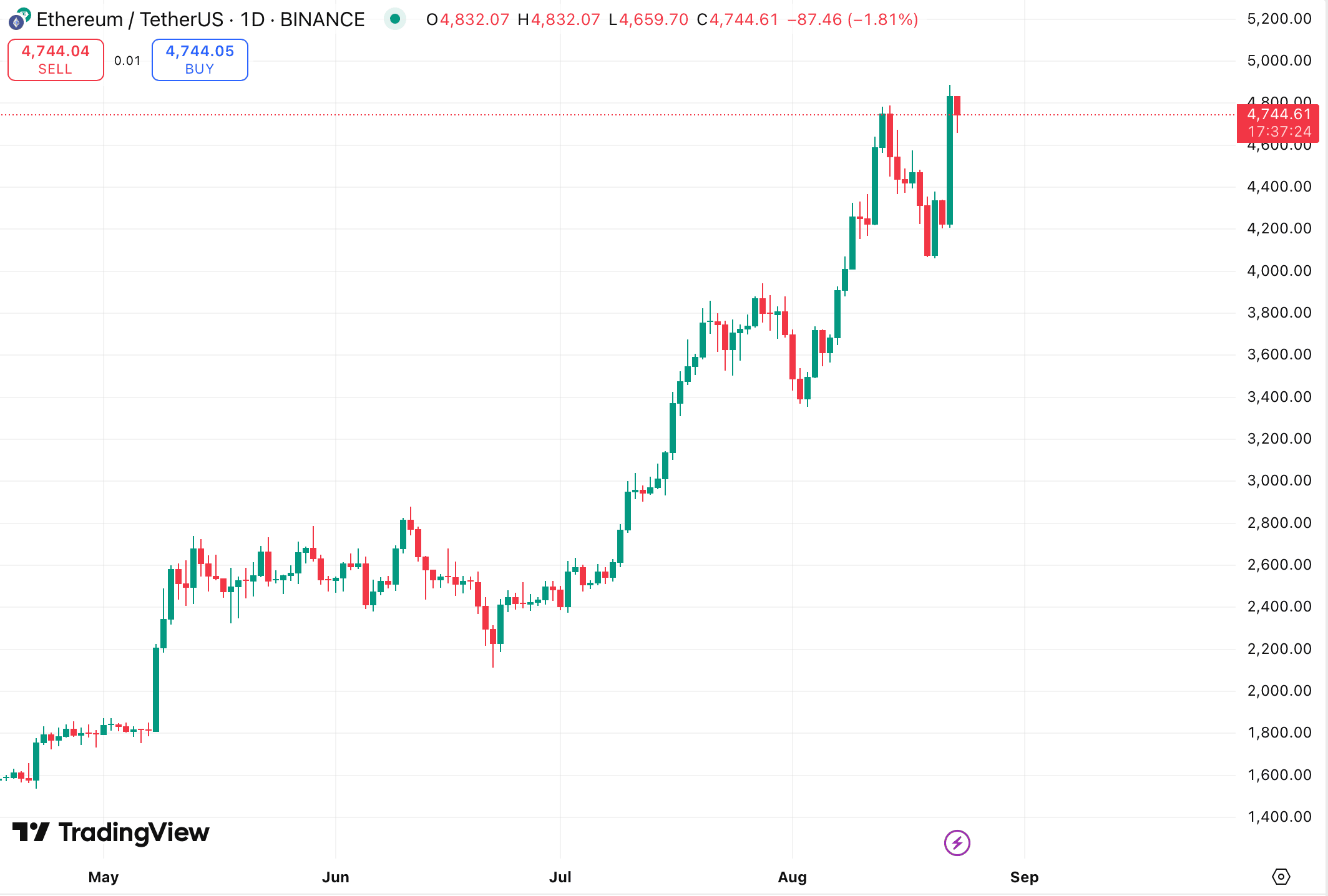

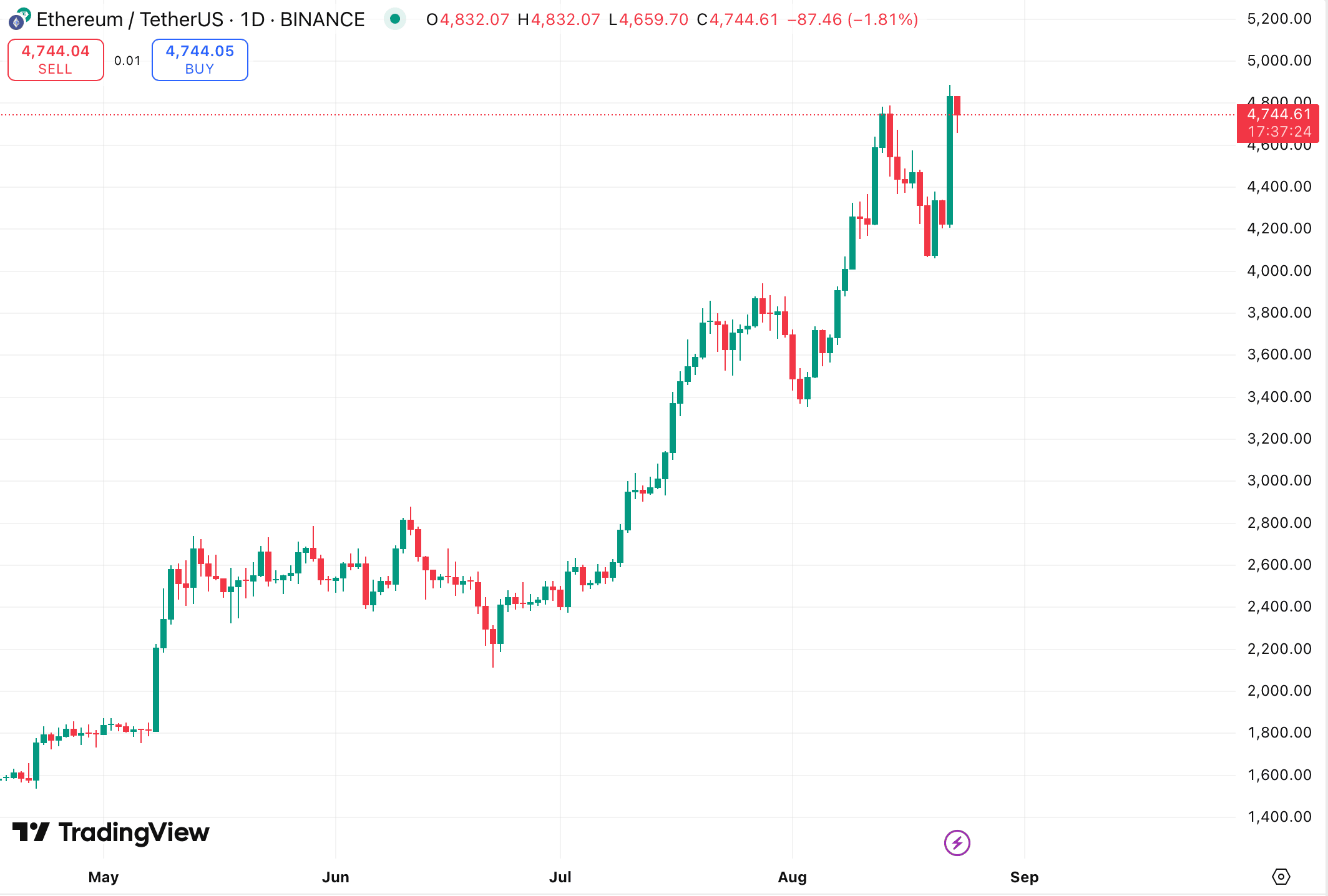

On August 22, the price of Ethereum exceeded $4880 for the first time since November 2021 and set a new all-time high. The asset is trading at $4744, according to TradingView at the time of writing.

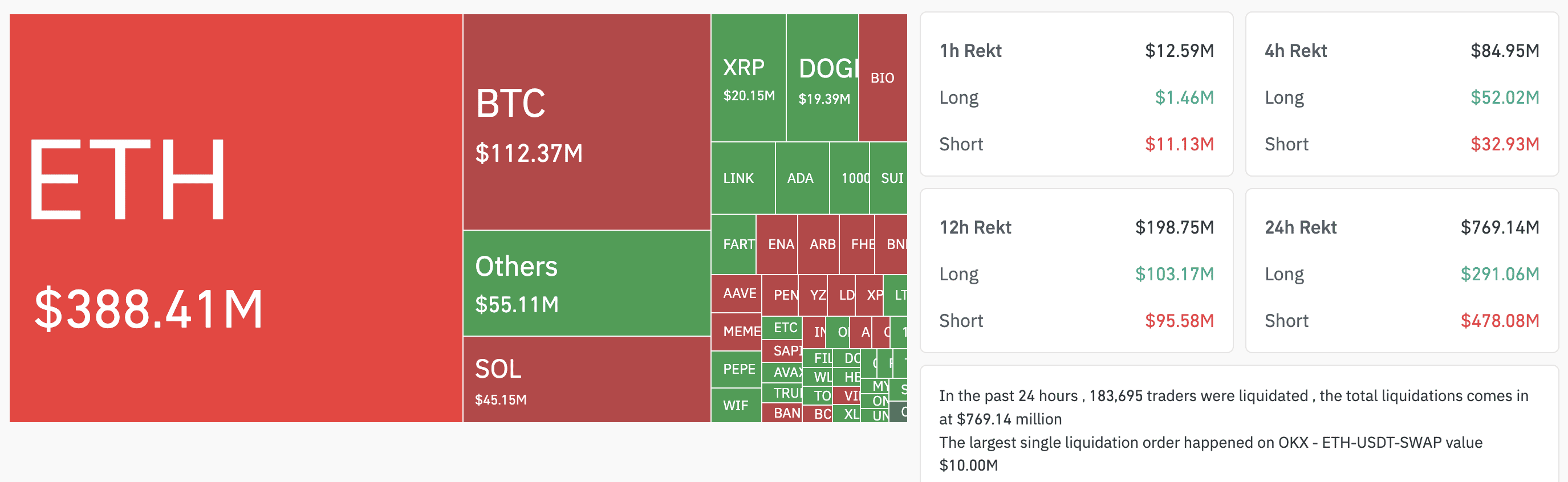

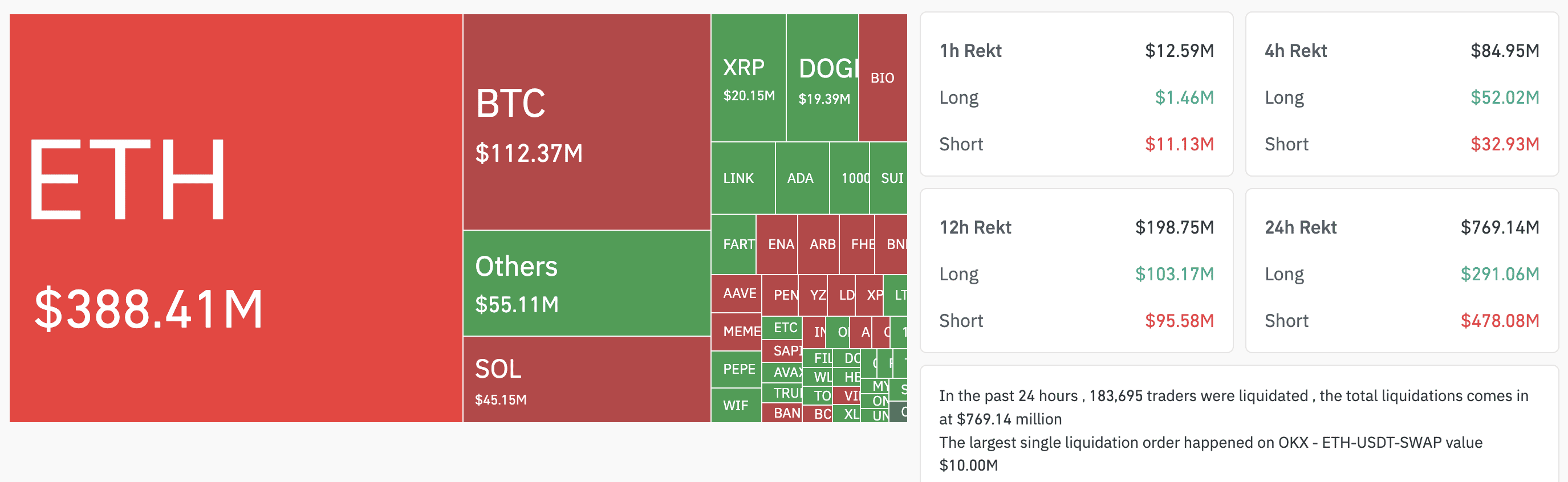

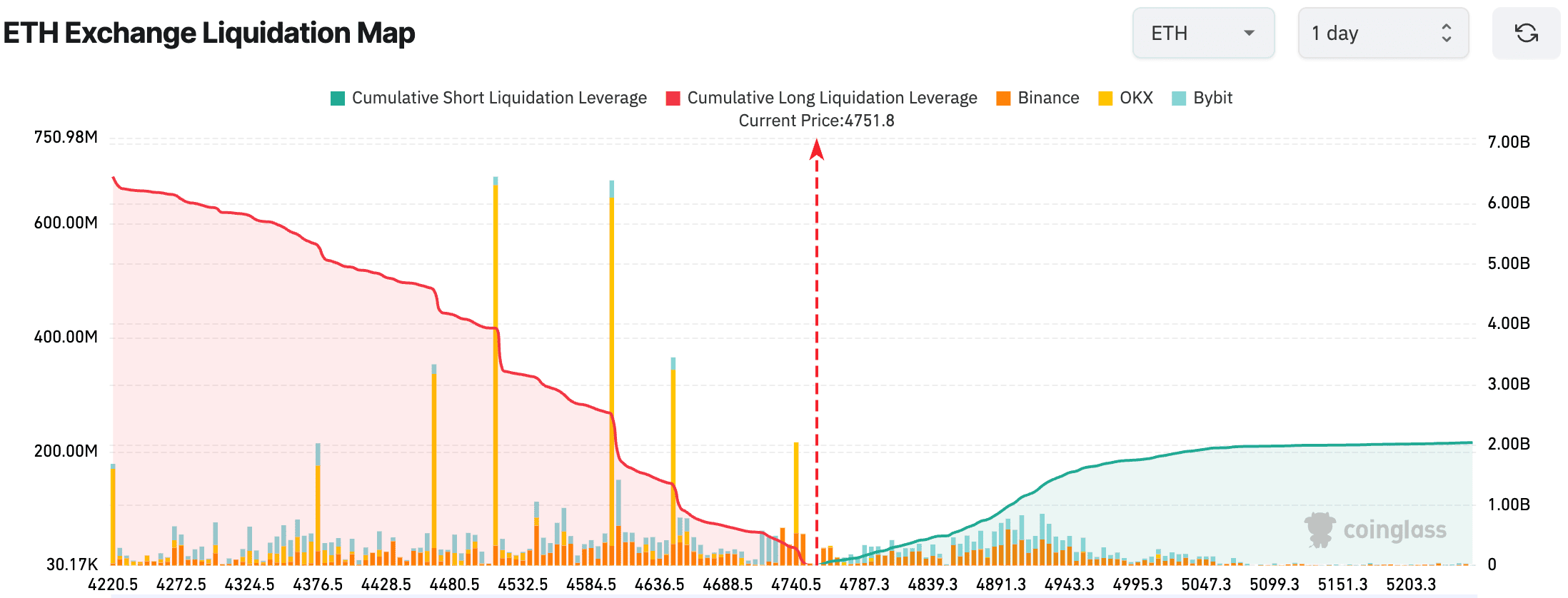

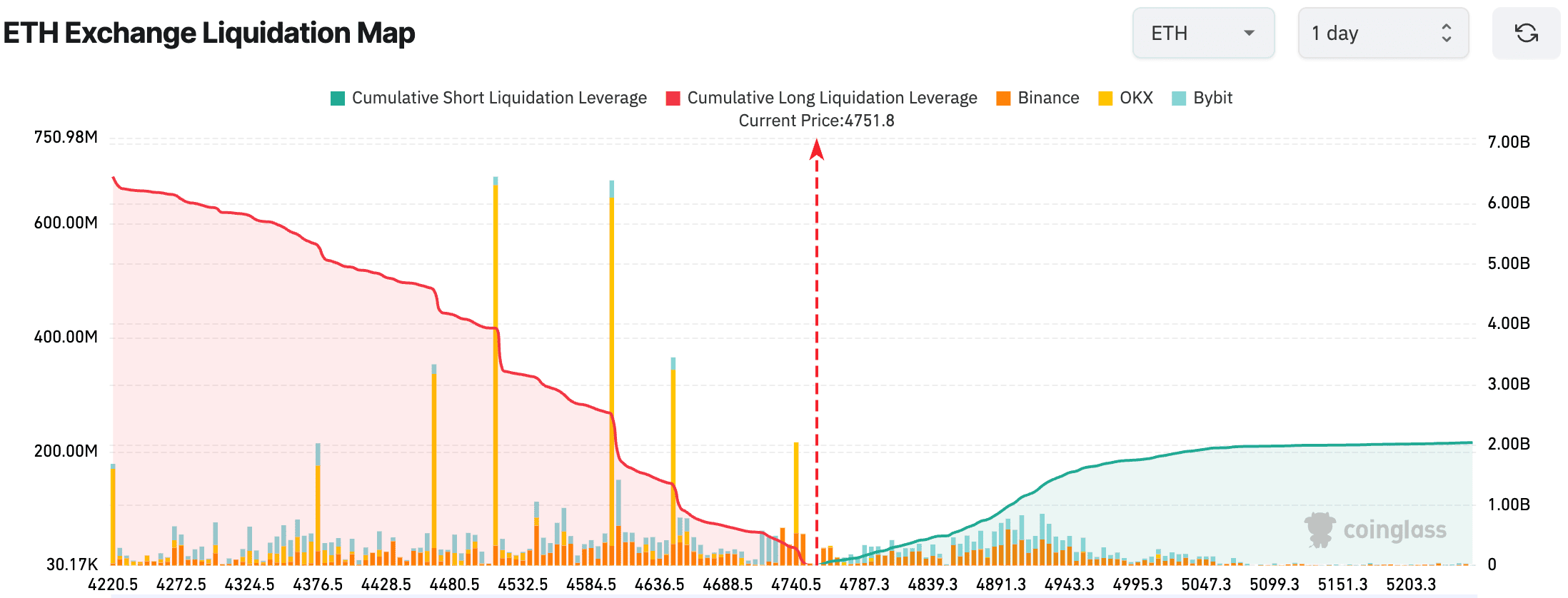

The growth in the crypto market led to liquidations on futures contracts worth $769.14 million. Holders of short positions in Ethereum suffered losses of $388.41 million (or 50%). A total of 183,695 traders recorded losses. The share of liquidations among bitcoin traders was $112.37 million.

Earlier, we wrote that crypto analyst Alessandro Ottaviani called Ethereum a “falling knife” in the crypto market due to its prolonged downward trend.

However, since May of this year, the situation has begun to change, as you can read in a separate article:

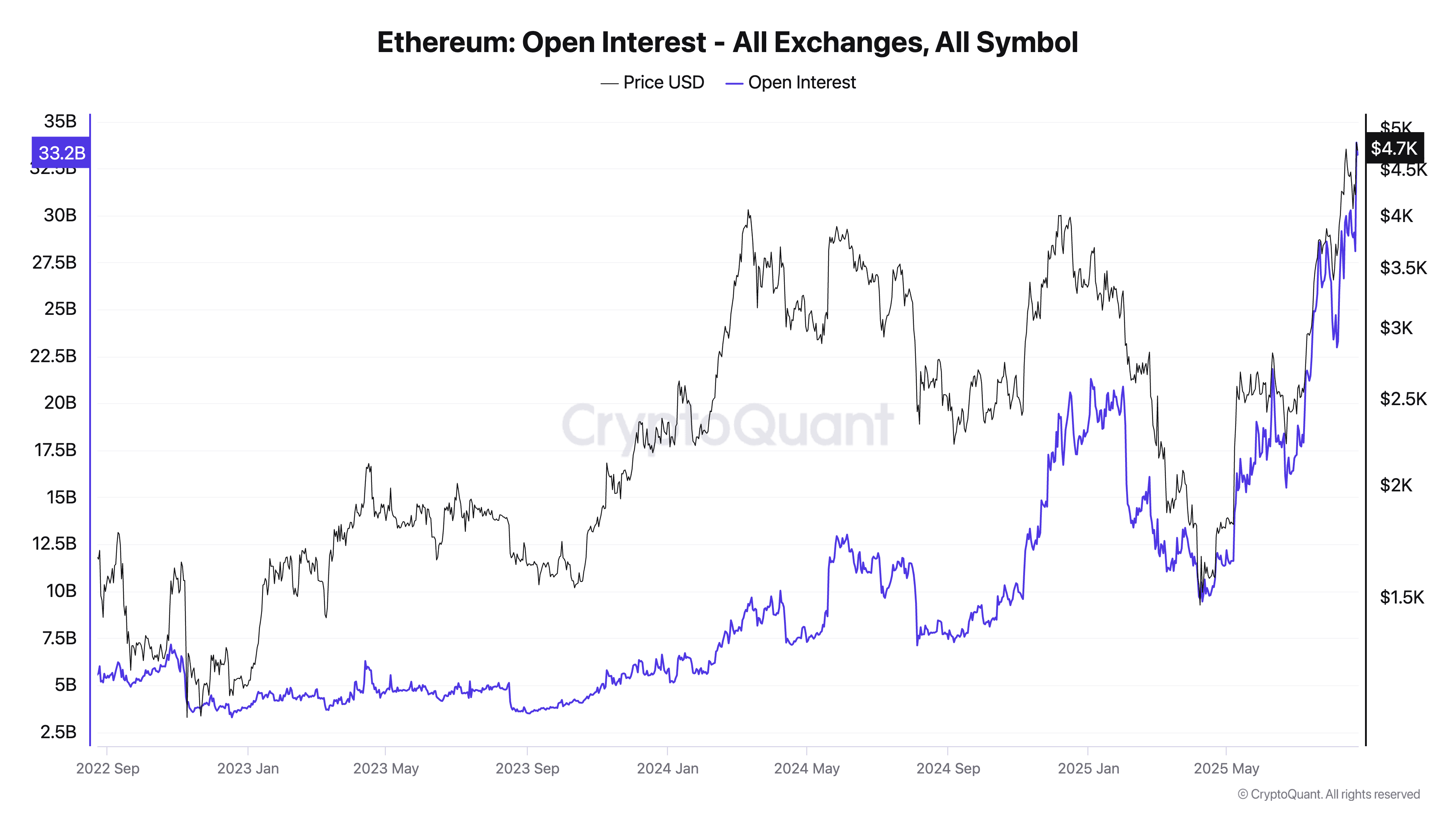

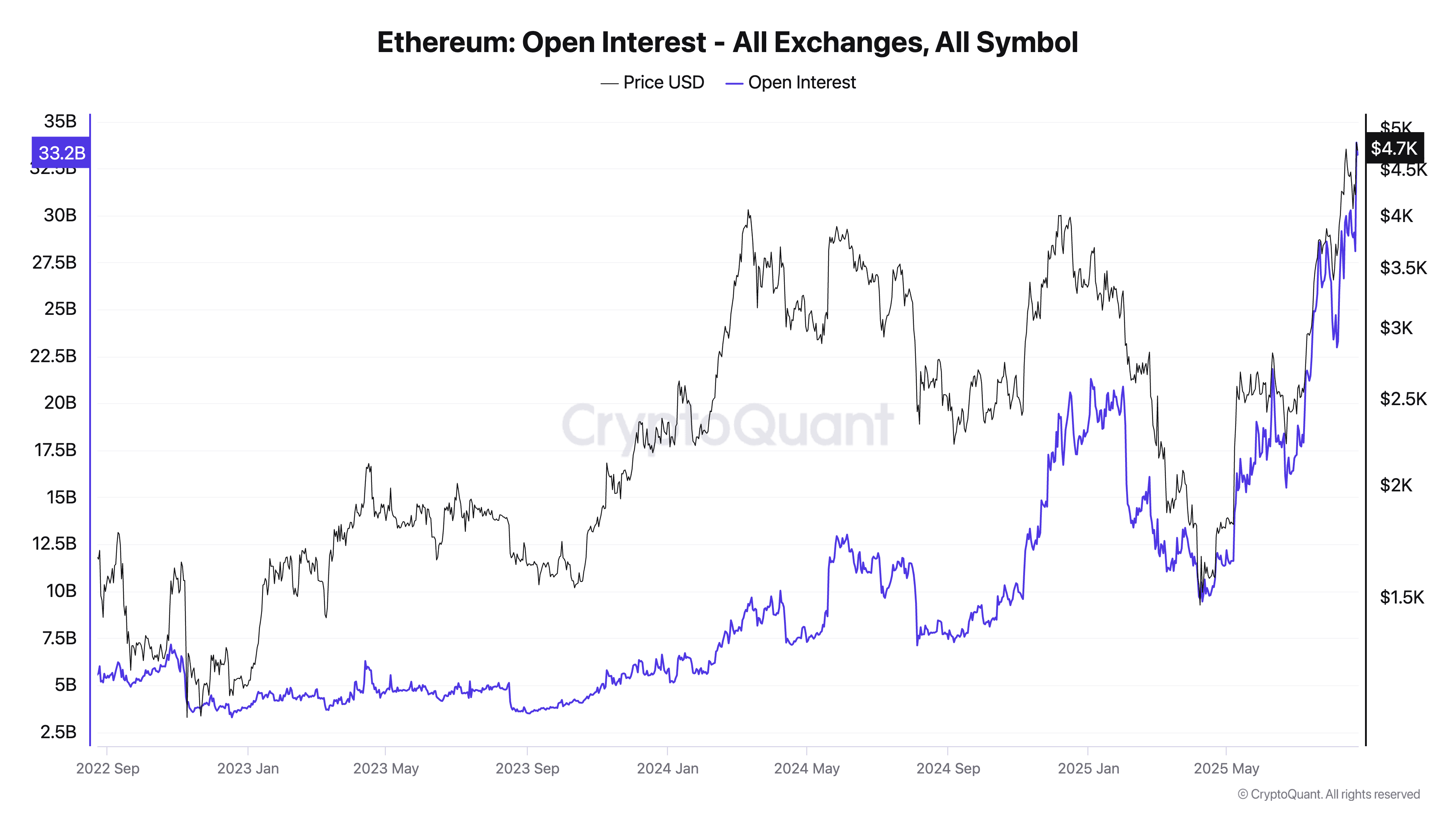

As the value of the analyzed cryptocurrency grew, traders’ activity on futures positions increased. The level of open interest stood at $33.2 billion as of 23 August:

If the price drops to $4,220, the volume of liquidations on long positions will amount to $6.45 billion:

At the same time, Ethereum’s capitalization reached $573.46 trillion with an increase of 10.7%, according to CoinMarketCap.

As a reminder, from August 11 to 15, 2025, spot Ethereum ETFs received a record investment of $2.85 billion, and on August 21, the positive dynamics in the segment resumed after four consecutive trading days in the red. Ethereum-based exchange-traded funds raised $287.61 million.

Arthur Hayes, co-founder of BitMEX predicted that the price of Ethereum will rise to $20,000 in the current market cycle.