On September 17, 2025 the Federal Open Market Committee (FOMC) of the U.S. Federal Reserve System will meet, following the results of which the regulator will announce its decision on the interest rate. Experts expect policy easing, which may lead to an inflow of liquidity into high-risk assets and, consequently, their growth.

Incrypted editorial team has collected different opinions and forecasts on what course the Fed will follow and why it is important for the crypto market.

What is the interest rate?

It is the cost of short-term (overnight) interbank borrowing. The Fed uses the interest rate (FFR) as its primary monetary policy tool.

By raising the interest rate, the regulator makes such loans less available, reducing the amount of money available and lowering inflation. When the rate is eased, additional liquidity flows into the economy as banks are more willing to lend to individuals and businesses.

How does this affect the stock and cryptocurrency markets?

The Fed’s interest rate directly affects the “cost” of capital. With tight monetary policy, households are reluctant to borrow and invest in low-risk assets, such as US Treasury bonds.

This is due to two factors. The first is the general expectation of economic instability as the Fed raises rates when inflation is high. The second is that bond yields, especially short-term bonds, such as three-month bonds, are in direct correlation with this rate.

A softening rate, in turn, leads to additional funds in the economy as demand for credit increases and investors look for higher-yielding assets. The latter include securities of commercial companies and crypto-assets.

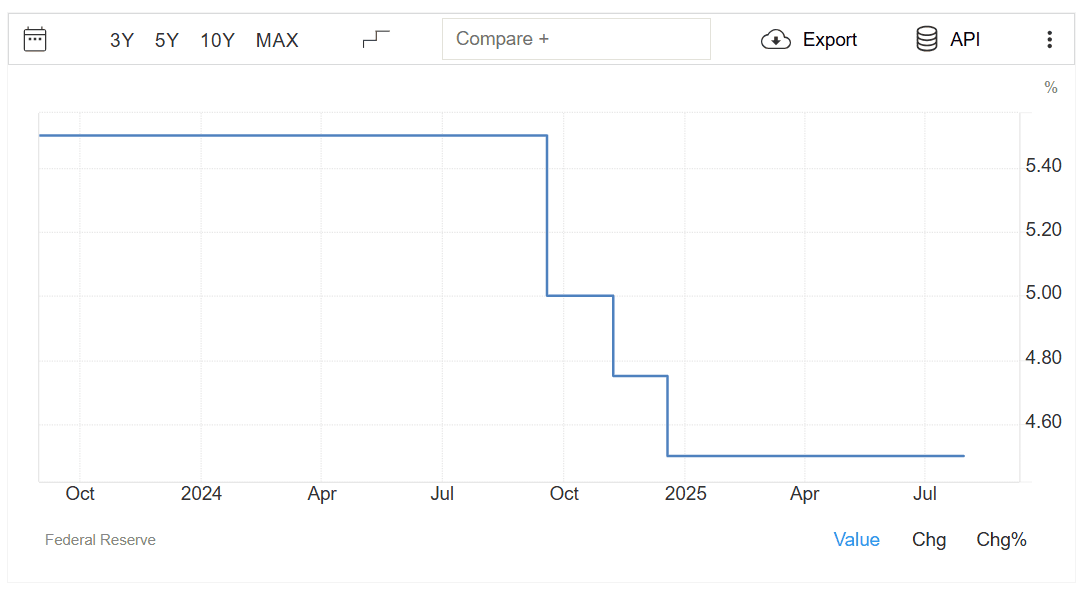

The current interest rate and hints of an interest rate cut

At the end of July 2025, the Fed left the rate unchanged at 4.25-4.5%. The regulator has not changed it since December 2024.

This is due to a number of factors. In particular, as Fed Chairman Jerome Powell said, the regulator “can afford to wait”. In addition, it still aims to achieve an inflation rate of 2%, which is far from the current values.

Specifically, the rate peaked at 2.9% in August, marking an increase of 0.2% for the month. This is a new high since January 2025. At the same time, it has only been rising since April.

Read more about the Consumer Price Index (CPI) and its impact on the crypto market:

Expectations that the Fed will still ease course are driven, in part, by Jerome Powell’s speech at the annual Jackson Hole Economic Policy Symposium. This is likely the last event of this level that he will attend as head of the regulator, as his term expires in May 2026.

His speech was assessed as “dovish” rather than “hawkish”, which fueled expectations of a rate easing. Prior to that, the minutes of the July meeting were released, which indicated that several members were in favor of a rate cut.

Another reason why the Fed may change course is the pressure on Powell from US President Donald Trump. The latter thus seeks to reduce the cost of servicing the national debt, support the housing market, improve economic growth and reduce fiscal pressure.

This was stated directly by himself on his page in the social network Truth Social. For example, these publications are referenced here and here. He also repeatedly criticized Powell himself for being slow and indecisive.

Market and cryptocurrency community expectations

According to the forecast of the CME exchange, the probability of an interest rate cut of 25 basis points is 96%, 50 – 4%. At the same time, up until mid-August, the chances that the Fed would still stick to the current rate were 10-15%.

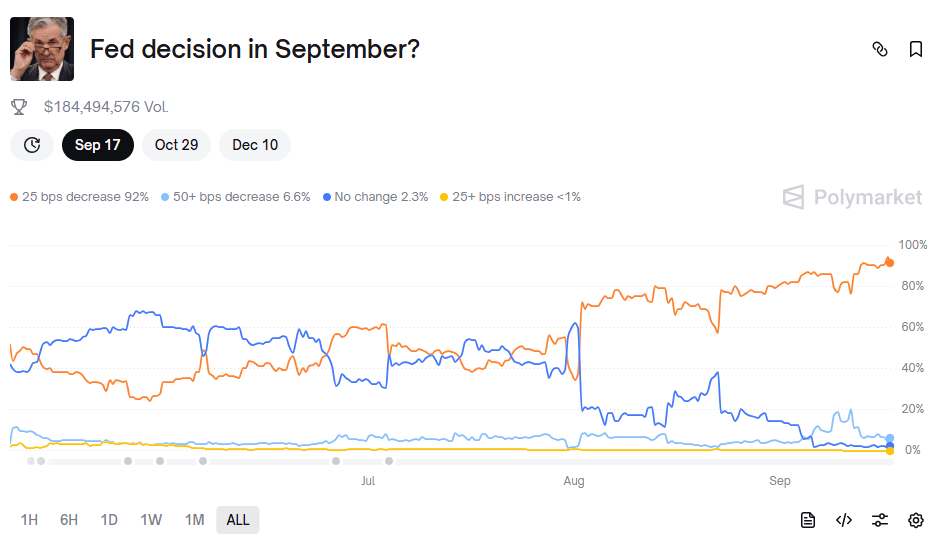

On the Polymarket platform, the probability of a 25 basis point interest rate cut is estimated at 92%, 50 points – 7%. The chances that it will be left unchanged, according to traders, is 2%.

Kalshi, another platform for betting on events, shows a similar pattern:

Some traders and contrarians also believe that the Fed may well cut the interest rate by 50 basis points. Even skeptics, such as Peter Schiff, are confident of a rate easing. He called such a decision “a big political mistake”.

BlackRock experts stick to their forecast that the Fed will reduce the rate twice or even three times in 2025. At the same time, the effect of such a decision has allegedly already partially materialized in the market.

JPMorgan Chase believes that the September interest rate cut will be followed by a consistent easing of the Fed’s policy. The company referred to the appointment of Trump supporter Stephen Miran to the Council.

Morgan Stanley experts take a more cautious position:

“Morgan Stanley’s Global Investment Committee recognizes the political pressure on the Fed to ease monetary policy. We also recognize some cooling of the labor market, which may contribute to a preemptive rate cut. Overall, however, we believe the probability of a cut is moderate, and we rate it much lower at about 50/50.”

Expert opinions and potential impact on markets

The Kobeissi Letter noted that the Fed is in a difficult position. The regulator often cuts interest rates when the economy is weak to support growth.

However, at this stage, valuations of U.S. stocks are at record highs and GDP continues to grow, the project said. In addition, inflation also continues to rise. At the same time, the experts named the weak labor market as the main factor that pressures the Fed to ease policy.

According to the Kobeissi Letter, there have been two years in history when the Fed cut rates when the stock market was rising – 2019 and 2024. This was followed by volatility in the short term and sustained growth in the long term.

“Gold and bitcoin know this. The straight-line price increases we are seeing in these asset classes reflect expectations of the future. Gold and bitcoin know that lower rates amid an already hot situation will only push the assets higher. Now is a great time to own long-term assets,” the experts summarized.

A similar opinion is held by analyst and entrepreneur Ted Pillows. He emphasized two possible scenarios of bitcoin price movement when the Fed rate is lowered:

- testing the $104,000 level and subsequent moderate upward movement;

- collapse to $92,000, rebound and move to a new all-time high.

Investor and entrepreneur Anthony Pompliano also agreed with Kobeissi Letter’s forecast. He noted that the growth factor in U.S. equities was only able to be realized by about 1% of local households, while the vast majority were “left out”.

“Yes, they [the Fed] will cut rates. And that’s with stocks near their highs and inflation above 2.9%. That’s never happened before,” he noted.

And he is also confident that stocks, gold and bitcoin will surge in response to the Fed’s policy easing.

The S&P 500 Index, according to TradingView, has not yet reacted in any way to the approaching Fed meeting. Both it and the Nasdaq 100 are trading below the closing level of the previous day’s session.

Bitcoin has also marked a drawdown. On the daily chart, it amounts to 0.08%. However, on the weekly chart, a gain of more than 4.6% can be traced. This may indicate that at least part of the expectations of a rate cut is already embedded in the formation of the asset price.

Note, we will be covering the Fed’s decision and Powell’s speech in our Telegram channel. Subscribe so as not to miss it.