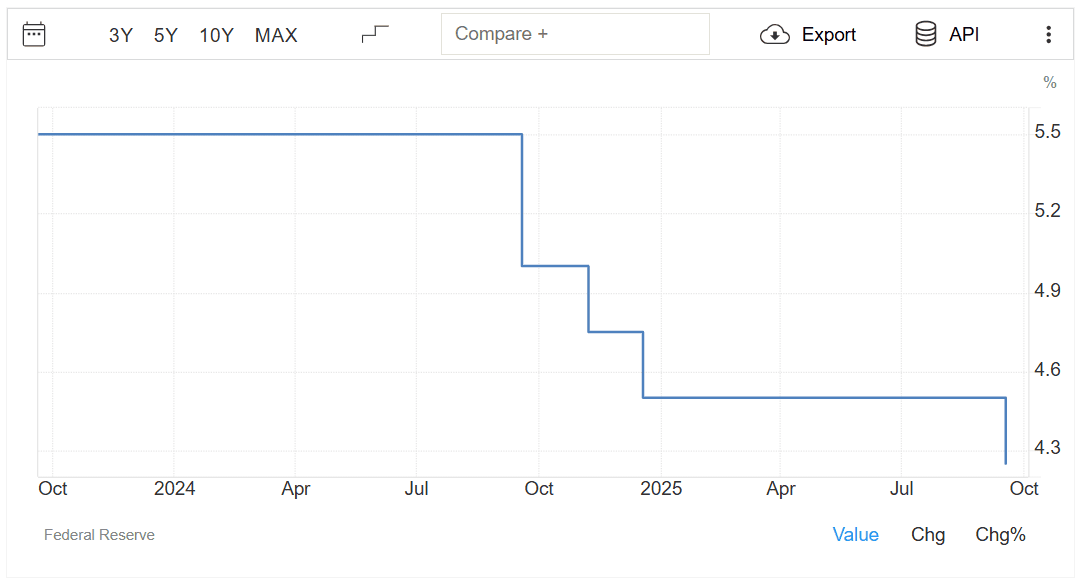

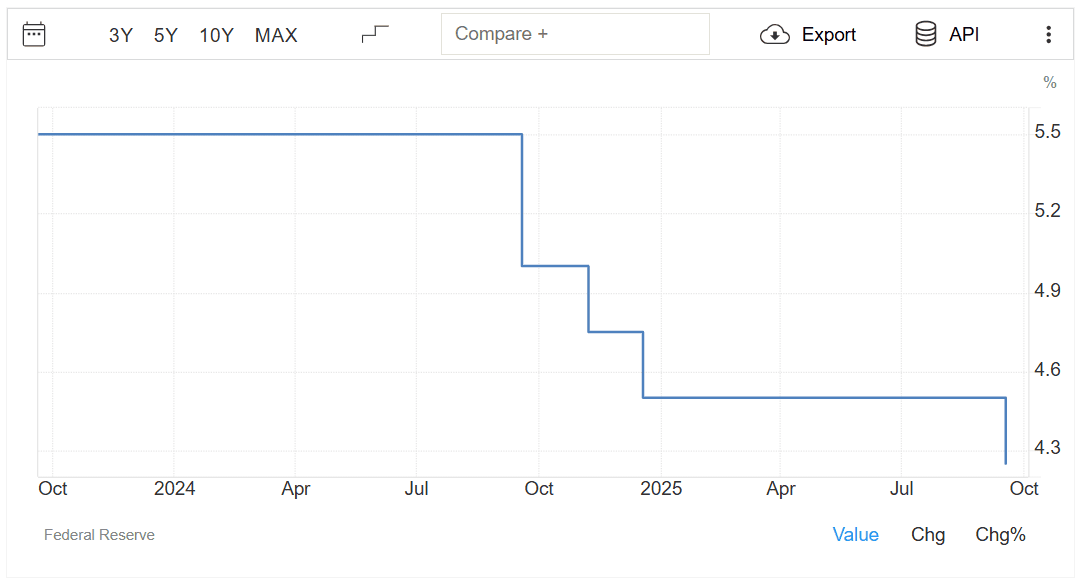

On September 17, 2025, the U.S. Federal Reserve’s Federal Open Market Committee (FOMC) met. The regulator decided to cut the interest rate to 4%-4.25% for the first time since December 2024.

We have previously covered in detail what the Fed interest rate is, how it affects markets, and why experts were confident that the regulator would ease policy despite the rise in US stocks and GDP.

Bitcoin reacted to the news with a moderate rise, reaching $117,900 at one point, after which the price pulled back. In the above-mentioned material, we cited the opinions of experts who believe that in the short term, the markets will face volatility, while in the long term – growth.

The next FOMC meeting is scheduled for October 28-29, 2025. Recall, many experts expect that the regulator will continue to consistently soften policy.

According to the forecast of the CME exchange, the Fed will leave the interest rate at the current level with a probability of 12.3%, reduce it by another 25 basis points – 87.7%.

Abstracts from Powell’s speech

After the FOMC meeting, Fed Chairman Jerome Powell traditionally gave a press conference. In his opening remarks, he noted that inflation in the U.S. has risen, as has the unemployment rate.

The main talking points from his speech:

- GDP growth was about 1.5% in the first half of the year, below the 2024 value;

- this is due to a decline in consumer spending;

- housing activity remains weak;

- unemployment rate rose to 4.3% in August;

- new job growth slowed, falling to 29,000 per month;

- but wage growth, though still moderate, continues to outpace inflation;

- goods inflation accelerated, leading to a rise in the overall index;

- short-term inflation expectations have risen, driven by tariff policy; long-term expectations remain within the 2% target;

- there was no broad support for a 50 basis point interest rate cut at the meeting;

- such a move is often necessitated by the need to drastically restructure the regulator’s policy, now it is inadvisable;

- The Fed rates the risks associated with a slowing labor market higher than those stemming from high inflation.

Responding to questions from the press, Powell declined to comment on Lisa Cook’s court case. She was the first African-American woman on the FOMC, having been appointed to it under President Joe Biden’s administration.

Current U.S. President Donald Trump fired her in late August 2025, accusing her of mortgage fraud. She sued him, noting that there were no legal grounds for resignation.

The American press regards the case as an attempt to influence the Fed by the Trump administration. As well as the appointment of Stephen Miran to the FOMC.