.post-accordion-wrapper .accordion-content {

max-height: 0;

overflow: hidden;

}

July 2025 has turned out to be a truly hot month for NFTs. Trading volumes and user activity have surged across the sector, while the value of many collections has jumped — in some cases, by several multiples.

The numbers are still far from their all-time highs, but for the first time in 2025, the “forgotten” corner of the industry is showing signs of a real comeback. Some call it a mere “dead cat bounce,” while others believe the market is entering a steady upward trend. But what’s really going on?

At Incrypted, we took a closer look at how the NFT landscape has changed, what might be driving the recent uptick, and whether we’re actually witnessing the revival of the 2021–2022 “NFT fever.”

The “Summer” of NFTs

Since May 2025, the NFT market has been showing signs of recovery. At first, the momentum was shaky — likely fueled by the launch of giveaways on Telegram.

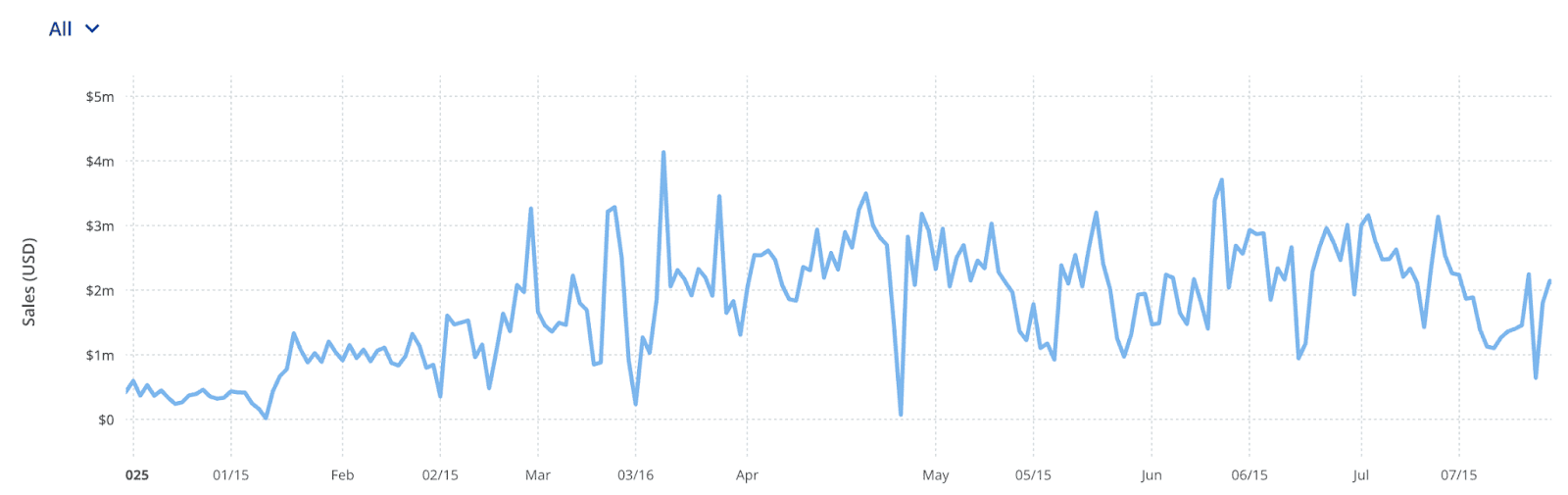

But by June the growth had continued, and in July it accelerated even further. According to CryptoSlam, total trading volume in July reached about $580 million — a 35% increase compared to June’s $389 million, and even surpassing the hype-driven May figure of $474 million. That makes July the strongest month for NFT growth in over a year.

According to CoinGecko, the total market capitalization of NFTs doubled in July — jumping from $3.4 billion to $6.8 billion.

However, this growth isn’t uniform across the board. While “blue-chip” NFTs like CryptoPunks and Pudgy Penguins have seen explosive gains, the CryptoSlam 500 NFT Index remains near its lows and hasn’t even recovered to June levels.

Another feature of this cycle is Bitcoin’s contribution to the market’s growth. So-called “Bitcoin NFTs,” built on the Inscriptions protocol, helped the network climb to fourth place in terms of trading volume.

However, the number and value of transactions on the Bitcoin network remain an order of magnitude lower than its closest competitor, Polygon. Alongside TON and Ethereum, Polygon played a key role in driving the July rally.

The First Sign

One of the earliest indicators of renewed interest in NFTs in 2025 came from Telegram — specifically, its internal gifting system, some of which was issued as NFTs on the TON blockchain.

At first, users saw these gifts simply as an in-app feature. But once it became clear that some digital items were limited in supply and could be traded on marketplaces, a local “NFT fever” erupted on TON.

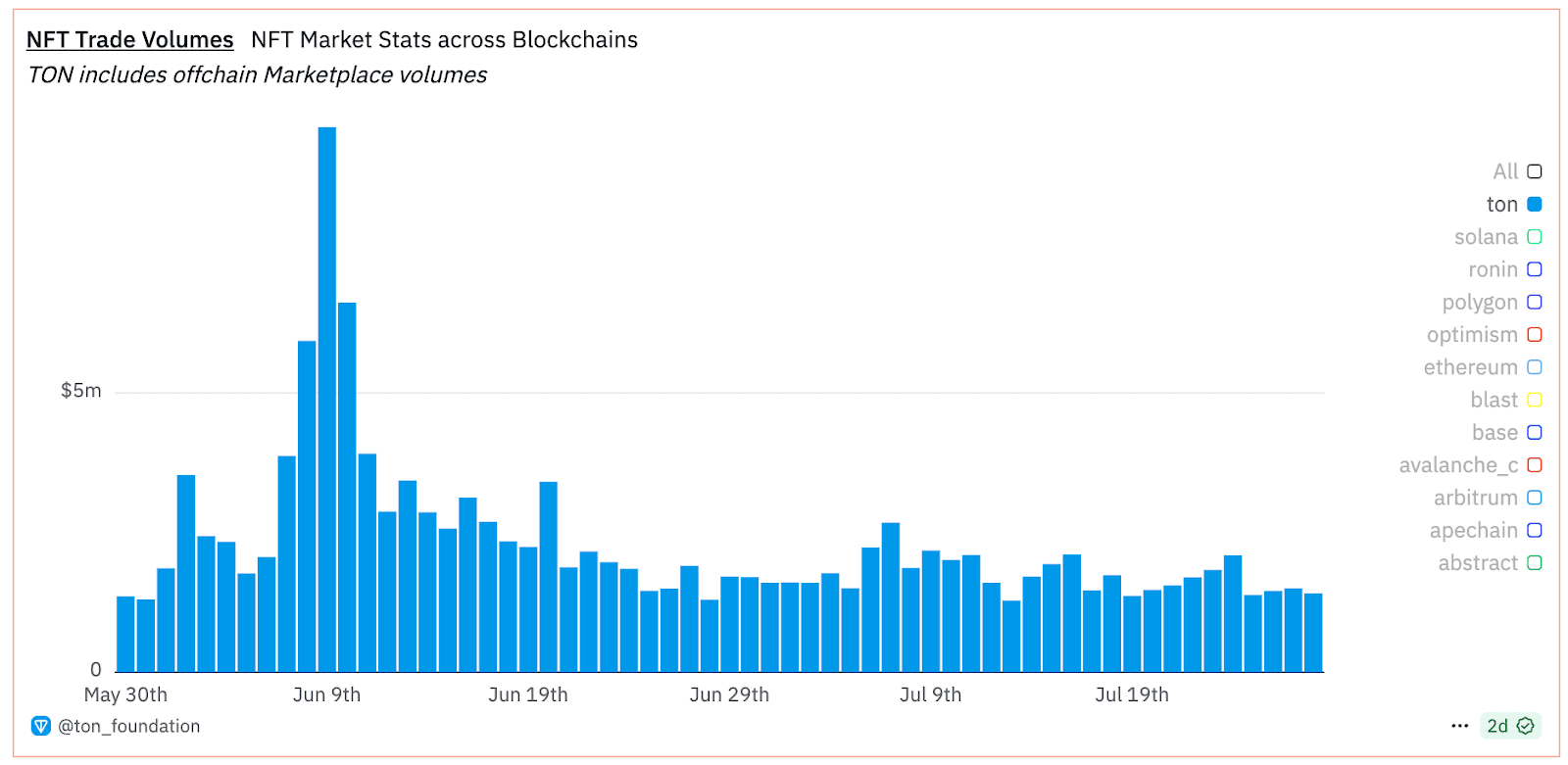

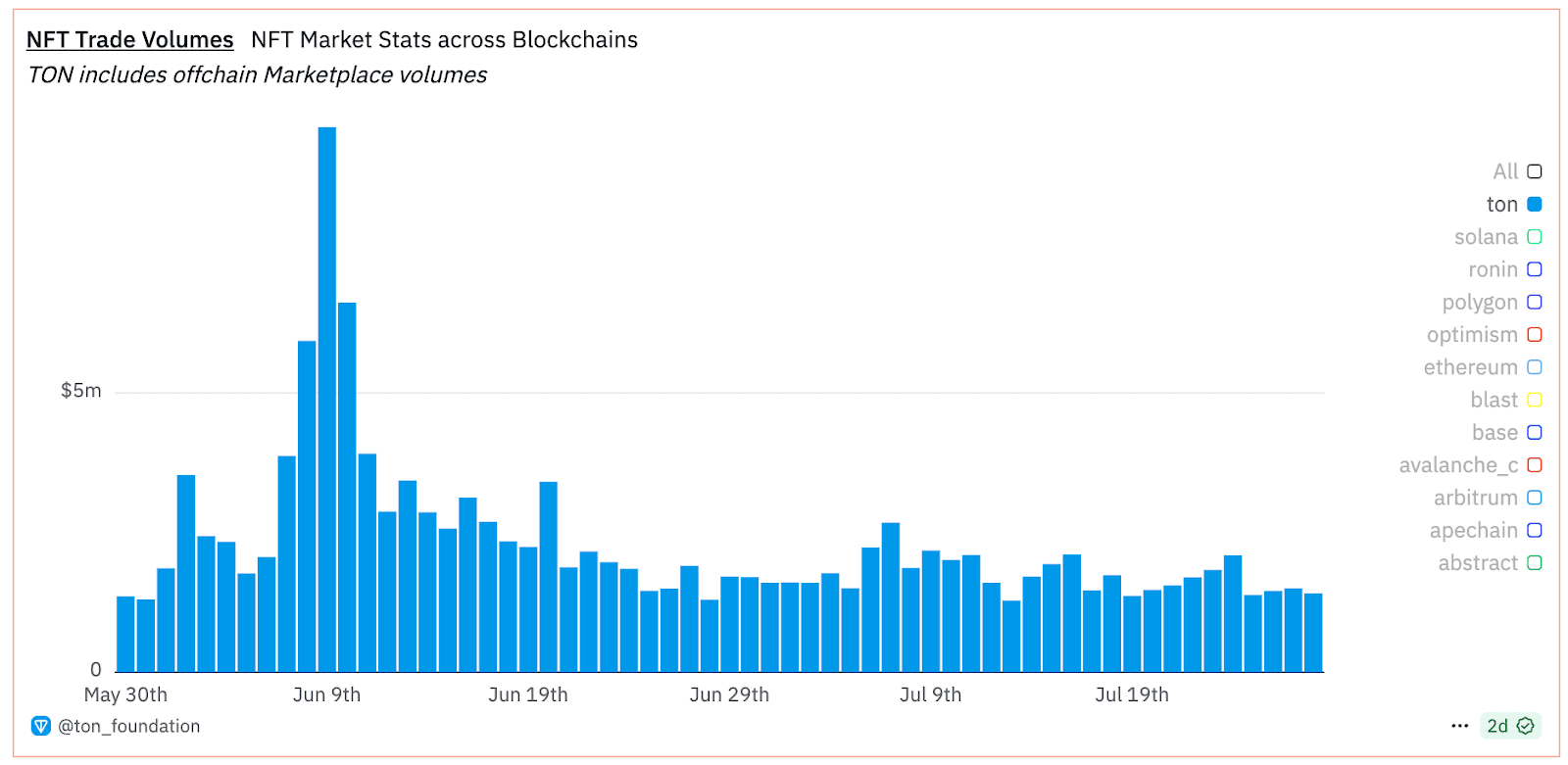

In total, over 300,000 unique addresses interacted with the gifts, more than 60% of which joined the network only in 2025. According to the developers, daily trading volumes of these gifts reached $3 million in June, helping TON secure second place in overall NFT trading rankings.

Active trading of the gifts also boosted the blockchain’s key metrics:

- Daily active wallets approached 250,000;

- Monthly transactions exceeded 70 million;

- NFT trading volumes in June hit a peak of $9.7 million per day, roughly five times higher than the May average.

Telegram gifts accounted for only about one-third of TON’s total NFT trading volume, yet the trend sparked active discussions on X over several weeks, highlighting its impact on retail user sentiment.

This influence is indirectly confirmed by the Plush Pepe collection, which shot into the top 5 NFT collections by value in early June — with its floor price doubling in just one week.

Top 10 NFTs by Floor Price.

Plush Pepe is at Top 5. Up over x2 less than a week.

When Top 3? pic.twitter.com/8Zj1MgKX52

— Gio (@Giooton) June 2, 2025

.post-accordion-wrapper .accordion-content {

max-height: 0;

overflow: hidden;

}

Punks Not Dead

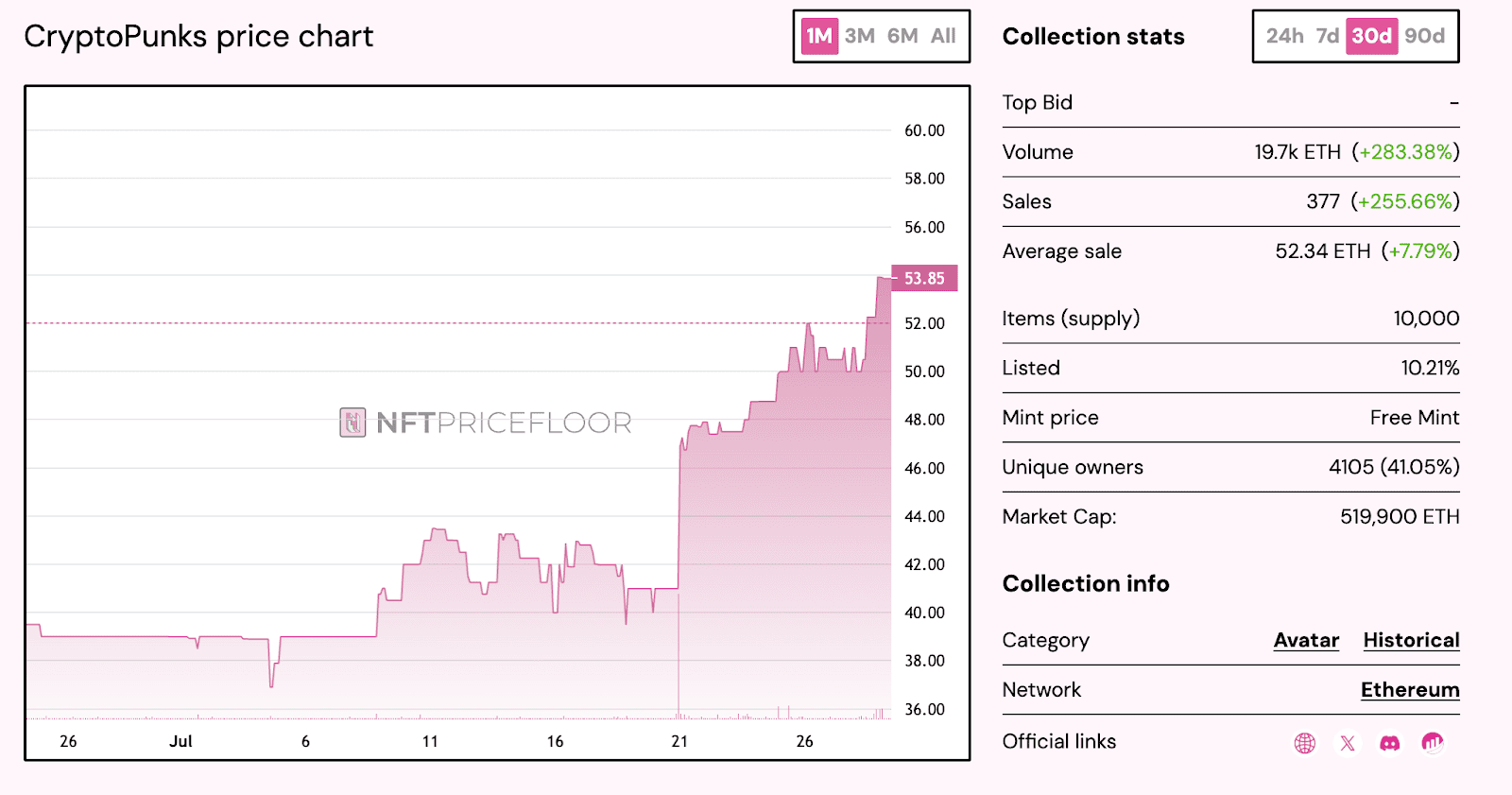

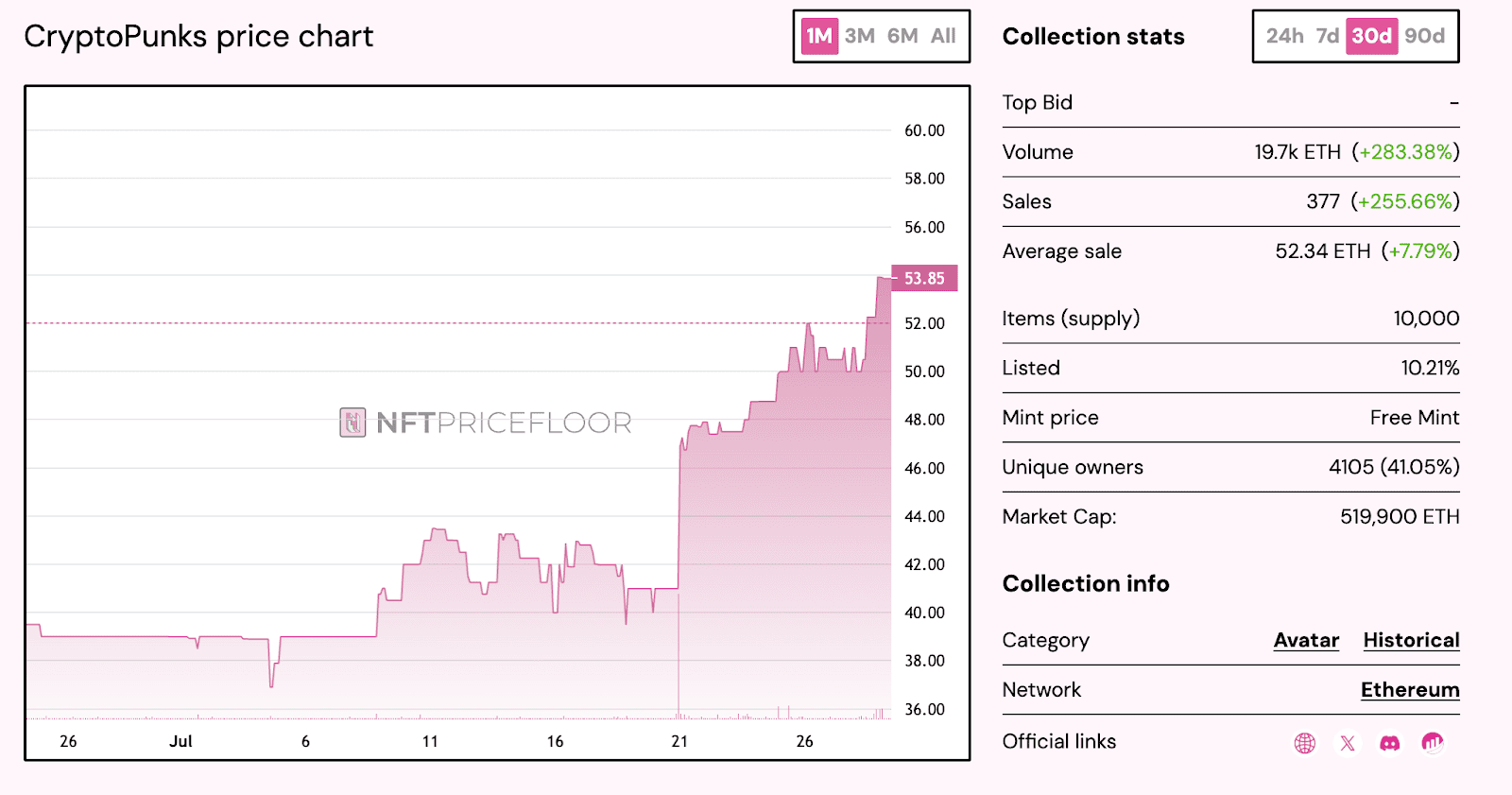

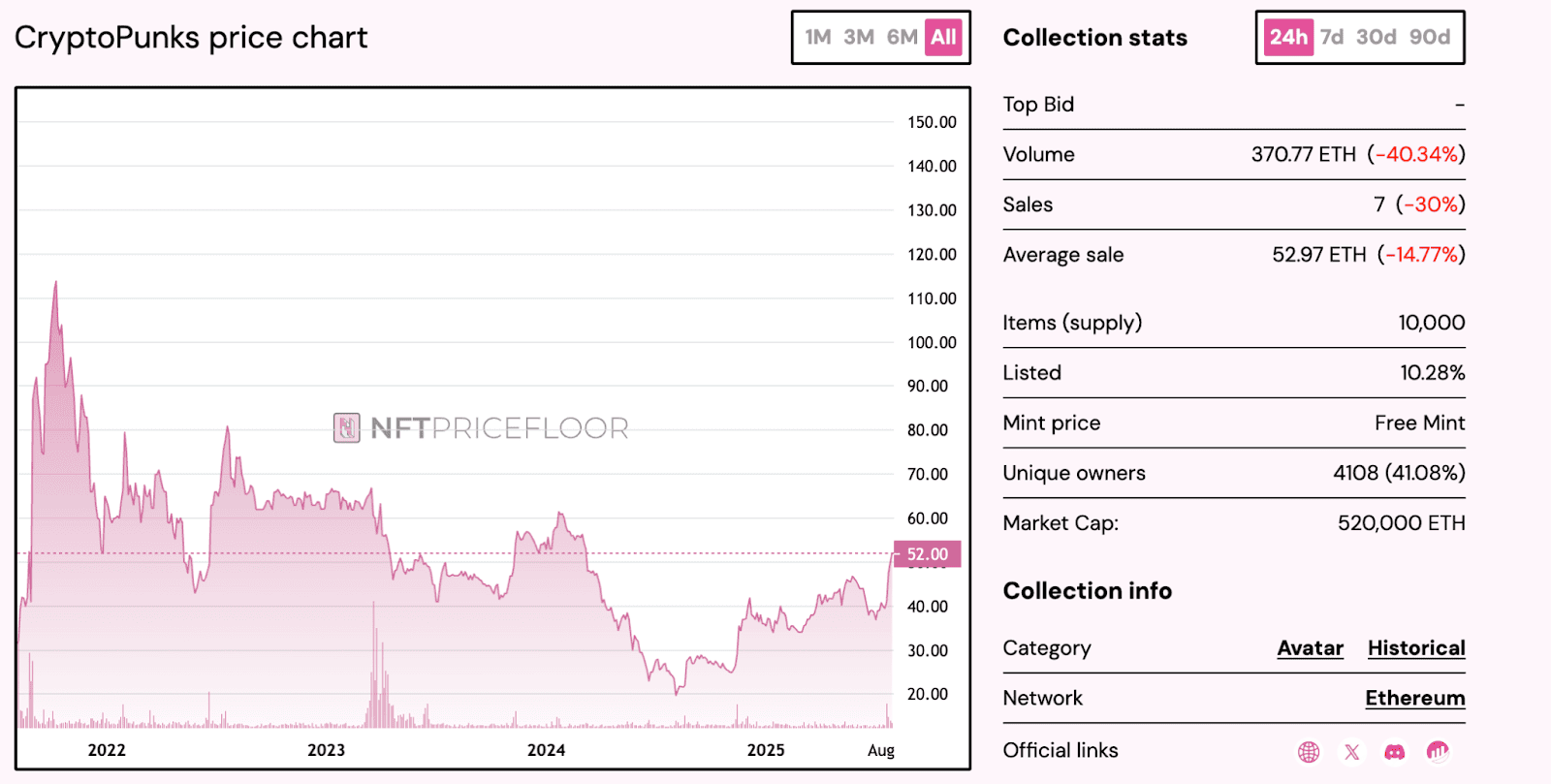

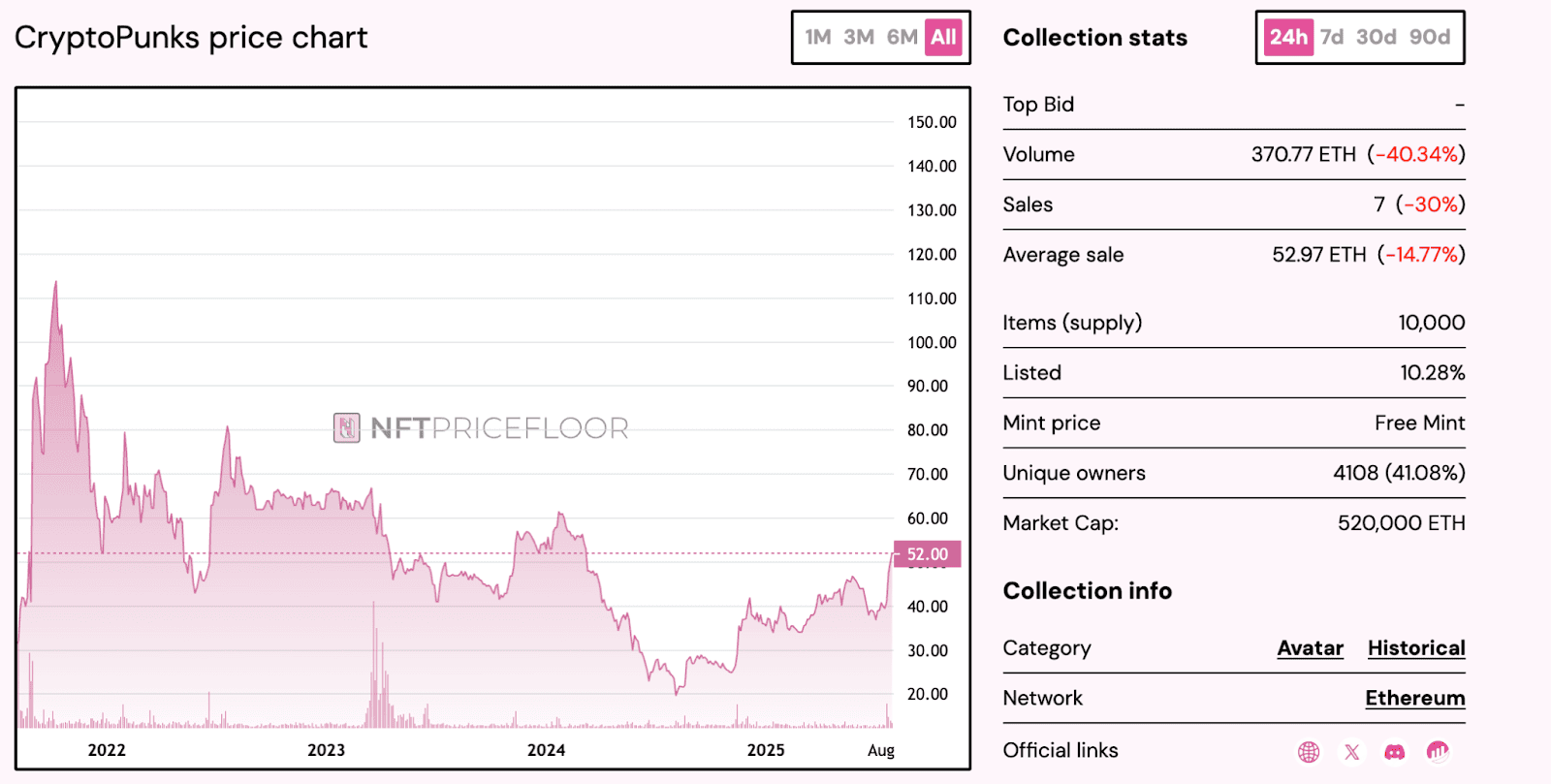

A standout event in July was the activity of an NFT whale, who purchased 48 CryptoPunks tokens, spending around $8.5 million. Additionally, another NFT — CryptoPunk #5577 — was acquired by the publicly traded company GameSquare.

2/ NFTs – remember them?

Yuh. Well, they’re up 17% over the last 24hrs, thanks in large part to a single buyer gobbling up 48 Crypto Punks

But it’s not just Crypto Punks that are having a moment

The sector is showing renewed signs of life across the board!

And NFTs = alt… pic.twitter.com/SfUPFcfvw4

— Milk Road (@MilkRoadDaily) July 21, 2025

This event not only drew widespread market attention but also boosted the collection’s value by 15.9%, from 40 ETH to 47 ETH. In total, 88 NFTs were sold in a single day, marking one of the most active days for CryptoPunks in recent times.

This transaction acted as a catalyst for other “blue-chip” NFTs. The Pudgy Penguins rose to 16.6 ETH, while their trading volume nearly quintupled — reaching $24.7 million in July compared to $5.3 million in June. Collections like Bored Ape Yacht Club, Milady Maker and Moonbirds also saw price increases, all amid a sharp surge in trading activity.

However, “blue-chip” NFTs come with a high entry barrier and, as a result, see a relatively low number of transactions. Between July 28 and August 3, only 86 CryptoPunks tokens were sold. Despite any FOMO effect, these top collections are aimed at a small niche of investors and don’t significantly influence overall retail activity.

Another project, however, managed to fill that gap.

Polygon! I Choose You!

For several months, one of the busiest marketplaces has been Courtyard on the Polygon network. Its main offering is a tokenization service that allows owners of Pok?mon, NBA, or MLB cards to turn them into NFTs.

Courtyard is cooking. Here’s how it works:

1?? You own a Pok?mon card

2?? Courtyard vaults it

3?? You mint it onchain

4?? The NFT = the card

5?? Burn it if you want it shippedIt’s like Vault-Tec meets Pikachu ??

— Milk Road (@MilkRoadDaily) March 29, 2025

These tokens have been popular among collectors, providing the platform with steady trading activity for several months. However, July saw a notable surge — weekly trading volume on Courtyard exceeded $20.7 million, and the number of users nearly doubled to 39,000, briefly making Polygon the leading network in the NFT market.

Amid this growth, Courtyard secured $30 million in funding. This milestone can also be seen as a sign of institutional investor interest in the NFT market.

Courtyard is not just a marketplace — it’s also a tokenization platform. The tokens traded there fall into the category of “phygital assets”, making Courtyard, in some ways, closer to RWA (real-world asset) projects than traditional NFTs.

The fact that these tokenized assets attracted retail interest may indicate a shift in the market structure. It’s likely that the “revival” will be felt mainly by the iconic collections of the previous cycle, while the broader adoption of NFTs will come through new classes of tokens, including those tied to physical assets.

.post-accordion-wrapper .accordion-content {

max-height: 0;

overflow: hidden;

}

Favorable Environment

The NFT rebound took place against the backdrop of a broader crypto market rally, particularly for Ethereum. Its price surged over 55% in July, reaching $3,900.

Rising prices have a strong impact on NFTs, since Ethereum is the leading network in the sector and most top collections are valued in ETH. As a result:

- Crypto-denominated tokens also rise in dollar terms, providing holders with a sort of passive income. Buying NFTs can also be seen as an indirect bet on Ethereum.

- ETH holders realized significant profits, which they could redirect into riskier investments, especially considering that in mid-July the Crypto Fear & Greed Index reached 79 points — the “greed zone.”

Just as Solana’s growth positively influences the meme coin market, Ethereum boosts NFT demand, acting as a kind of meme-token analogue within this ecosystem.

Notably, NFTs have outpaced Ethereum in growth, nearly doubling its gains, showing that price increases aren’t solely due to a revaluation in dollar terms.

This trend is historically confirmed — a simple comparison of the cryptocurrency’s price chart with the NFT market capitalization makes it clear.

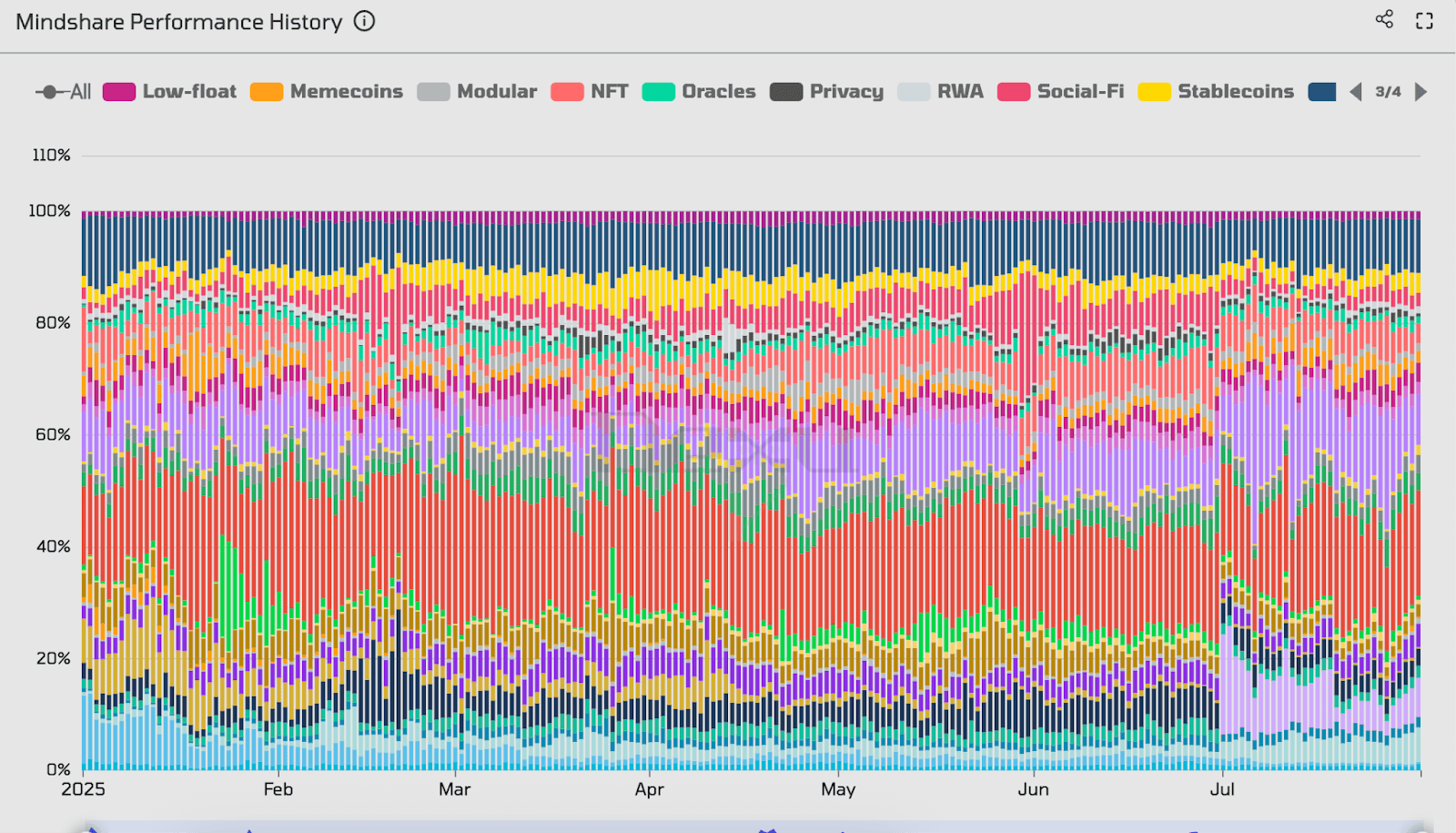

According to Dexu.ai at the peak of the July rally, NFTs captured over 8% of social media attention, becoming one of the most talked-about narratives. Only L1 blockchains and launchpads received a higher share of attention.

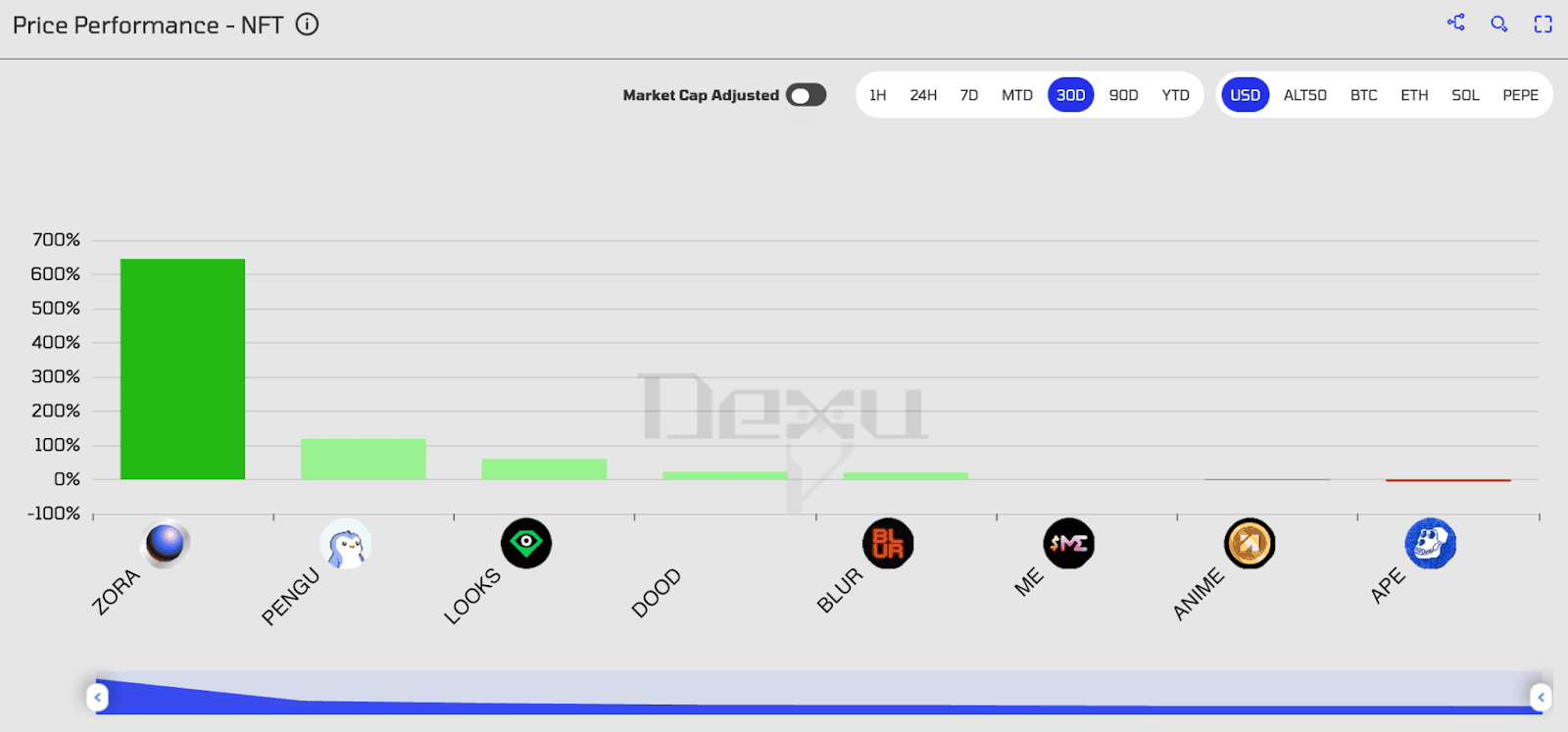

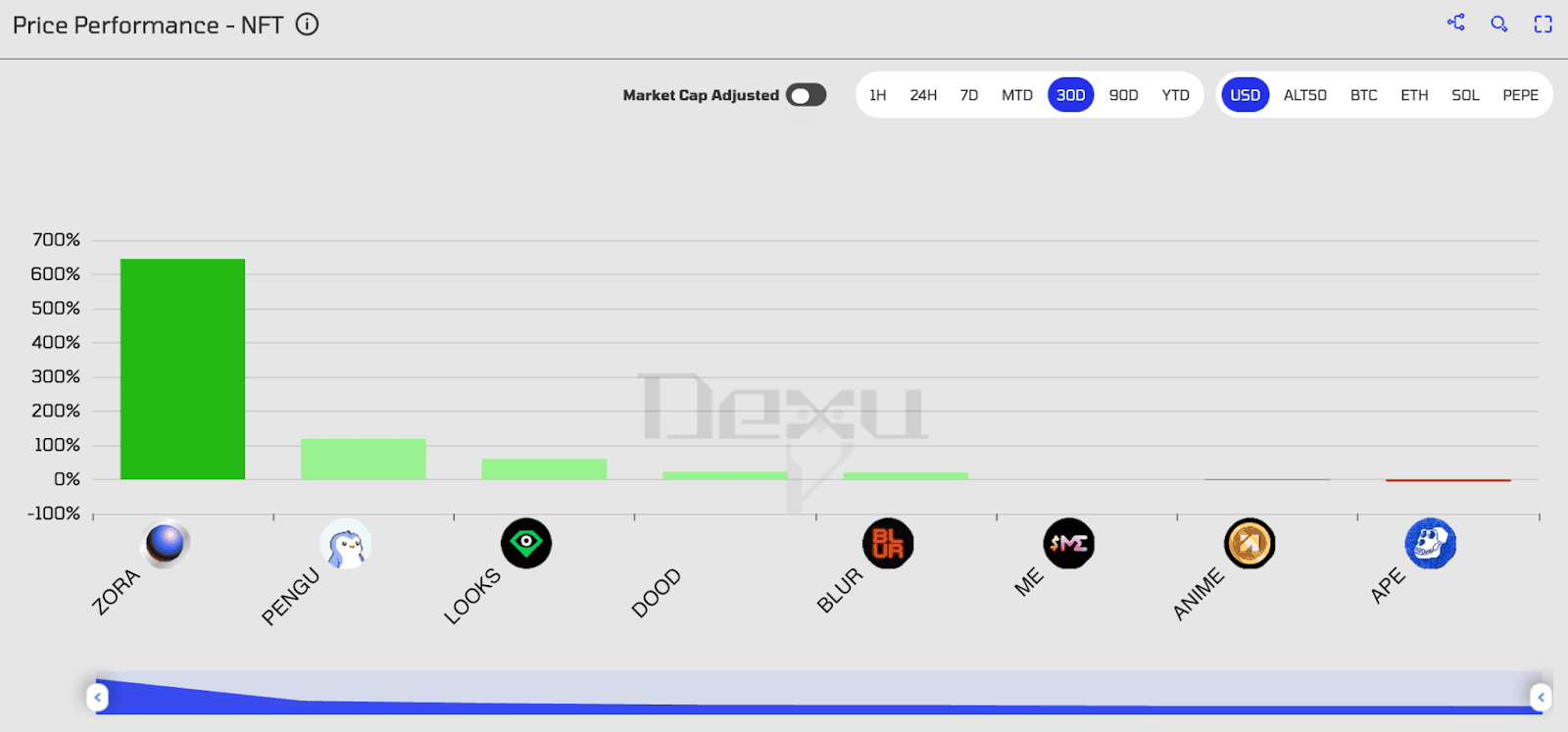

Over a 90-day period, NFTs emerged as one of the most profitable sectors, trailing only SocialFi and launchpads in performance.

Another notable event in the NFT market in July was the explosive growth of Zora Protocol. Zora is a decentralized NFT marketplace and content tokenization platform. Its integration with the Base App as part of a super app allowed users to monetize their posts and treat them as speculative assets.

This partnership drove the project’s token to nearly eightfold growth, drawing significant community attention and impacting NFT market metrics.

However, the popularization of Zora could have long-term implications for the NFT sector.

The platform significantly simplifies NFT creation and trading. Combined with its social component, these tokens could occupy an intermediate niche between meme coins and unique asset collections, or even boost the visibility and capital appeal of the latter.

.post-accordion-wrapper .accordion-content {

max-height: 0;

overflow: hidden;

}

In summary, the July NFT rally was fueled both by broader market factors — shifts in sentiment and the flow of capital from Ethereum into riskier assets — and by local trends. But the key question remains: how sustainable is this effect, and have NFTs managed to capture not only the minds but also the wallets of the community?

Cautious Optimism

Looking at the factors above, the NFT market in July experienced a sort of “perfect storm”:

- Retail engagement through user-friendly apps and collecting;

- Mini-rallies of blue-chip collections from the previous cycle;

- Overall market recovery and Ethereum’s surge.

However, short-term impulses don’t always translate into a sustainable trend. Even with the recovery, market activity and capitalization remain below 2024 levels during the so-called “Trump rally,” let alone the heights of 2021–2022.

According to DappRadar, in July the average NFT price rose significantly more than the number of transactions — 40% versus 7%. Analysts suggest this indicates a shift of investors toward higher-value assets, aligning with demand for top collections and whale-driven activity.

The market remains highly fragmented, resembling the meme coin segment: some collections surge 200% in a week, while others lose liquidity and traders. Even among “blue-chip” NFTs, many haven’t recovered to the bear-market levels of 2023–2024.

Regarding user attention, despite data showing growing interest in the narrative, Google Trends search volume remains well below spring 2025 levels.

Additionally, NFTs now face a new competitor for attention and capital — memecoins, which also leverage social and cultural narratives.

It’s likely that part of the liquidity that would have gone into NFT collections is now flowing into meme coins, which are easier and faster to trade. This reduces the likelihood of a broad-based rally, especially for new collections.

However, against the backdrop of the overall recovery, NFTs outpaced meme coins in growth — their market capitalization rose 100%, compared to roughly 80% for the largest meme coin segments. This suggests that we may be witnessing a more systemic shift in attention.

Overall, the July growth is targeted, driven by specific collections and platforms rather than a broad revival of the entire ecosystem. NFTs are indeed waking from their slumber, but for now, it feels like a “probe” by major players to gauge audience interest and growth potential.

However, if the price rally continues and user-friendly apps along with “affordable” collections attract a wider audience, NFTs could experience a full-fledged growth phase that surpasses the “Trump rally.”