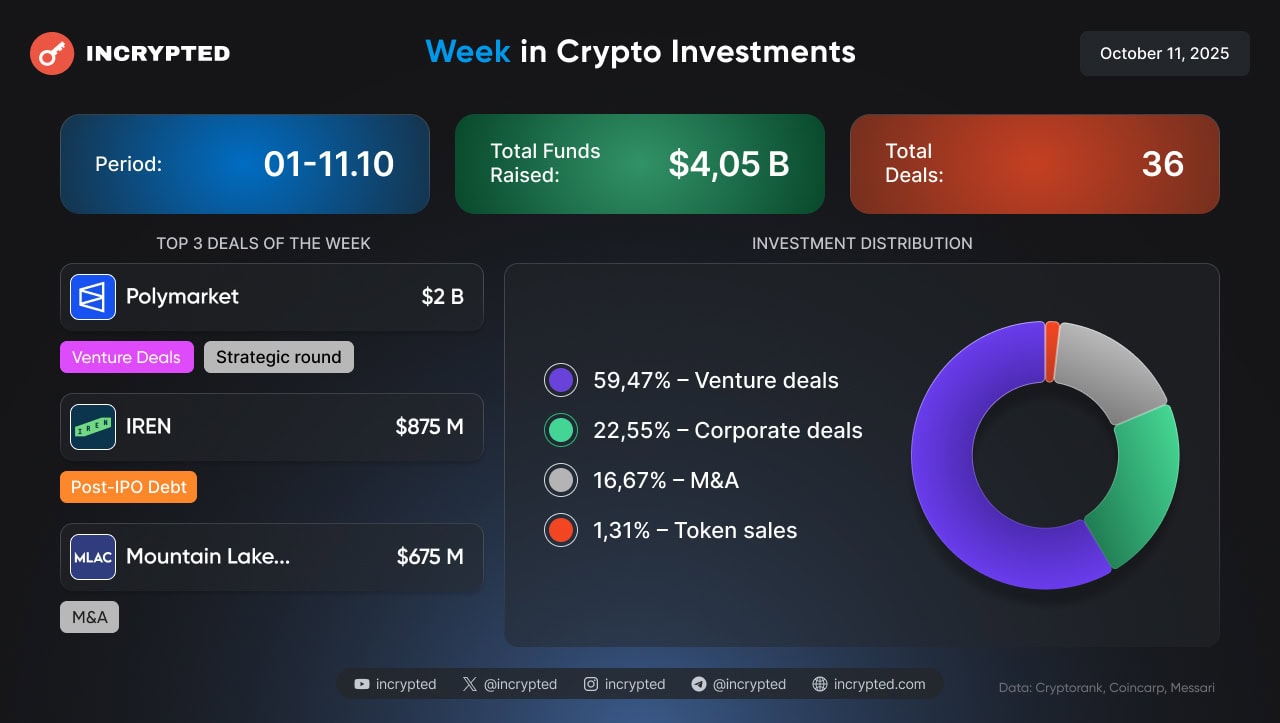

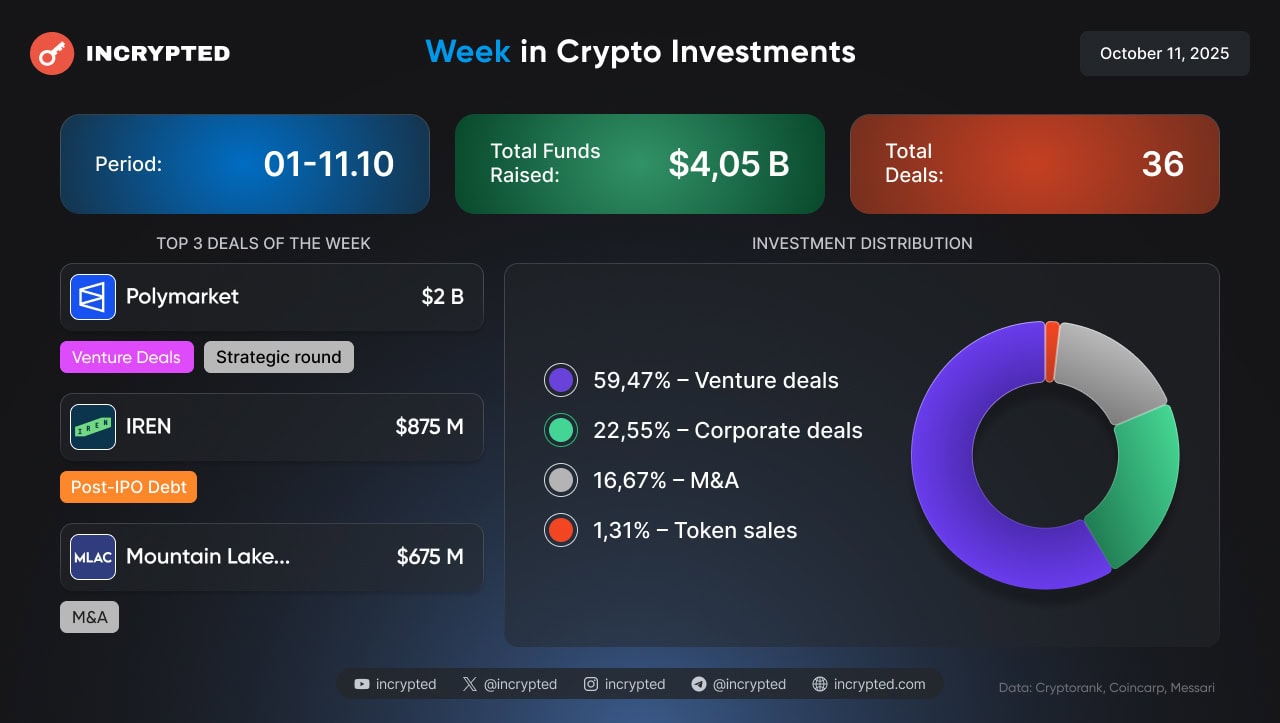

Between October 1 and 11, 2025, Incrypted’s editorial team recorded 51 investment deals, 36 of which totaled almost $4.05 billion. These included corporate deals, traditional venture capital fundraising, token sales, and more. The lion’s share of funding came from the Polymarket betting platform, with $2 billion. Read more in our weekly digest.

Classic venture capital

During this period, 28 projects received funding from venture capital companies. In particular:

- $82 million — Meanwhile. The insurance company, which offers bitcoin-denominated life policies with fixed benefits and a secured lending option, raised funds in an undisclosed round with participation from Pantera Capital, Haun Ventures, Bain Capital Crypto, Stillmark, and Apollo Global Management for global expansion into Hong Kong, Dubai, and Singapore.

- $35 million — Amdax. The Dutch crypto platform for investment and digital asset management reported on the investment received to launch a subsidiary AMBTS BV, which will focus on bitcoin treasury and plans to list on Euronext Amsterdam.

- 32 million — Bee Maps. The company, which develops mapping technologies and APIs for geo-analytics using a network of contributing devices, closed an undisclosed funding round with participation from Pantera Capital, Borderless Capital, LDA Capital, and Ajna Capital.

- 30 million — Cypher Games. The mobile gaming company that creates and publishes games, including Match Squad, which combines match-3 mechanics, social interaction and city-building elements, raised funds in a Series A round led by Play Ventures, The Raine Group, e2vc, MIT and BigBets.vc to expand its game lineup and enter new markets.

- 25 million — Coinflow Software. The payment solution for merchants that reduces customer losses during transactions received a Series A round of investment from Coinbase Ventures, Pantera Capital, CMT Digital, Jump Capital, and other investors.

- $22 million — Anthea. The Bermuda-based fintech insurer, which offers cryptocurrency-denominated life policies with savings and loans, closed a Series A round with investment from Yunfeng Financial Group to expand its international presence and develop insurance products in digital assets.

- 17.5 million — Lava. Lava, a financial platform that allows you to store savings in bitcoin and spend them in dollars, has raised capital in an expanded Series A round with a group of private investors, including Lee Linden and Terry Angelos.

- 15 million — Ambrus Studio. The game development studio, which creates blockchain projects using artificial intelligence (AI), has secured a funding round led by Bolts Capital to develop Web2/Web3 games as part of its mission to “make good games for good causes.”

- 15 million — TransCrypts. The digital document management and verification platform that helps businesses and educational institutions simplify data verification reported seed round investment from Techstars, Pantera Capital, Protocol Labs, Alumni Ventures Group, Faction VC, and other investors.

- $15 million — CipherOwl. The digital asset regulatory compliance infrastructure platform that provides APIs and modular tools for blockchain address verification, AI risk analysis, and automated reporting has raised capital in a seed round led by Coinbase Ventures, OKX Ventures, General Catalyst, AME Cloud Ventures, Flourish Ventures, and other investors.

- $14 million — Ethena Labs. The DeFi protocol, which creates a synthetic USDe dollar backed by hedged Ethereum and Bitcoin assets, has attracted strategic investments led by MEXC Exchange to develop a stable crypto-dollar infrastructure.

- $11.5 million — BlockStreet. The fintech platform offering tokenised equity trading, decentralized lending, leverage and profitable strategies for investors has raised funds in a strategic round with DWF Labs, Hack VC, Jane Street Capital, Generative Ventures, Point72 Ventures, and other investors to expand its financial product ecosystem.

- $11.5 million — Fanable. The Web3 marketplace for trading collectibles such as Pok?mon, comics, and digital assets has raised capital in an undisclosed funding round with Polygon, Borderless Capital, Morningstar Ventures, Ripple Ventures, Steel Perlot, and other investors to scale its digital collectibles ecosystem.

- 10 million — Securitize. The company, which provides access to alternative assets through its own digital platform, closed an undisclosed investment round with Ark Invest to further develop its financial infrastructure.

- 10 million — Grass. Solana, a DePIN project that allows users to earn money by sharing unused internet bandwidth, announced investment proceeds in an undisclosed round of funding led by Polychain Capital, and Tribe Capital to expand its network.

- $10 million — 375AI. The company, which develops a decentralised data processing network based on AI and blockchain, announced that it has raised capital in an undisclosed funding round from Delphi Ventures, Hack VC, 6th Man Ventures, Arca, Strobe Ventures, and others to build an edge-data intelligence infrastructure.

- $10 million — Falcon Finance. The DeFi protocol, which creates a universal infrastructure for providing liquidity and issuing synthetic dollars on the blockchain, has raised a strategic round investment from M2 Capital and Cypher Capital to accelerate the development of its universal collateralization infrastructure and increase capital efficiency in decentralized finance.

- 6 million — Agio Ratings. The analytical platform for assessing the risk of companies with digital assets announced that it has raised capital in a round led by Portage Ventures, AlbionVC, and MS&AD Ventures, bringing the total amount raised to over $11 million.

- $6 million — NebX. The decentralized blockchain-based cryptocurrency exchange has closed a funding round with investment from M2M Capital to expand its trading infrastructure.

- 5.5 million — Mesta. The international payments platform that combines blockchain technology and traditional financial systems has received seed funding from Circle Ventures, Canonical Crypto, Paxos, and other investors.

- $5 million — Takenos. The fintech platform for Latin American freelancers that simplifies global payments received funds in a seed round with participation from Lattice Capital, Variant, Nascent, and other funds.

- 5 million — CrunchDAO. A decentralized data analytics platform that collects financial forecasts from a global community of analysts has raised investment in a strategic round from GSR Investments, Galaxy Ventures, Multicoin Capital, and others.

- 5 million — LAB. The multi-chain trading terminal for cryptocurrency trading with low fees, automated strategies, and flexible orders announced the capital raised with the participation of Selini Capital, Re7 Capital, Cypher Capital, Red Beard VC, Lemniscap, OKX Ventures, Animoca Brands, and other investors, which confirms the confidence in the product and its potential in the field of digital culture.

- 4.9 million — fan3. The platform, which helps artists collect and manage fan data from offline events through NFC wristbands and merchandise, has recorded cash inflows led by Pitbull, Improbable, and Zayn Malik.

- 2 million – Ephyra (formerly Game Beast). The interactive entertainment platform that combines AI and gaming in a single virtual environment received funds in a strategic round from Castrum Capital and TBV to develop AI content and new game formats.

- 2 million — Rhuna. The blockchain-based infrastructure layer combining payment, marketing, ticketing, and analytics solutions announced an infusion in a seed round led by Aptos Labs with participation from NewTribe Capital, FunFair Ventures, Keyrock, X Ventures, and other investors to build a stablecoin infrastructure for the entertainment industry.

- 760,000 — Initiativ, a regulated emissions trading platform in the EU and the UK, reported raising capital led by Holmarcom, FrenchFounders and U-Investors to develop direct carbon trading instruments.

A number of other projects have raised funding, but have not disclosed the amount of investment.

Cheeze, a rewards platform that allows users to earn points for purchases made with linked bank cards or crypto wallets at more than 1 million merchants, has raised seed round investment from MH Ventures, Crypto.com Capital, Dutch Crypto Investors, Black Dragon Capital, Newman Capital, and 13 other investors.

Swan Bitcoin, a financial platform that provides bitcoin purchasing and automatic savings plans, has secured Series C funding to expand its service and develop infrastructure for bitcoin investors.

Lighter, an exchange for perpetual futures based on zk-rollup technology on the Arbitrum network that provides transparency through zero proof of knowledge, has secured funding in an undisclosed round from Dragonfly, Founders Fund and Haun Ventures.

Figment, a blockchain infrastructure provider with a Proof-of-Stake mechanism that supports more than 50 networks and over $17bn in staked assets, closed an undisclosed funding round with C1 Fund to support the development of scalable blockchain infrastructure.

BVNK, a payments platform that provides financial solutions to corporate clients, announced an undisclosed round of investment from Citi Ventures that will help expand its global operations.

Binance Japan, a registered Japanese crypto exchange offering spot trading and profit-making products, reported receiving capital in a strategic round from PayPay to strengthen its position in the Japanese digital asset market.

Tokensales

This week, the following projects went public with tokensales:

- tea, an open-source infrastructure platform that uses blockchain to reward developers for their contributions to projects, which raised $3 million to expand the ecosystem and boost open source software development

- Novastro, a blockchain project focused on tokenization and trading of real assets through a cross-chain modular architecture, which received $2 million to develop its technology and launch a platform for tokenizing real-world assets

- Limitless, a decentralized prediction marketplace that allows users to trade cryptocurrencies and tokens on multiple blockchains, which reported $1 million in investment to expand trading capabilities and integrate new blockchains

In addition, you can find out about current and upcoming token sales through the relevant section on the website, where all users have access to information about active and upcoming asset sales campaigns. Our team also maintains a dedicated Telegram channel and monitors the most relevant events:

Corporate placements and transactions

Representatives of the institutional sector continue to accumulate funds to build up cryptocurrency reserves and expand their operations. The following deals were recorded last week:

- $875 million — IREN (Iris Energy). The company, which builds and manages data centers and power infrastructure for bitcoin mining, raised funds in a post-IPO debt financing round to expand its mining and power generation capacity.

- $19 million — VivoPower. The sustainable energy solutions provider with divisions that focus on fleet electrification, renewable energy, and digital asset investments closed a post-IPO round to develop its environmental and blockchain businesses, including the Caret Power to X infrastructure.

- $16.5 million — The Smarter Web Company. The UK’s largest publicly traded bitcoin holder has raised capital in a post-IPO round to scale its operations and improve its platform.

- $2.5 million — Dogehash Technologies. The blockchain company, which specializes in large-scale mining of Scrypt algorithm assets such as Dogecoin and Litecoin, has secured investment proceeds in a post-IPO debt financing round from Thumzup Media Corporation to expand its mining capacity.

Acquisitions and mergers

Between October 1 and 11, the market recorded nine M&A deals.

Avalanche Treasury Co. (AVAT) acquired Mountain Lake Acquisition Corp in a deal worth more than $675 million, including about $460 million in treasury assets. The transaction is intended to create a public company that will provide institutional access to AVAX assets and strengthen the Avalanche ecosystem with over $1 billion in assets under management.

Bastion Asset Management is a London-based fund management company specialising in digital assets and regulated by the UK’s Financial Conduct Authority (FCA). It was acquired by CoinShares to integrate quantitative investment strategies into the crypto market. The deal is pending approval by the UK financial regulator.

AlphaTON Capital has acquired 51% of GAMEE, a subsidiary of Animoca Brands that operates at the intersection of blockchain and mobile gaming. The deal also includes the acquisition of 51% of GMEE and WAT tokens, as well as AlphaTON’s plan to invest up to $4 million in these tokens to strengthen its presence in the Web3 gaming ecosystem.

National Bitcoin ATM is a network of crypto kiosks in the United States that allows you to instantly buy bitcoin and store it in your own wallet. Bitcoin Depot has acquired the assets of National Bitcoin ATM, adding more than 500 terminals in 27 states and strengthening its position as the largest Bitcoin ATM operator in North America.

CoinRoutes, an institutional algorithmic trading platform for crypto assets, purchased QIS Risk, a risk management and portfolio monitoring service for digital assets. The merger creates the industry’s first complete OEMS platform, combining CoinRoutes’ execution technology with QIS Risk’s advanced risk management solutions.

Oasis Pro Markets, a provider of infrastructure for digital securities trading, has become part of Ondo Finance, a decentralised financial protocol. The deal provides Ondo Finance with a full suite of SEC licences (ATS, broker-dealer and transfer agent), making it one of the most regulated digital asset providers in the US.

GuideStar, a team of researchers and engineers specialising in AMM design and order routing for decentralised markets, has joined Uniswap Labs to continue developing cutting-edge solutions in the field of decentralised liquidity and market mechanisms.

Dinero is the developer of one of the fastest growing liquid staking protocols, Ethereum (ETH). The company was acquired by Plume Network to strengthen its RWAfi ecosystem with institutional infrastructure for staking Ethereum (ETH), Solana (SOL), and Bitcoin.

Rezolve Ai is a provider of AI solutions for retail and e-commerce that has announced the acquisition of SQD (Subsquid), a blockchain platform for data indexing and creating GraphQL APIs. With this deal, the company combines AI, decentralised data warehouses, and digital asset payment infrastructures into a single intelligent commercial ecosystem.

Accelerators, grants, and DAO funding

This week, Titan Network, a decentralised platform that pools community computing resources such as power, storage and bandwidth to provide DePIN (Decentralised Physical Infrastructure Network) services, raised an investment with Cointelegraph to develop its decentralised resource infrastructure.

Top investors

The most active investors of the week were Pantera Capital, Road Capital, X Ventures, Coinbase Ventures, and Hack VC, according to CryptoRank.

What is the focus of investors’ attention?

Between October 1 and 11, projects from such segments as DeFi, blockchain infrastructure, blockchain services, CeFi, GameFi, NFT, DAT, and others attracted funding. Investors focused on DeFi.

As a reminder, in September, Web3 projects attracted $34 billion in investments.

Follow the materials on Incrypted to keep abreast of new investments in the development of the digital world.