Against the backdrop of the US Federal Reserve’s (Fed) interest rate decision, as well as in its run-up, traders began actively transferring funds to the Binance crypto exchange. This is stated in a release provided by Incrypted.

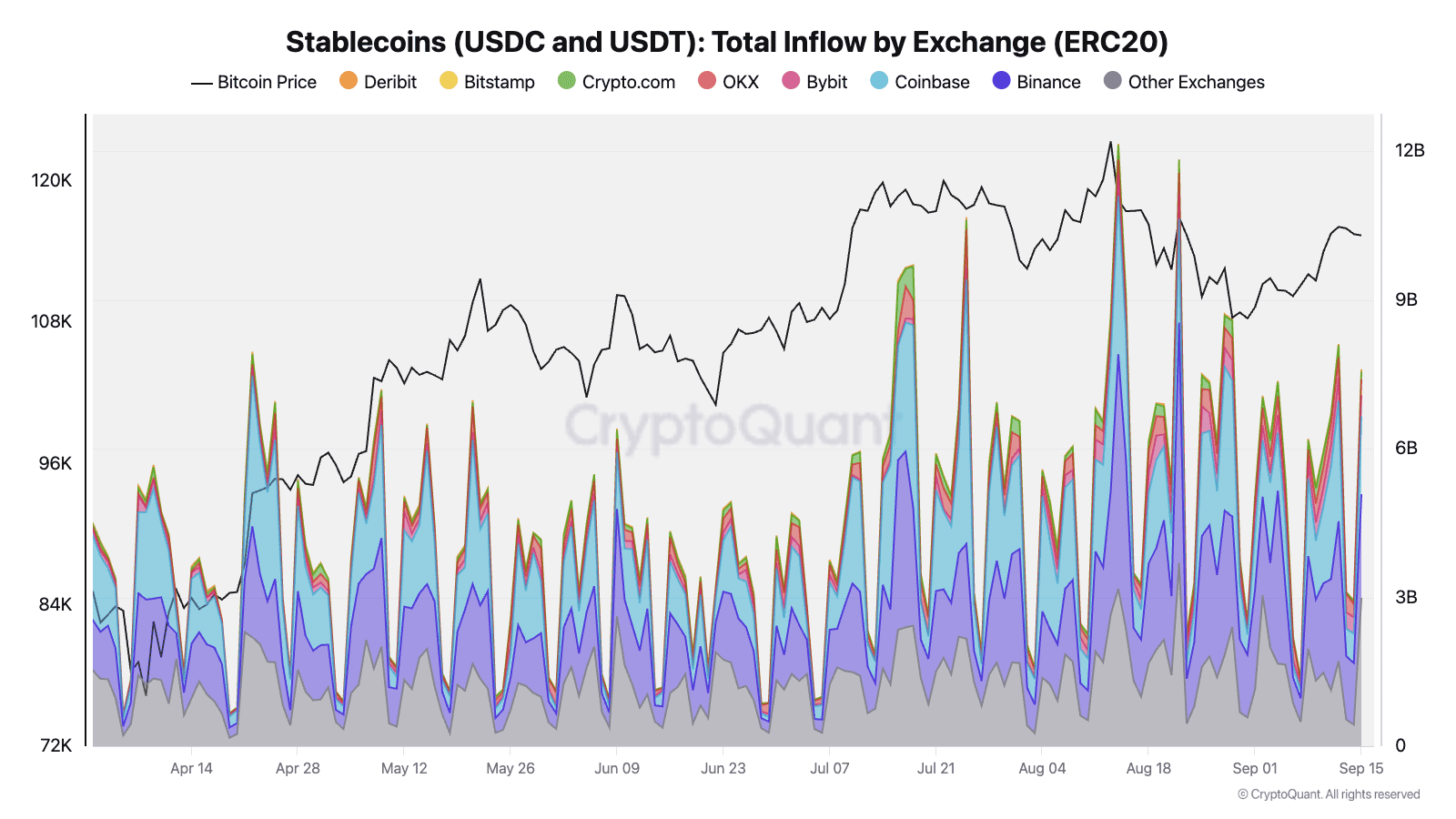

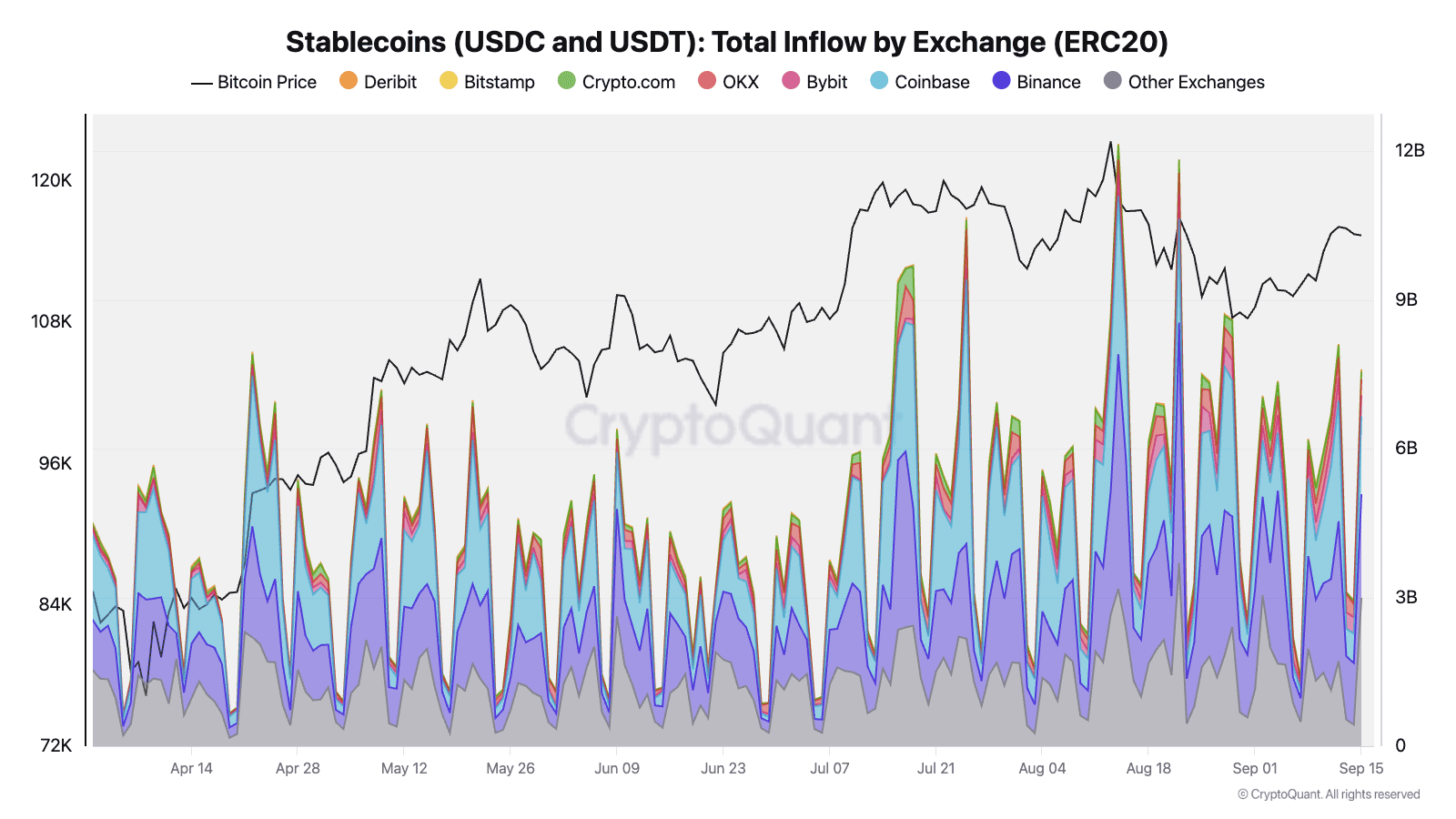

According to CryptoQuant analysts, there was an inflow of USDT and USDC steiblcoins worth more than $2.1 billion — this is more than on any other platform. Experts note that users are building capital in anticipation of potential market growth.

A significant role in the growth was played by large holders. The average USDT deposit on Binance reached $214,000, almost double the July figure, the company noted.

Analysts attribute this to the Fed’s recent decision, which is likely to have an impact on the macroeconomic situation and digital asset markets.

In addition, the number of altcoin deposits on centralised platforms has risen to 55,000 in the last week, well above the early 2025 levels (20,000-30,000). Almost half of this volume — 25,000 deposits — came from Binance.

The exchange is also leading in terms of the number of unique addresses, the release emphasises. This indicates high liquidity and activity on the platform, making it easier for traders to quickly access altcoins and favourable transactions, Binance said.