.post-accordion-wrapper .accordion-content {

max-height: 0;

overflow: hidden;

}

Back in the late 1990s, cryptographer Nick Szabo introduced the concept of Bit gold — a decentralized digital currency with a fixed supply, designed to mirror the scarcity of gold. The project was never launched, but many of its core ideas became the foundation for the world’s first cryptocurrency: Bitcoin.

Szabo brought more to the emerging crypto space than just technical blueprints. He introduced the “ghost of gold” — a metaphor that has haunted attempts to build decentralized payment systems for decades.

The notion of Bitcoin as “digital gold” quickly took root among investors, developers, and journalists, eventually becoming one of the most enduring narratives shaping how people perceive the cryptocurrency.

For some, this “virtual metal” feels just as real as its physical counterpart. For others, it’s nothing more than a clever marketing trick. Either way, the comparison has firmly embedded itself in the collective imagination of the crypto community.

At Incrypted, we set out to examine whether Bitcoin truly deserves its reputation as the new gold — and where this comparison originally came from.

The Myth of “Digital Gold”

In reality, Satoshi Nakamoto never intended to create “digital gold.” At least not in the way the narrative is often presented today. In the Bitcoin whitepaper, the cryptocurrency is described as a peer-to-peer electronic cash system, with a clear focus on its role as a means of payment.

The only reference to gold appears in the explanation of the Proof-of-Work mechanism. Nakamoto noted that, much like precious metals, Bitcoin requires a certain cost and effort to be “mined.”

This comparison likely played a role in shaping the idea of “digital gold,” but there is no evidence it was taken seriously in the early days.

Was the similarity between the names Bit Gold and Bitcoin merely accidental? Nick Szabo presented his concept in 2005, although it is widely believed that he developed the idea much earlier. In any case, Nakamoto was familiar with Szabo’s work, and it influenced Bitcoin’s architecture.

Adding the word coin to the name may have been a deliberate choice, emphasizing Bitcoin’s role as a medium of exchange rather than merely a store of value or a precious asset, like gold.

.post-accordion-wrapper .accordion-content {

max-height: 0;

overflow: hidden;

}

Another step in this direction was taken by Litecoin founder Charlie Lee. In November 2011, while explaining the differences between his project and Bitcoin, he used the metaphor of “silver” and “gold.”

At the time, Lee was simply referring to Bitcoin’s low throughput and network speed, which, in his view, made it unsuitable for everyday payments. However, his remarks helped shape a clear perception of cryptocurrencies through analogy.

The birth of the “digital gold” myth can be traced to January 2015, when The New York Times journalist Nathaniel Popper published the book Digital Gold. In it, he shared the stories of early Bitcoin community members, illustrating how different people perceive the cryptocurrency’s value in different ways. The catchy title, however, clearly played a decisive role in popularizing the metaphor.

Later, the term was embraced by investors as well. As early as 2019, Gemini exchange founders Cameron and Tyler Winklevoss described Bitcoin as “digital gold,” highlighting its scarcity, divisibility, and fungibility.

Interestingly, another comparison they made — Ethereum as “digital oil” — has also remained widespread within the community.

What do all these companies have in common?

They are all building on @ethereum. $ETH is digital oil. pic.twitter.com/4CKZvx7ad7— Matteoikari.eth (@matteoikari) July 1, 2025

Against the backdrop of rapidly rising inflation during the COVID-19 pandemic, the concept gained new momentum. In September 2020, Strategy CEO Michael Saylor not only called Bitcoin “digital gold” but also made it the company’s primary corporate reserve asset. He later transformed the company into the largest publicly disclosed holder of the cryptocurrency.

Around the same time, similar statements came from Rick Rieder, a top executive at BlackRock, and Anthony Scaramucci, founder of the venture fund SkyBridge Capital.

After Donald Trump’s victory in the 2024 presidential election, the term also entered political discourse.

Mentions of “digital gold” appeared in a White House statement on the creation of a U.S. strategic digital assets reserve. Additionally, the president’s son, Eric Trump, has repeatedly publicly compared Bitcoin to gold.

The popularity of “digital gold” can largely be attributed to its simplicity and intuitive appeal. It doesn’t require a deep understanding of cryptography or economic theory. Everyone knows what gold is and what it’s used for. By using this analogy, it’s easy to imagine Bitcoin as a rare, limited resource capable of storing value.

This concise metaphor works much like the “world computer” image used for Ethereum. It’s not a precise technical description, but it provides a convenient way to explain the concept to a broad audience.

.post-accordion-wrapper .accordion-content {

max-height: 0;

overflow: hidden;

}

By 2025, “digital gold” has become a well-established and widely recognized term. It frames Bitcoin as a store-of-value instrument, analogous to gold, but in a digital environment. The metaphor has proven so effective that it has taken hold in popular perception, despite not being part of Bitcoin’s original design.

But what exactly allowed all these prominent figures to draw a parallel between “solid” gold and a digital asset that has no physical form at all?

Precious Metal Simulation and the S2F Concept

The “digital gold” theory is essentially a successful analogy. Several technical characteristics of Bitcoin allow this comparison, as they closely mirror the properties of physical gold:

- Limited supply — Bitcoin’s supply is capped at 21 million coins, making it a scarce resource, similar to gold, which exists in finite quantities.

- Costly extraction — Mining requires significant computational power and energy, which Nakamoto compared to the effort needed to extract gold from the ground.

- Gradual issuance reduction — The halving every four years slows the creation of new coins, akin to how the depletion of gold deposits slows mining.

- Divisibility — Bitcoin can be divided down to 1 satoshi, making it suitable for transactions of any scale. Gold, too, can be divided into bars and coins of various weights.

- Universality — Bitcoin can be sent anywhere in the world, independent of borders or authorities. Gold, while requiring physical transport, is also a universal asset, not tied to any particular currency or country.

In essence, Bitcoin simulates the physical properties of precious metal. Nakamoto himself was aware of this, likening the creation of new coins to gold mining.

In the early versions of the Bitcoin client, the process of creating new coins was called generation. However, the term mining, likely inspired by the analogy in the technical documentation, quickly caught on within the community.

By the end of 2010, threads began appearing on BitcoinTalk with titles like New demonstration CPU miner available and World’s First Mining Pool. This marked the shift from neutral “generation” to a costly, competitive process — much like extracting precious metals. This change in terminology may also have contributed to the formation of the “digital gold” narrative.

.post-accordion-wrapper .accordion-content {

max-height: 0;

overflow: hidden;

}

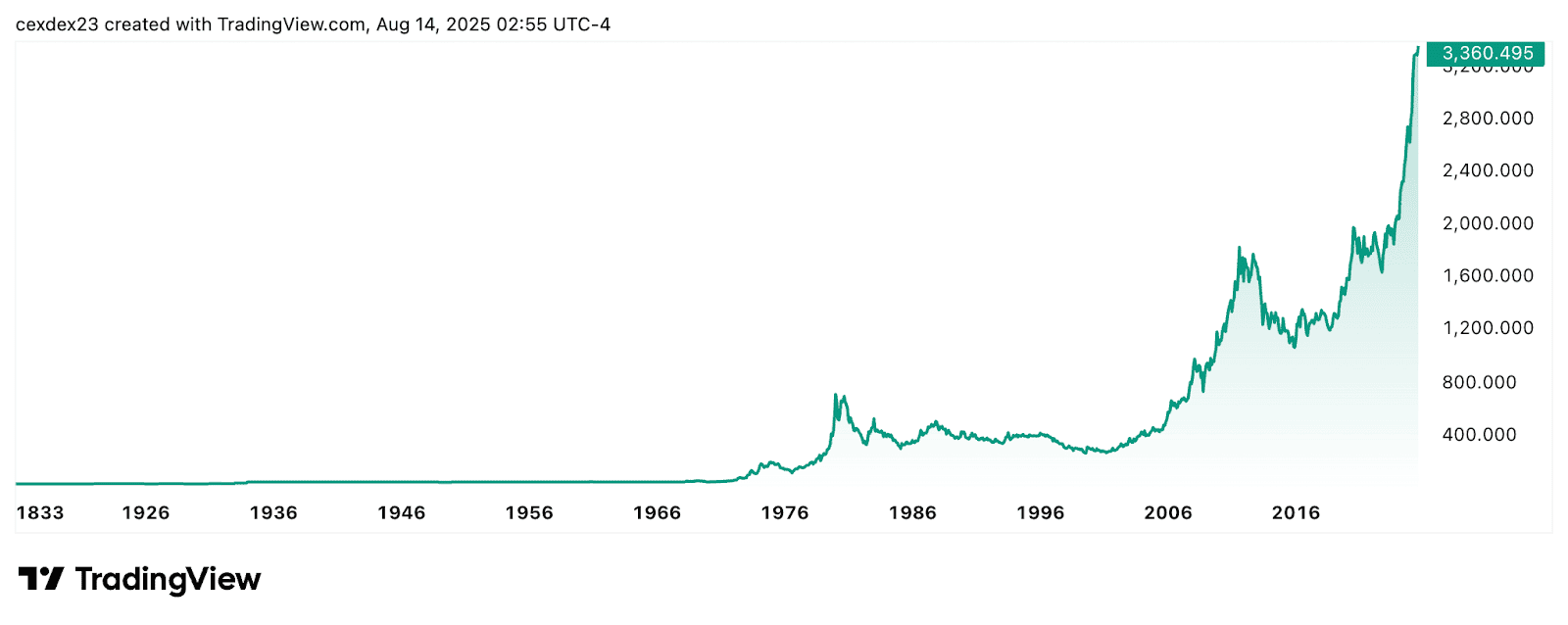

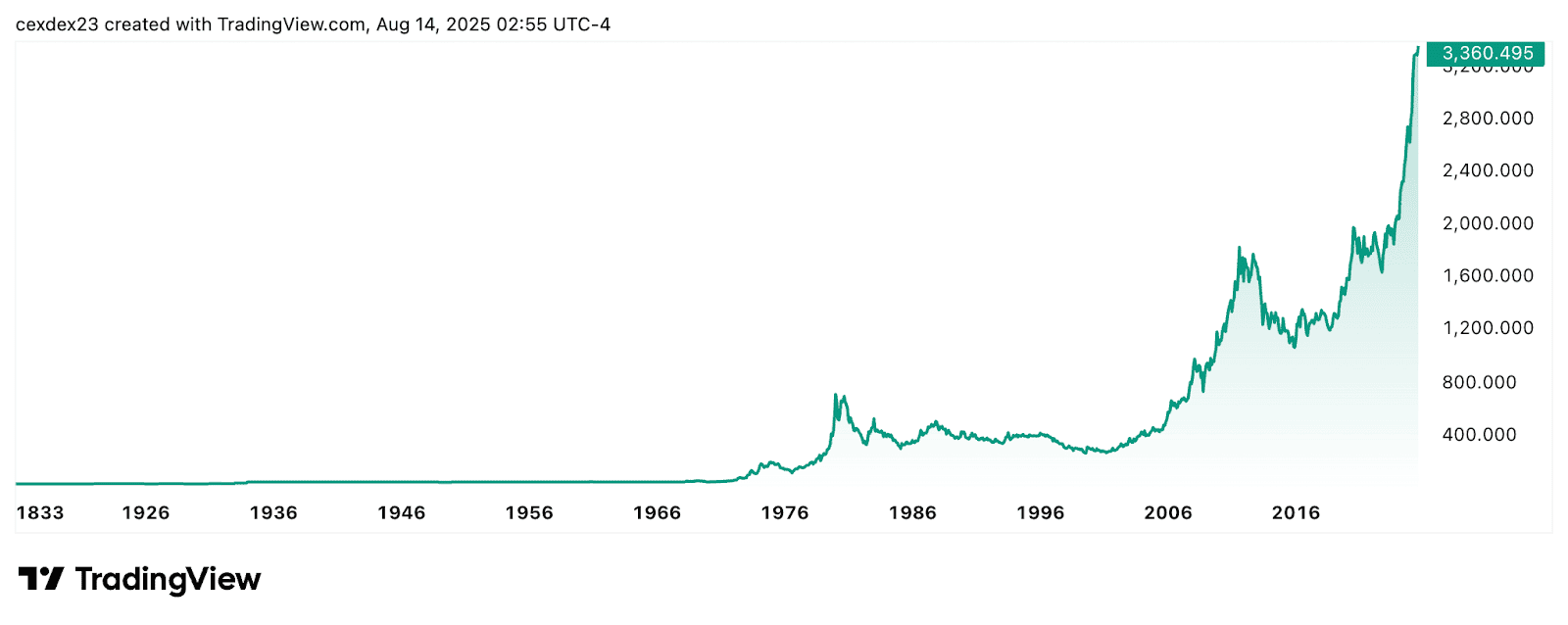

Another proof of the success of this simulation is Bitcoin’s Stock-to-Flow (S2F) pricing model, popularized by analyst PlanB in 2019.

The model measures the ratio of an asset’s existing stock to its annual production — a metric traditionally used to assess the scarcity of gold and silver. For Bitcoin, this ratio automatically increases due to programmed halvings, which gradually reduce the supply. Notably, this reduction is far more predictable and occurs faster than it does with gold.

Based on historical data, the S2F model has proven relatively effective at forecasting Bitcoin’s price dynamics over the long term.

Supporters of the “digital gold” concept view the strong correlation between S2F and Bitcoin’s price as evidence that the cryptocurrency follows the same economic principles as precious metals.

However, the model is often criticized for ignoring market factors, which can lead to inaccurate predictions, especially over shorter timeframes. At the time of writing, Bitcoin’s expected value was roughly three times higher than its actual price — hardly a “minor” deviation.

So what truly determines Bitcoin’s value, and does the market actually see it as a digital equivalent of gold?

“Digital Gold” in Action

Bitcoin’s fundamental characteristics — limited supply, mining difficulty, and universality — do indeed resemble those of gold. However, the numbers suggest that market participants are not as confident in this precious metal simulation as PlanB might hope.

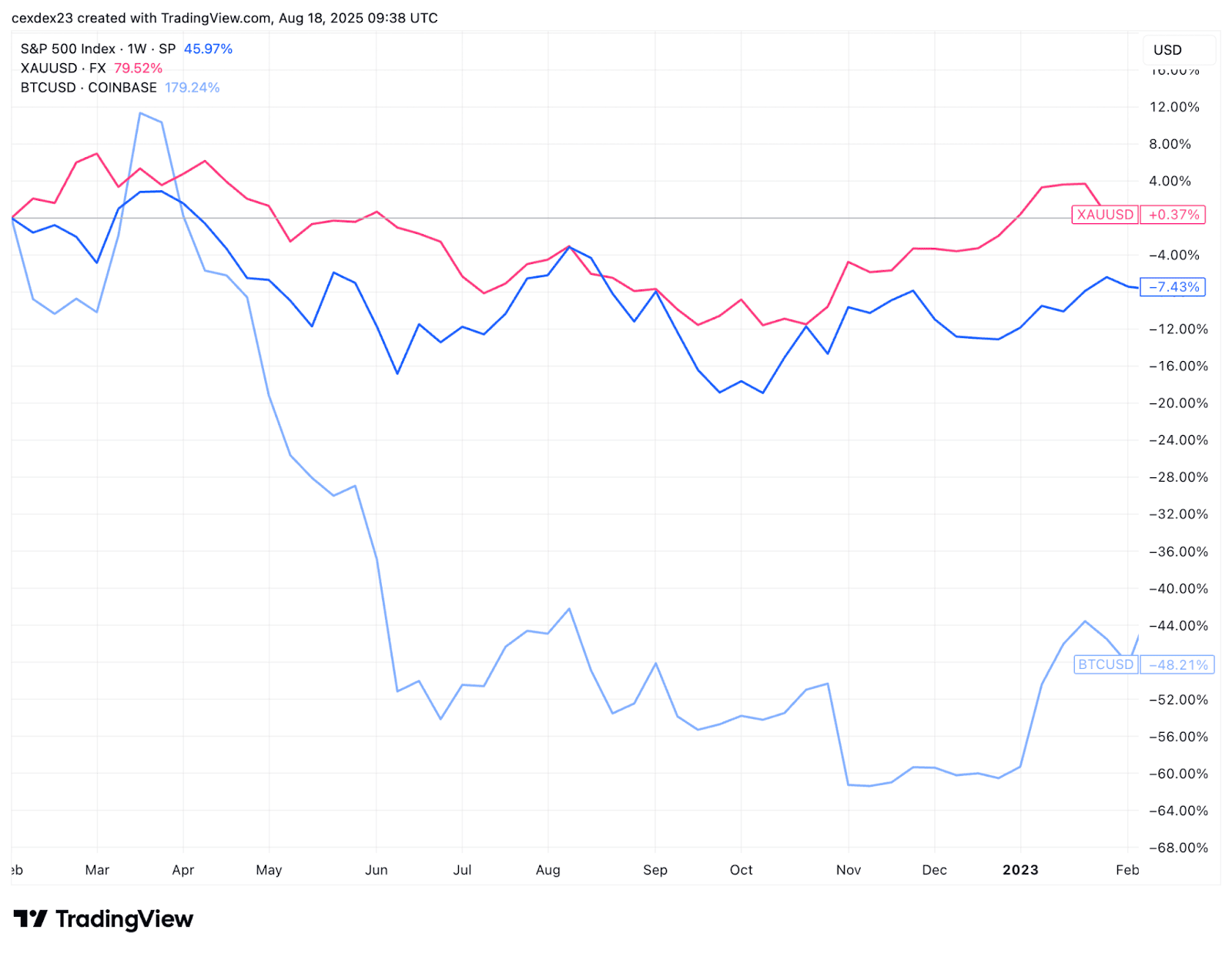

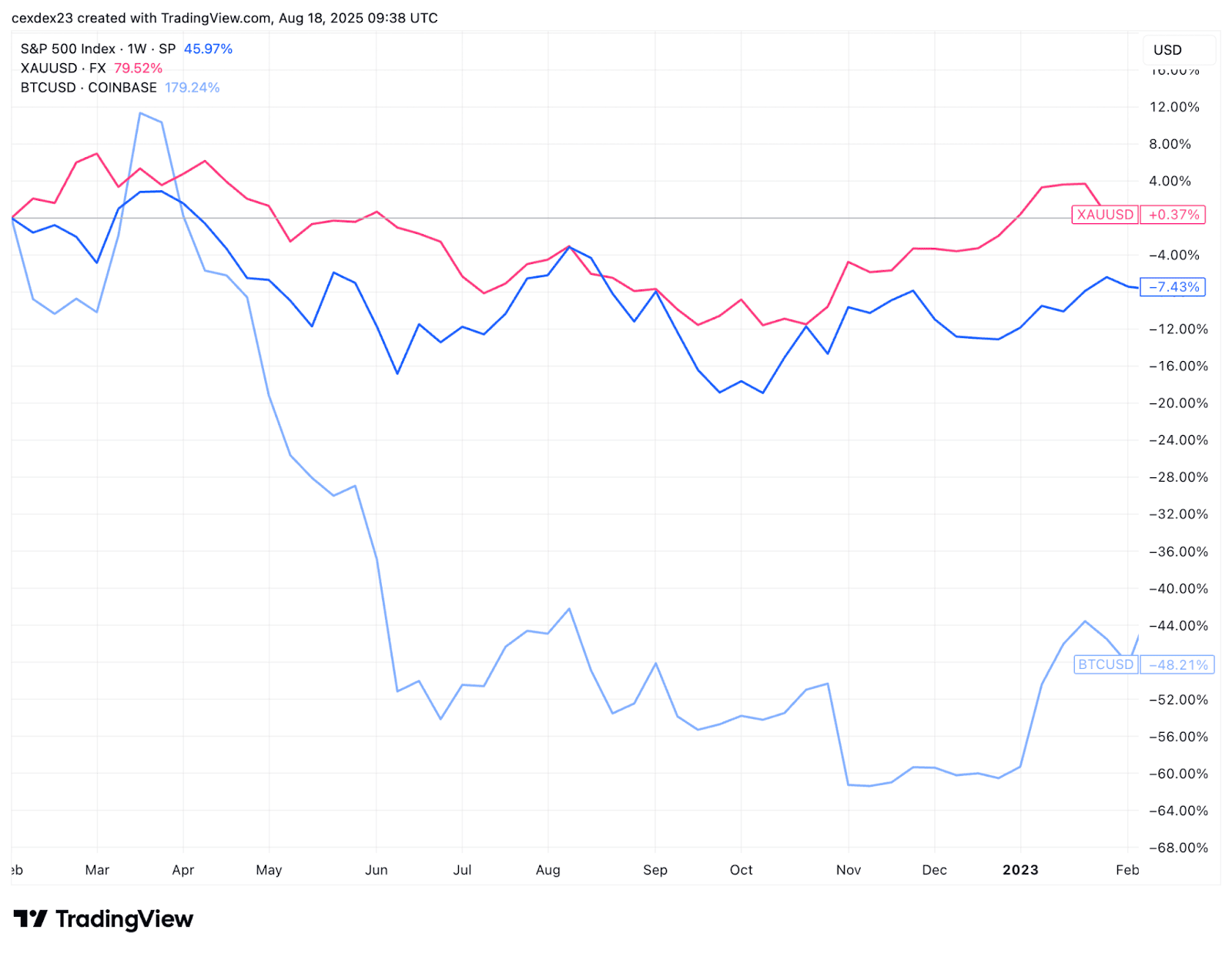

According to DIW data, from 2015 to 2025, the monthly correlation between Bitcoin returns and the S&P 500 was around 0.33. In contrast, gold shows almost no correlation with stock indices (around -0.01) and has a negligible connection to Bitcoin (around 0.04).

In other words, the market dynamics of the first cryptocurrency are synchronized with risk assets — stocks and tech indices — rather than with traditional safe-haven instruments.

After 2020, Bitcoin’s dependence on the stock market only intensified. The influx of venture investors, exchange-traded funds and public companies has turned Bitcoin into a component of portfolios managed using the same models as equities.

For these holders, cryptocurrency is simply another speculative instrument, and their buy and sell decisions are driven by liquidity and risk appetite. This is fundamentally different from gold, which is perceived as insurance, designed to protect capital during periods of instability.

The Illusion of Synchrony

The idea that “Bitcoin is digital gold” becomes most popular during periods of loose monetary policy. When central banks cut rates, expand their balance sheets, and increase liquidity in the financial system, both cryptocurrency and gold often rise simultaneously.

On charts, their trends appear synchronized, and media reports frequently claim that investors view Bitcoin as an inflation hedge. This resemblance fuels the digital gold narrative, but the underlying drivers are different:

- Gold reacts to falling real interest rates and the weakening of fiat currencies. Loose monetary policy makes the asset more attractive compared to low-yield bonds or deposits, while inflationary and geopolitical risks further boost demand from central banks and investors.

- Bitcoin, like the stock market, is driven by rising risk appetite and excess liquidity. Cheap money encourages capital inflows into high-volatility assets, including cryptocurrencies.

Additionally, gold can preserve and even strengthen its position when rising rates coexist with inflationary or fiscal threats, as seen in 2022–2024. Bitcoin, however, almost always moves in tandem with stock indices, falling or recovering in line with macroeconomic factors.

The challenge is that rising inflation and liquidity almost always occur simultaneously, affecting both risk assets and safe havens. Therefore, a more reliable indicator is the demand for gold and Bitcoin during periods of crisis.

In theory, the digital gold concept implies that Bitcoin should act as a “safe haven” during market shocks. In practice, however, Bitcoin does not provide capital protection during market downturns.

2020

At the peak of COVID-19 panic in spring 2020, Bitcoin plummeted by more than 50% in just a few days, moving in tandem with the S&P 500 and NASDAQ indices. Gold, on the other hand, after a brief dip due to the liquidation of liquid assets, quickly recovered and reached new all-time highs within a few months.

2022

Amid aggressive rate hikes by the Federal Reserve and a decline in stocks, Bitcoin lost about 65% from its peak values. During the same period, gold preserved its value much better, with a maximum drop of only 16%.

Bitcoin and the stock markets respond just as synchronously to short-term shocks caused by military conflicts or political statements. For example, during a flare-up in Iranian-Israeli tensions in June 2025.

.post-accordion-wrapper .accordion-content {

max-height: 0;

overflow: hidden;

}

Another key feature of Bitcoin is its clear price rhythm, expressed in four-year cycles tied to the halving events. Each halving is typically followed 12–18 months later by a rapid price surge, which is then succeeded by a correction and a prolonged “crypto winter.”

Although external factors — from macroeconomic policy to investor sentiment — also influence price movements, historical experience shows that the halving acts as a sort of reference point. This strong link between price and the halving event makes the Bitcoin market, to some extent, somewhat predictable.

Gold, on the other hand, lacks an embedded “spring” — a coded event that periodically triggers price surges or declines. Its price is driven upward by crises, inflation spikes, or geopolitical instability. During calmer periods, gold can remain in a sideways trend or gradually lose value for years, before suddenly spiking, as seen in 2008 or 2022.

It is worth noting that, according to some researchers, gold’s market dynamics still exhibit certain regularities. They suggest that the asset follows a 16-year cycle, with 4 years of decline and 12 years of growth. However, they also emphasize that gold lacks pronounced short- and medium-term price patterns.

Is a Paradigm Shift Possible?

The key issue with the digital gold myth lies in the dissonance between Bitcoin’s characteristics and how market participants perceive it. A kind of closed loop has formed:

- Bitcoin is considered a risky asset due to its correlation with the stock market and high volatility;

- Its connection to equities persists because investors buy and sell Bitcoin in sync with other risk assets.

Breaking this loop requires either a shift in investors’ mental models or a structural change in price dynamics — primarily, lower volatility and weaker correlation with stocks.

Experience shows that the first method is ineffective, as investors focus on numbers and data-driven forecasts. The second requires the injection of significant capital, capable of materially influencing the Bitcoin market and shaping the idea of “digital gold” not just in investors’ minds but also on the charts.

We are likely witnessing this transformation process now — over the past few years, Bitcoin’s volatility index has noticeably decreased.

From 2023 to 2025, the 60-day volatility has remained in the 1.2–2.8% range, standing at 1.27% at the time of writing. By contrast, during 2020–2022, the indicator never fell below 2% and could reach 7% during rallies.

The dynamics are shifting with the influx of institutional capital. For example, the peak volatility of this cycle was reached in September 2024 at 2.65%. Just a month later, Michael Saylor announced a $42 billion campaign to purchase cryptocurrency, kicking off the “Bitcoin treasury” race.

Additionally, the period from October 2024 to January 2025 marked the best stretch for Bitcoin ETFs. Net cumulative inflows into exchange-traded funds over these four months exceeded $21 billion.

Since then, the cryptocurrency’s volatility index has continued to decline at varying rates and, at the time of writing, is approaching historical lows.

In other words, even if Bitcoin prices still move in tandem with the stock market, exposure to these swings is decreasing. This is prompting investors to reassess their expectations for the cryptocurrency and its role in portfolios.

The ultimate argument for “digital gold” could be the establishment of strategic Bitcoin reserves at the state level. The United States has already taken initial steps in this direction, though it is not yet ready to allocate budget funds to this instrument. Other countries are also exploring similar possibilities.

Public companies, national governments, and exchange-traded funds together can reshape perceptions of Bitcoin by increasing its capitalization and holding it long-term. Recognition of the cryptocurrency as a reserve asset at the state level would likely prompt many analysts and investors to reassess their evaluations.

In summary, Bitcoin is a digital asset that possesses some characteristics of gold. While the market does not yet treat it as gold, it is arguably moving in that direction. Its role in a portfolio depends directly on the investment horizon:

- Short-term: it remains a bet on the stock market, with all the associated risks;

- Long-term: it could become a stable reserve asset and a “safe haven.”

The key question is whether the “digital gold” concept will gain enough traction to be adopted at the state level, and how quickly this might happen.

The challenge for investors lies in the absence of information or precedents to guide assessment by analogy. In modern history, no asset has claimed to replace gold as “hard money” or a reserve asset.

In this sense, the notion of “digital gold” truly requires investors to have faith that physical and digital stores of value, sharing similar characteristics, will eventually be perceived in the same way.