On October 26, 2025, on the sidelines of the Association of Southeast Asian Nations (ASEAN) summit in Malaysia, US and Chinese authorities reached an interim agreement on a trade deal, ABC News reported citing US Treasury Secretary Scott Bessent. Against this backdrop, high-risk assets, including bitcoin, marked an increase.

Recall, in early October 2025, US President Donald Trump threatened to impose additional duties of 100% on some exported goods from China. This caused the largest wave of liquidations in the cryptocurrency market in history.

This is not the first time something like this has happened. The trade war between China and the US continues to have a significant impact on the markets since the spring of 2025. Read more:

However, this situation is now showing signs of de-escalation. In particular, U.S. Treasury Secretary Scott Bessent said the following in an interview with ABC News:

“I think we’ve reached a substantial basis for the two leaders to meet in Korea next Thursday.”

According to Bessent, official Beijing decided to postpone for a year the implementation of export controls on rare earth minerals and also made concessions on U.S. soybean purchases.

The agreements reached made it possible to remove from the agenda the introduction of additional duties on Chinese exports from November 1, the minister summarized.

The probability of such a scenario in the cryptocurrency community is now estimated at just 2%, according to data from the Polymarket platform.

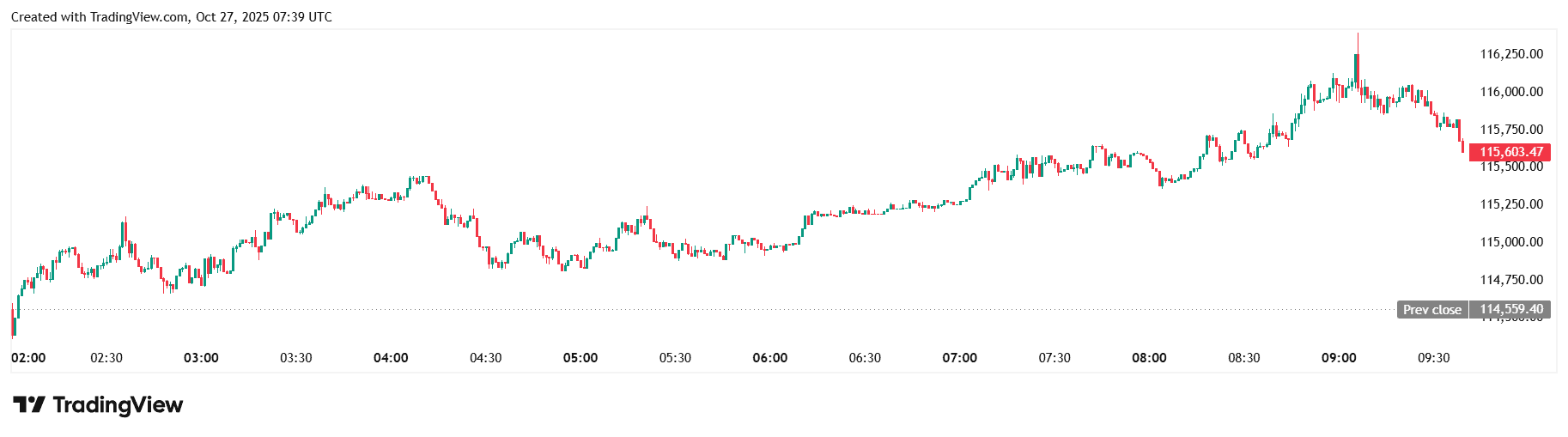

Against this backdrop, high-risk assets, including stock indices and cryptocurrencies, registered positive dynamics. Bitcoin, in particular, recovered to the $116,000 level before pulling back. The gain on the daily chart is 1%, on the weekly chart — more than 6%.

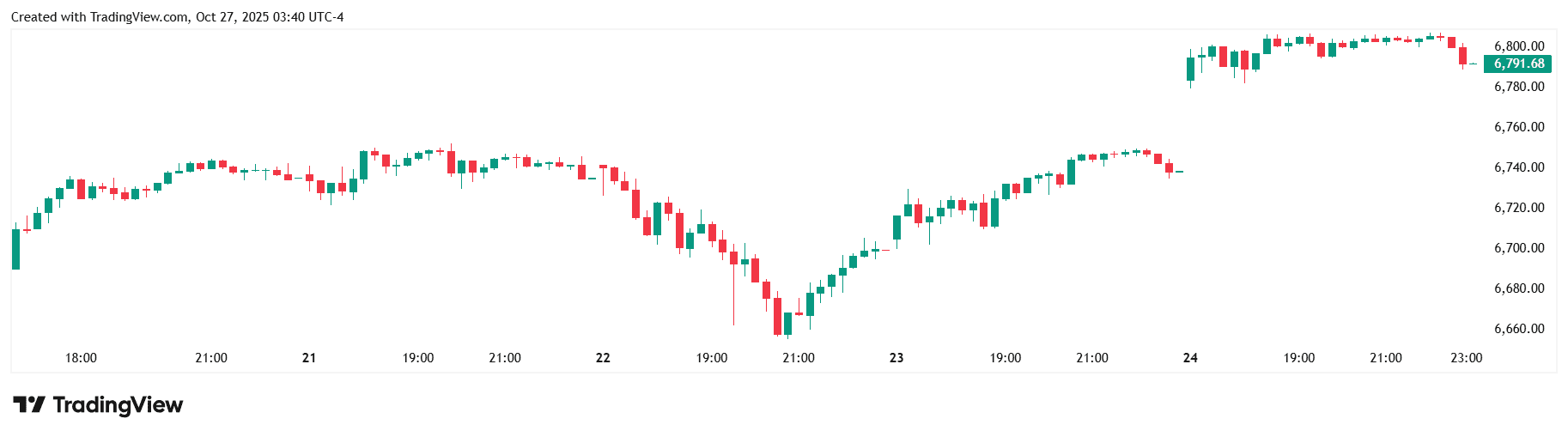

The S&P 500 index, in turn, jumped more than 5% on the premarket:

The next factor that could impact the markets is Trump’s meeting with Chinese President Xi Jinping. It will probably take place on October 30, 2025, but official Beijing has yet to confirm it.

“Trump’s resumption of the US-China dialog has had a positive impact on bitcoin and other risk assets. This week’s ACEAH summit is likely to increase short-term volatility,” Daniel Kim, CEO of Tiger Research, told Decrypt.

The Fear and Greed Index also points to increased optimism among investors. According to CoinStats, it rose by eight points in the last 24 hours.