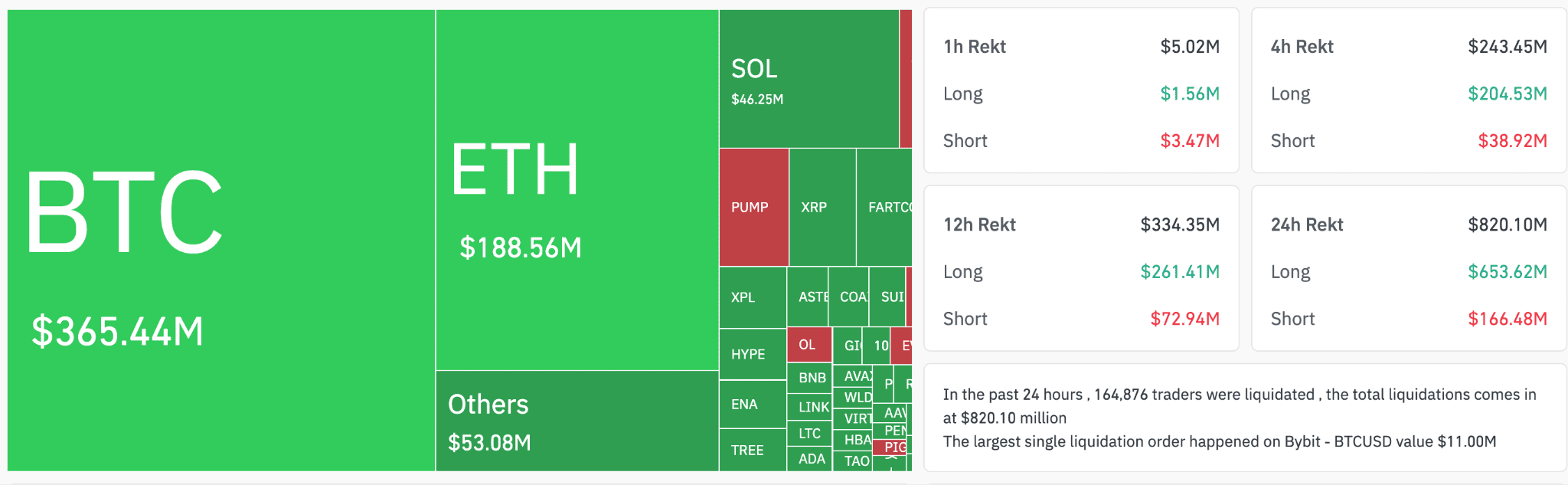

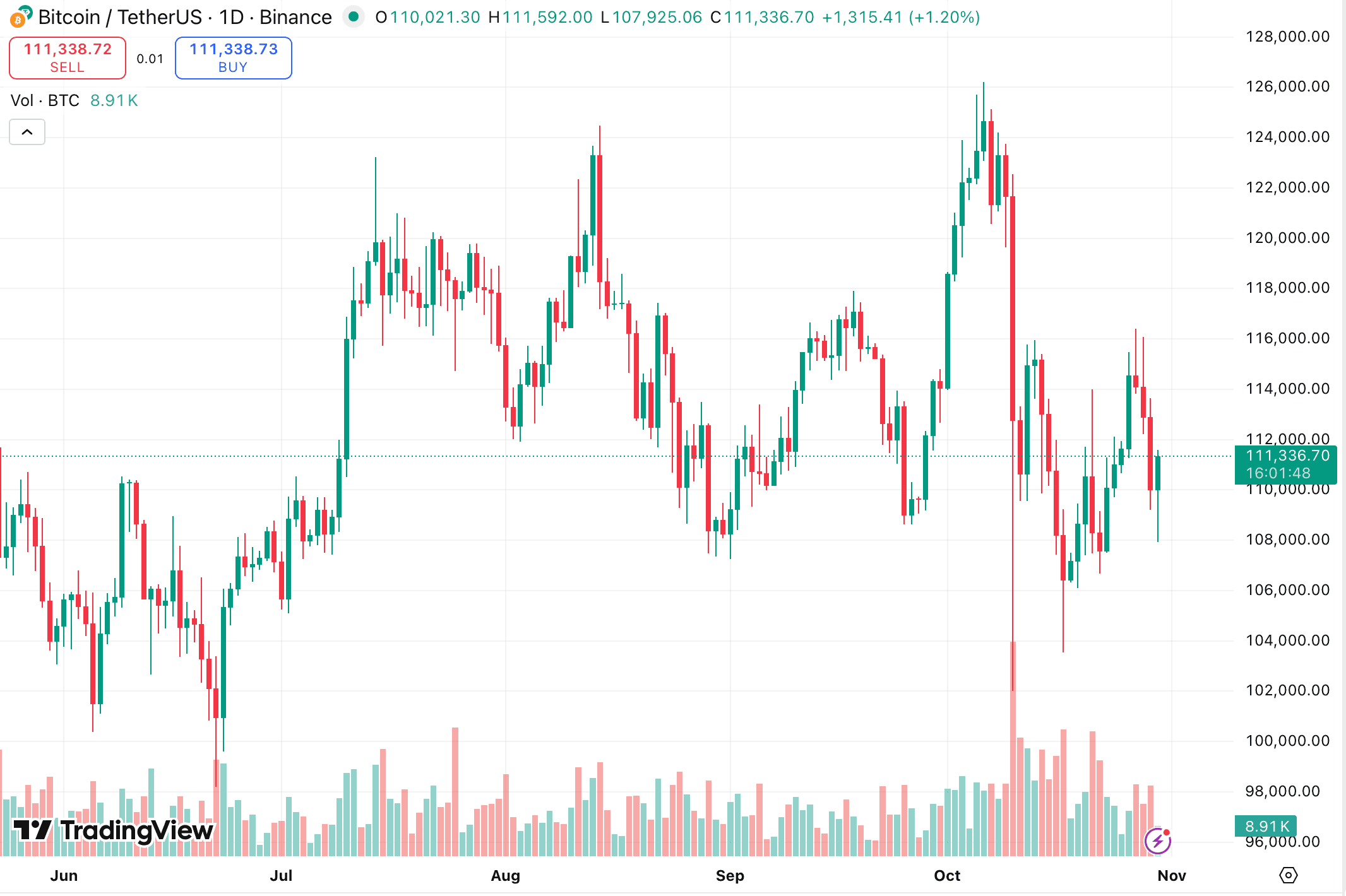

On October 30, 2025, the price of bitcoin dropped to $108,000, but within a few hours, it rose again to over $111,000. This behavior resulted in liquidations in the crypto futures market worth $820.1 million, with traders holding long positions suffering the majority of the losses.

Holders of long positions on many assets lost $653.62 million, while holders of short positions lost $166.48 million. A total of 164,876 traders recorded losses. The share of liquidations among bitcoin and Ethereum traders was $365.44 million and $188.56 million, respectively.

According to CoinGlass, one of the largest liquidations of $11 million was recorded on the Bybit exchange. The decentralized platform Hyperliquid led the way in terms of liquidations (over $285 million), followed by Bybit (almost $225 million), and Binance (over $146 million).

The collapse came shortly after the US Federal Reserve announced an expected 25 basis point rate cut, but Fed Chairman Jerome Powell cooled market optimism, noting that “a December cut is not guaranteed.”

“While the Fed cut interest rates as expected, Chair Powell’s cautious press conference triggered a sharp sell-off in a ‘sell-the-news’ event after stating that the anticipated December cut is not guaranteed,” Nick Ruck, director at LVRG Research, explained in a commentary for CoinDesk.

At the same time, Ruck noted the potential for market recovery:

“While short-term volatility persists, the Fed’s pivot to ending quantitative tightening in December signals a bullish undercurrent for risk assets like crypto, positioning Bitcoin and Ethereum for renewed upside as cheaper capital flows in over the coming months.”

At the time of writing, bitcoin is trading at $111,336, according to TradingView.

In early October, the first cryptocurrency reached a record price of more than $125,000, and a few days later, the crypto market faced the largest wave of liquidations in history, amounting to more than $19 billion.

The Fear and Greed Index in the crypto market is 34 points, indicating that fear prevails. Compared to the previous day, the indicator fell by eight points.

The dominance of the first cryptocurrency was 59.65% at the time of writing, according to TradingView.

Earlier, we wrote that the recent de-escalation of the trade war between China and the United States caused the growth of bitcoin to $116,000.