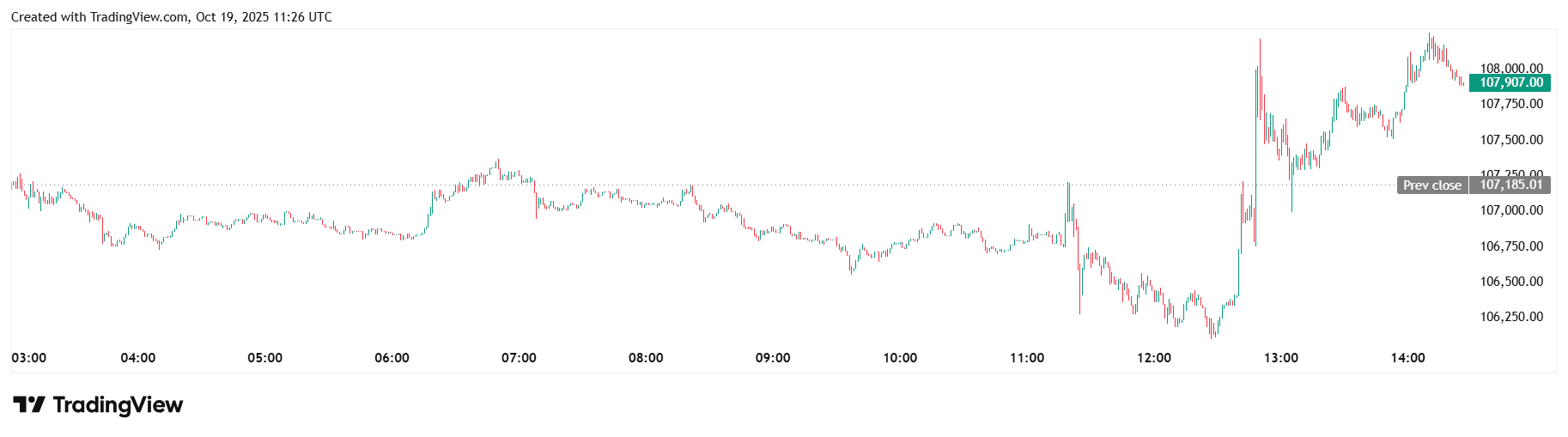

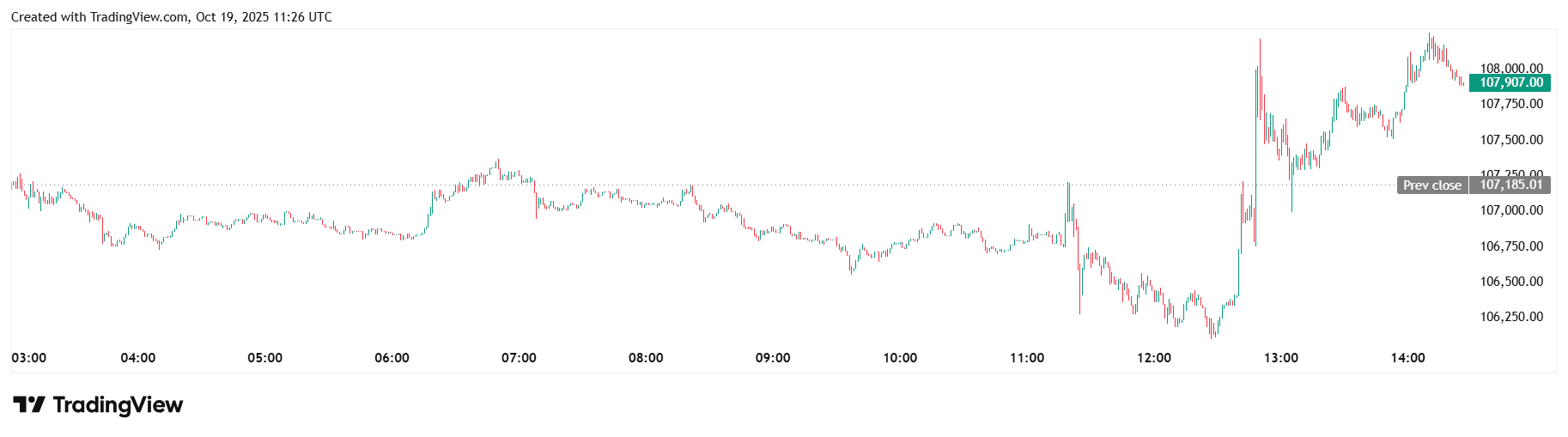

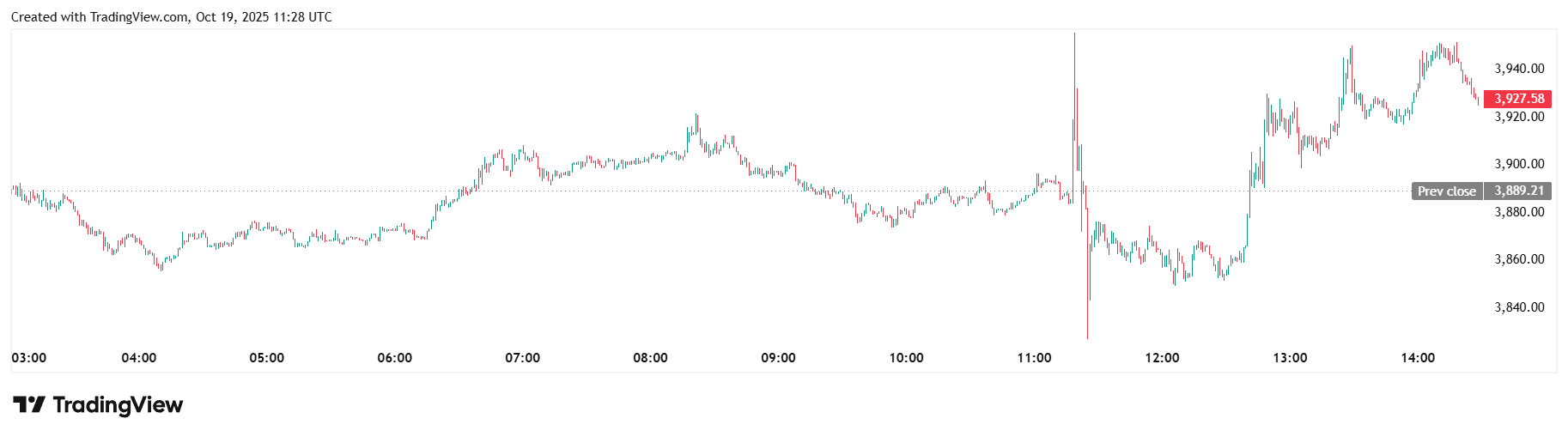

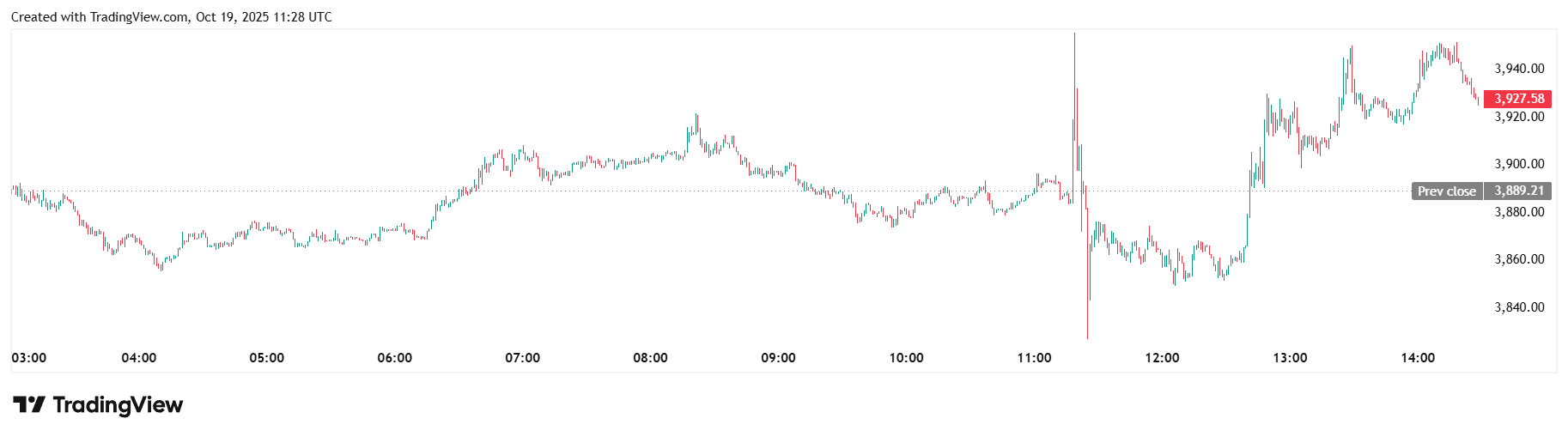

After a large-scale wave of liquidations worth more than $19 billion, bitcoin recovered above $115,000 and Ethereum to $4100 at the beginning of the week, stabilizing the market. On the night of October 17, the price of the first cryptocurrency dropped to $105,000, causing liquidations of $1.2 billion and a drop in the fear index of 22 points. At the time of writing, bitcoin is trading below $108,000, according to TradingView.

Meanwhile, gold has set an all-time high of $4380 an ounce with a market capitalization of over $30 trillion, confirming its safe-haven status amid market turbulence.

- Analytics, Forecasts, and Investor Behavior

According to CryptoQuant, bitcoin has entered the late stage of the bull cycle, and open interest has decreased by $12 billion, indicating a decline in speculative activity. Citigroup stressed the asset’s close correlation with the stock market, but maintained its forecast of $133,000 by the end of the year. Analysts at 10X Research estimated that retail investors lost $17 billion due to the overvaluation of bitcoin stocks such as Metaplanet and Strategy.

- Corporate Activity and Technology Adoption

MARA has increased its portfolio to 53,250 BTC, taking advantage of the market downturn, while Metaplanet has lost capitalization below the value of its bitcoin assets. At the same time, analysts recorded the movement of $75 million in bitcoins to wallets linked to the US government, which they interpreted as a rebalancing.

Meanwhile, the Bitcoin Core team released the v30.0 update, and Square launched the world’s first bitcoin payment at Compass Coffee, testing the Lightning network in a real business.

- Mining

Mining equipment manufacturer Canaan, in cooperation with Canadian Aurora AZ Energy Ltd, has launched a pilot mining centre in Alberta. Its capacity is 2.5 MW, and electricity is generated from hard-to-reach natural gas.

Ethereum

- Market Trends and Metrics

Citizens Investment Bank predicts more than 200% growth in SharpLink shares, calling the company the new Ethereum treasurer. Analysts expect that Ethereum could rise to $7,000 by 2026 and drive SharpLink’s capitalization as the network’s ecosystem expands.

At the time of writing, the price of Ethereum below $4000, according to TradingView.

- Technological Development of the Network

Bhutan’s Digital Identification System (NDI) will be switched from Polygon to Ethereum by early 2026 to improve its reliability, security, and decentralization. The new solution will provide citizens with an embedded digital identity, passwordless login, and electronic signature capabilities.

- Technical Error or New Record

Paxos accidentally released 300 trillion PYUSD on the Ethereum network during an internal transfer, but the excess was immediately burned. The incident was not related to a hacker attack and became the subject of active discussion on social media.

Regulation

- Laws and Draft Laws

The parliaments of Kenya and California have passed laws that create new approaches to the storage and use of digital assets. The Kenyan law regulates the activities of crypto service providers, while the California document guarantees the preservation of unclaimed assets in their original form under state control.

- Policy, Innovation, and Government Initiatives

In the United States, Republicans are preparing a bill that will allow the inclusion of crypto assets in pension plans, and Securities and Exchange Commission (SEC) Chairman Paul Atkins has called tokenization a key area of regulatory policy.

Meanwhile, Sony has applied for a banking license to issue its own stablecoin, while the NBU has postponed the launch of the e-hryvnia due to the excessive cost and ethical risks during the war.

Stablecoins

- Investments and Stablecoin Products

BlackRock has restructured one of its funds to attract stablecoin issuers and plans to invest in short-term bonds and overnight REPOs.

Meanwhile, Stripe has added payment for subscriptions in USDC stablecoins to Polygon and Base, and Tether has announced the launch of the Wallet Development Kit for the simplified creation of crypto wallets.

- Market and Regulation

Bernstein analysts predict that USDC and Circle will become the leaders of the US stablecoin market, growing to $220 billion in capitalization by 2027 and $4 trillion by 2035.

Meanwhile, the Governor of the Bank of England, Andrew Bailey, called on the G20 countries to tighten control over stablecoins due to the risks of private financing and regulatory arbitrage.

Projects

- Investments and Corporate Transactions

According to Bloomberg, Securitize is preparing to go public through a merger with a special purpose vehicle (SPAC) from Cantor Fitzgerald, which could value the company at $1 billion.

Meanwhile, Ripple Labs plans to raise $1 billion through a SPAC to create an XRP reserve, and Coinbase has invested in CoinDCX with a valuation of $2.45 billion. Also, Kraken acquired Small Exchange for $100 million, while DL Holdings and Antalpha are investing $200 million in tokenized gold and mining.

- Innovations and Technological Launches

The Enso Network, Monad, and Hyperliquid teams presented major updates ranging from the launch of the mainnet to the opening of the token stamp and the introduction of the HIP-3 offering.

In addition, the Brevis project launched The Proving Grounds campaign to demonstrate applications of zero-disclosure technologies, and Uniswap added Solana support to the web version of its application. Meanwhile, Backpack Exchange is integrating the Superstate platform to allow trading in SEC-registered US tokenized stocks.

- Politics, Media, and Regulation

According to the FT, companies associated with US President Donald Trump have earned more than $1 billion from crypto projects, while his son Eric confirmed World Liberty Financial’s plans to tokenise real estate.

At the same time, the mayor of New York City has created an office for crypto assets and blockchain, which will be the first of its kind in the United States.

In addition, Bloomberg reports that China Renaissance is preparing a $600 million investment product in BNB, and Arthur Hayes is launching a $250 million fund to buy mid-tier crypto services.

Hackers

- Cyberattacks and Fraud

Ukraine’s cyber police exposed a group of residents of Khmelnytsky region who created a fake cryptocurrency and fraudulently appropriated funds from investors from Europe and the Middle East.

Meanwhile, the official Dota 2 YouTube channel was hacked to promote a fake memecoin with a market cap of more than $9,000, but access to the channel was later restored.

- Cyber Investigations and Privacy

Crypto analyst ZachXBT has revealed the identity of the hacker who stole $28 million from the Bittensor protocol using his own method of deanonymizing transactions through the Railgun mixer.

At the same time, Telegram warned users in France about the risks of the Chat Control law, which could effectively destroy the privacy of messages in the European Union.

Artificial Intelligence

- Artificial Intelligence and Science

Google DeepMind has made a breakthrough in biomedicine: its new artificial intelligence (AI) model has discovered a potential cancer treatment that increases the immune visibility of tumors.

At the same time, Anthropic is forecasting explosive revenue growth to $26 billion in 2026, driven by enterprise customers and scaling its global presence.

- Competition between Tech Giants

Global corporations are massively investing in AI capacities:

- Google — $24 billion in centers in the US and India;

- BlackRock, Nvidia, Microsoft — $40 billion in the purchase of Aligned data centres;

- Oracle and AMD — a cluster of 50,000 MI450 GPUs (200 MW);

- Black Forest Labs — plans to raise $300 million at a valuation of $3.25 billion.

Against this backdrop, Microsoft is under pressure from lawsuits over allegations of artificially inflating ChatGPT prices, which could affect its position in the AI market.

Market Manipulation, Insiders, and the Shadow of the White House: The Crypto Market after the Crash

After large-scale liquidations of more than $19 billion, Hyperliquid founder Jeff Yang accused centralized exchanges of manipulating data, saying that they underreported statistics by hundreds of times. Crypto.com CEO Chris Marszalek called on regulators to check the platforms’ activities and tighten requirements for transparency in trading.

Amid the scandal, analysts discovered a possible leak of information from the White House that could have been used by traders on Hyperliquid to open shorts worth hundreds of millions of dollars. One of them, having earned $150 million, reopened a position worth $160 million, which only increased suspicions of insider trading and market manipulation.

FUD, Crash, and Optimism: How the Market Reacts to Shocks and Recovers

Following Trump’s announcement of tariffs against China, Santiment analysts recorded the highest level of FUD since March. Historically, this has been accompanied by a rise in the price of bitcoin. The large-scale collapse of the crypto market on October 11 generated more than $20 million for credit protocols in fees per day, while a report by Bank of America showed a recovery in investor optimism to a year’s high despite fears of an AI bubble.

In other news:

- Trust Wallet reported a glitch in the display of user balances

- WazirX received a court order to compensate victims of last year’s hack

- Crypto whale held a loss-making short for five months, despite the opportunity to close the deal in profit

- JPMorgan Chase confirmed its plans to launch crypto trading

- South Korea resumed its review of the Binance-Gopax deal, with approval expected by the end of the year

- Binance denied allegations of trying to make money on the listing of new tokens

- The IMF called on governments to officially recognize digital currencies as part of the global financial system

- Poland said that Russia finances sabotage in the EU through cryptocurrencies

- Australia is considering restricting access to crypto ATMs

- The US continues the shutdown due to the Senate’s blocking of government funding

What’s up with Incrypted?

Articles

The Incrypted editorial team has analyzed the success factors of BNB after the largest correction in the history of the crypto market:

Airdrops

Guides and activities:

- Brevis;

- Mento;

- Block Street;

- XMTP;

- OpenMind.

In addition..

- We’ve gathered the key investments in blockchain, cryptoassets, and AI over the past week in one article.

- We regularly update the Incrypted crypto calendar, where you will find a lot of interesting events and announcements.