.post-accordion-wrapper .accordion-content {

max-height: 0;

overflow: hidden;

}

The market capitalization of tokenized real-world assets (RWA) has skyrocketed from $5 billion in 2022 to over $24 billion by June 2025 — a staggering 380% growth. This makes RWA the second-fastest growing sector in crypto after stablecoins.

As the space continues to evolve, industry players are working on increasingly sophisticated infrastructure to overcome the operational bottlenecks inherited from both traditional finance (TradFi) and decentralized finance (DeFi) ecosystems.

Operating at this intersection introduces a complex matrix of challenges, from regulatory compliance to asset verification. Converge aims to act as a settlement layer that addresses these pain points.

Incrypted has taken a closer look at the Converge project and what it brings to the table.

What Is Converge?

Converge is a Layer 2 network for Ethereum, jointly developed by Ethena Labs — the issuer behind the USDe stablecoin — and the real-world asset (RWA) platform Securitize.

The project aims to deliver institutional-grade infrastructure that can scale real-world asset tokenization for major financial institutions. By bridging the gap between RWAs and decentralized finance (DeFi), Converge seeks to accelerate the mainstream adoption of on-chain finance.

The network is being built with three core objectives in mind:

- A high-performance environment optimized for both developers and end users;

- Seamless integration with the USDe and USDtb stablecoins;

- Institutional-grade capital protection through the Converge Validator Network (CVN).

To participate in CVN, validators will be required to stake Ethena’s governance token, ENA. Meanwhile, USDe and USDtb will serve as the gas tokens for network transactions.

Ethena founder Guy Young describes Converge as “a high-performance EVM-compatible network with enhanced security features that go beyond what existing solutions offer.”

Architecture

Converge is built on the Arbitrum Orbit technology stack, with Celestia serving as its data availability layer.

The platform leverages Celestia to efficiently publish large volumes of data as blobs at low cost. In testnet trials, Converge successfully handled 128MB blobs with throughput reaching approximately 21MB/s. Its roadmap even includes support for block sizes up to 1GB.

By integrating Celestia, Converge can publish massive amounts of transaction data in parallel — bypassing the throughput limitations currently faced by Ethereum.

Transaction ordering on Converge is handled by Conduit G2, a high-performance implementation of Arbitrum’s sequencer. This node is responsible for aggregating transactions, executing them, and rapidly producing new blocks.

Performance Metrics

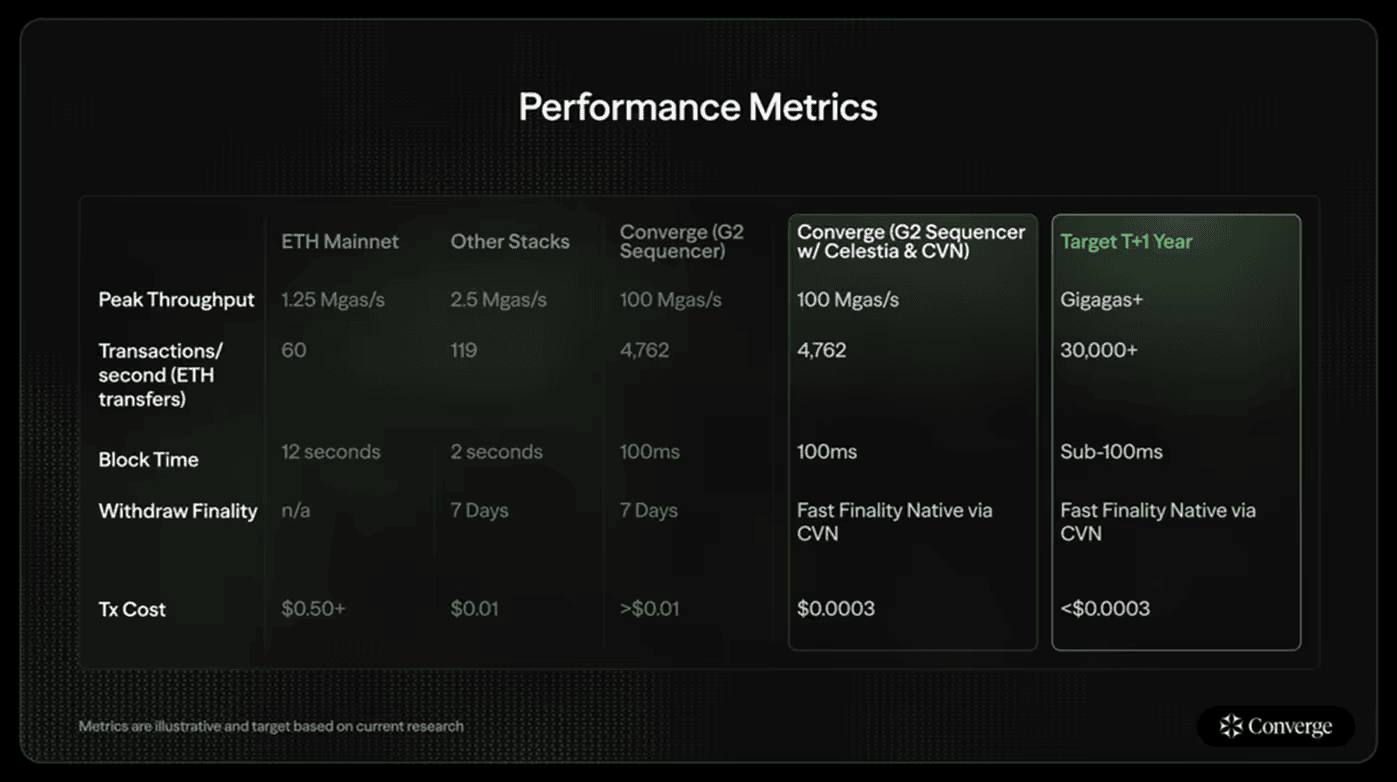

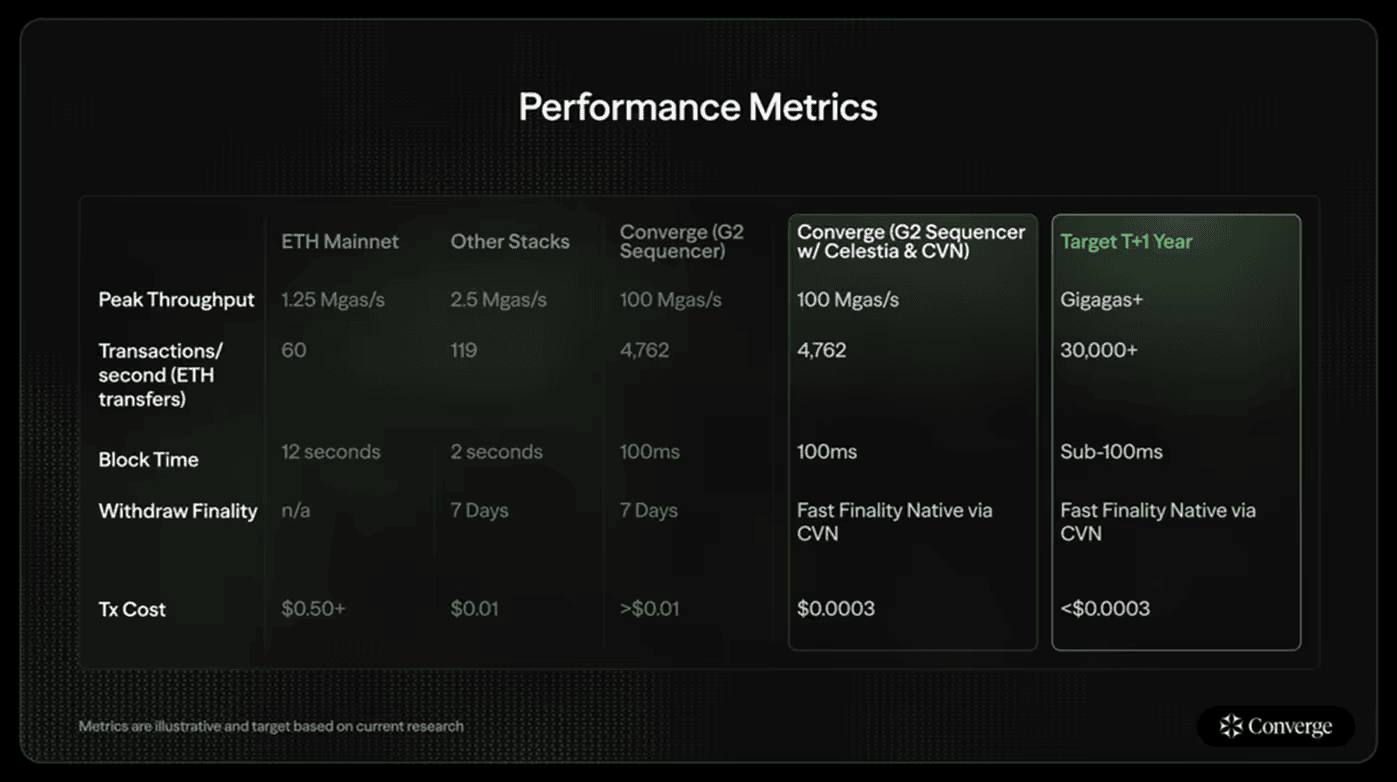

Converge is expected to deliver best-in-class performance, with the ability to sustain high throughput and minimal latency.

The network targets a block interval of approximately 100 milliseconds — meaning new blocks (often referred to as mini-blocks or flash blocks) are produced about 10 times per second on average.

Over the first year following its launch, Converge aims to achieve a 10x performance boost and reduce block creation time to under 50 milliseconds.

To reach this level of efficiency, the development team is implementing a comprehensive set of enhancements:

- Pipelined and parallel execution architecture that allows the G2 sequencer to process transactions in a multithreaded environment without sacrificing determinism;

- Streaming mini-block generation instead of monolithic blocks, enabling validators to begin execution and verification as transactions arrive;

- State storage optimization using a flat access model and high-performance databases to enable faster access, parallel processing, and real-time garbage collection;

- Support for Stylus, a WASM engine that allows developers to write smart contracts in Rust, C, and C++, delivering 10x to 100x speed improvements for resource-intensive logic;

- Utilization of Ethereum’s blob space (EIP-4844) and Brotli compression to post even extremely large blocks on Ethereum with minimal costs.

If successfully implemented, these upgrades could position Converge as a blockchain capable of operating at the scale and responsiveness of a modern cloud backend.

Features

Traditional finance involves numerous intermediaries, each maintaining separate records at various stages of a transaction — including issuance, trading, matching, settlement, custody, and corporate actions processing. Tokenization fundamentally transforms this structure by automating these steps through smart contracts.

By utilizing a shared ledger for all assets, Converge introduces a suite of enhanced financial tools and capabilities:

- Support for both permissioned and permissionless assets with seamless interoperability;

- The ability to pay fees not only in USDtb and USDe, but also in other assets (such as Ethereum) via Paymasters;

- Exchange of RWAs for USDtb and USDe;

- ERC-7702 support, enabling the creation of temporary smart contracts during transaction execution;

- User authorization through session keys;

- Advanced user interface features, including batch transactions;

- Fast and easy asset transfers from Ethereum, Solana, Arbitrum, and other networks into Converge;

- Support for writing smart contracts in Rust, C++, and Solidity, with cross-language composability;

- Security and suspicious activity monitoring enforced by its own validator network.

These features are designed to ensure smooth onboarding for users into dApps.

Governance and Ecosystem

Today, many networks — both permissionless and permissioned — are competing to attract tokenization to their platforms. Some prioritize KYC, AML compliance, and full stack control (such as Avalanche subnetworks and various Layer 2 solutions), while others emphasize composability and rapidly evolving DeFi ecosystems (like Solana, Ethereum, and others).

Converge aims to offer institutions looking to onboard assets to the blockchain a balanced combination of control and composability.

Converge Validator Network (CVN)

The CVN validator network serves as the foundational layer of security, governance, and economic coordination for Converge, operating through staking of the ENA token.

Unlike traditional validators focused solely on consensus or data availability, CVN is designed specifically to address Converge’s unique security and coordination challenges. These include enabling instant withdrawal finality via a native bridge, enhanced block validation security, resilience against MEV, and safeguarding upgrade processes.

Essentially, CVN acts as a security council with discretionary authority to intervene in scenarios that threaten user funds or network integrity. For example, it can slow down or block malicious cross-chain messages transmitted via Decentralized Verification Networks (DVN) from LayerZero — effectively protecting against bridge attacks.

Additionally, CVN can coordinate the triggering of protocol-level circuit breakers, both at the chain-wide and individual contract levels, to pause activity in cases of oracle manipulation, critical smart contract bugs, or economic anomalies.

In extreme situations, CVN can dispute block finality or coordinate community efforts in fork selection, providing an added layer of protection for users and developers within the Converge ecosystem.

Ethena founder Guy Young acknowledges that granting validators such powers may conflict with the ideals of some community members, but he insists the only way to attract institutional capital is to offer solutions that address their key pain points.

Open and Permissioned Ecosystem

Interacting with Converge is permissionless by default. Anyone can use the applications, and developers are free to deploy smart contracts at their discretion.

Access restrictions apply only to specific apps and real-world assets (RWA), where certain features or contracts may be available exclusively to “whitelisted” participants. These controls are managed at the application or asset issuer level — neither validators nor Converge developers hold centralized authority or regulate access.

Converge supports two distinct types of applications running in parallel:

- A fully open DeFi ecosystem with permissionless apps utilizing USDe, already gaining market traction — such as Pendle;

- Permissioned applications where traditional financial institutions can operate with tokenized assets while leveraging smart contract benefits, exemplified by Aave Horizon.

The network aims to foster both application types built on Ethena and Securitize assets, spurring new financial product use cases and expanding the user base.

Terminal Finance and Ethereal

Terminal Finance is an upcoming marketplace designed for trading yield-bearing digital dollars and institutional assets, envisioned as the central liquidity hub within the Converge network. Thanks to concentrated liquidity pools, Terminal Finance is expected to provide the network with seamless access to substantial capital.

At the time of writing, the protocol is in the pre-deposit phase, allowing users to deposit USDe, WETH, and WBTC to accumulate Roots points.

Announcing the launch of Terminal’s early deposit phase!

To participate, you can deposit USDe, WETH, WBTC through Terminal.

sENA holders will also be eligible for Terminal’s incentives.

Details on Session 1 can be found below. pic.twitter.com/rpB7hZ4JTQ

— Terminal Finance (@Terminal_fi) June 27, 2025

Terminal Finance will manage a suite of liquidity pools designed for efficient asset swapping. These pools are based on the Uniswap v3 model, enabling liquidity providers (LPs) to allocate capital within specified price ranges, reducing slippage and boosting capital efficiency.

The protocol will be tailored for the yield-bearing stablecoin ecosystem, allowing Terminal Finance pools to accumulate profits without incurring impermanent loss. Earnings generated will be treated as pool revenue and either distributed back to liquidity providers or exchanged for rewards in Roots.

As of July 8, 2025, Terminal Finance’s total value locked (TVL) exceeds $73 million.

Ethereal is a decentralized exchange offering high performance—with latency under 20 milliseconds and around 1 million orders per second—while enabling self-custody and delivering the security guarantees typical of DeFi.

The project’s vision is to become a one-stop capital management app in DeFi, integrating perpetuals, spot trading, lending and borrowing, RWAs, yield strategies, and other core DeFi primitives on a single vertically integrated platform.

In its beta version, Ethereal already supports perpetual trading with margin collateralized in USDe.

Order matching is handled by Ethereal’s specialized sequencer, delivering speeds comparable to centralized exchanges while maintaining on-chain security guarantees.

Plans include adding spot trading, lending markets, RWA products, and other solutions based on USDe.

Ethereal is deployed as an app chain with the following configuration:

- Trade finalization occurs on the Converge network;

- Execution runs within the Arbitrum environment;

- Data availability is provided by Celestia.

This architecture is said to offer the flexibility and customizability required to realize Ethereal’s product vision while maintaining Ethereum-level scalability, performance, and security.

As of July 8, 2025, Ethereal’s total value locked (TVL) exceeds $714 million, with peak values surpassing $1 billion.

Prospects

Converge can be seen as an attempt to bring Wall Street into Web3 — without compromising the foundations of either. It’s a platform for asset tokenization designed with regulatory compliance in mind. The project prioritizes trust and transparency over anonymity.

Though still in its early stages, Converge’s architecture and team position it as one of the most compelling blockchain projects of 2025. If it succeeds in building a robust infrastructure for institutional players, it stands a strong chance of riding the tokenization wave—with trillions of dollars potentially at stake.