The Incrypted editorial team prepared a digest of the main events in the cryptocurrency industry this week. In it we told about the pardon of former Binance CEO Changpeng Zhao, the first Solana-ETF in Hong Kong, bitcoin price forecasts and experts’ opinions on the current state of the market.

Top news

Bitcoin news

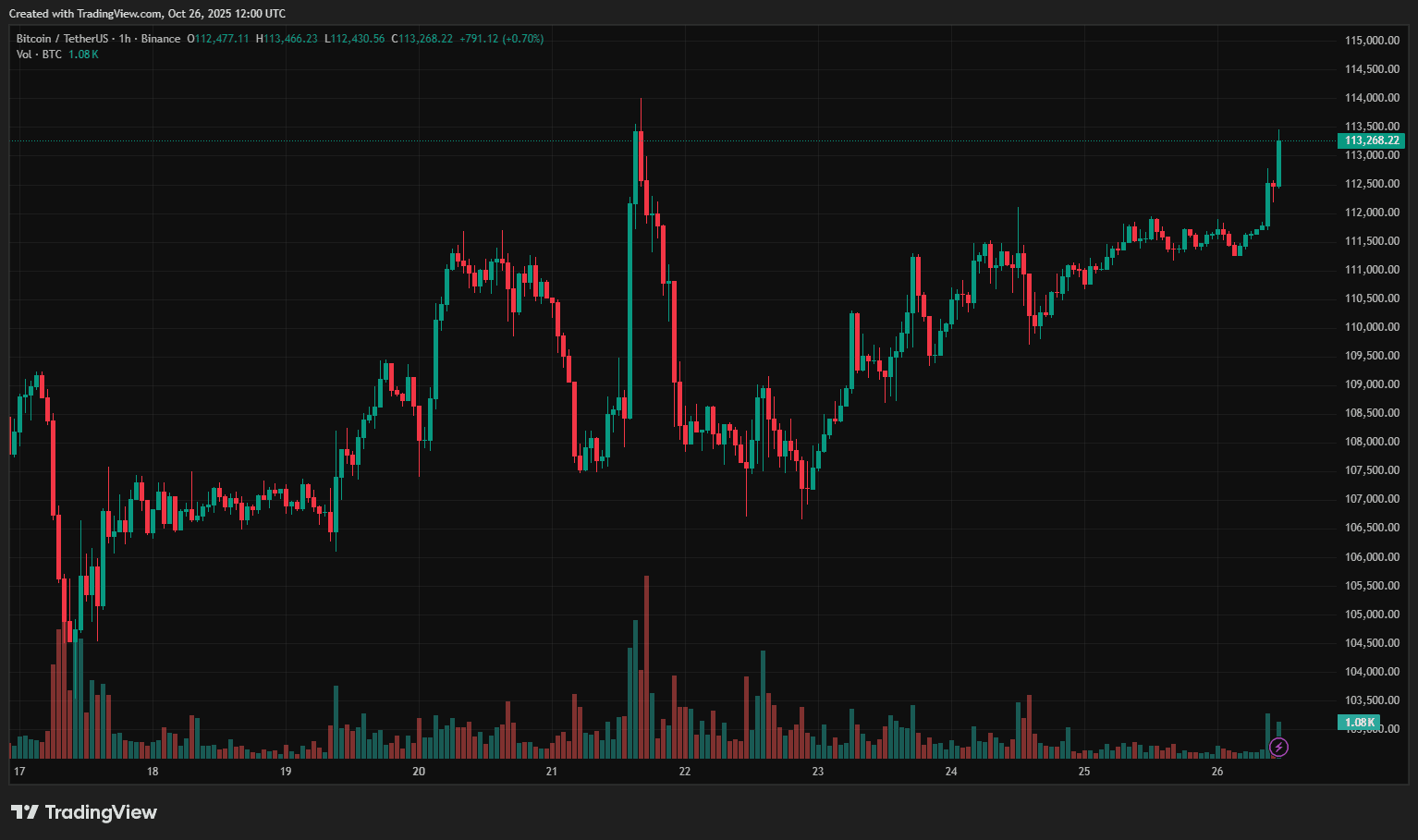

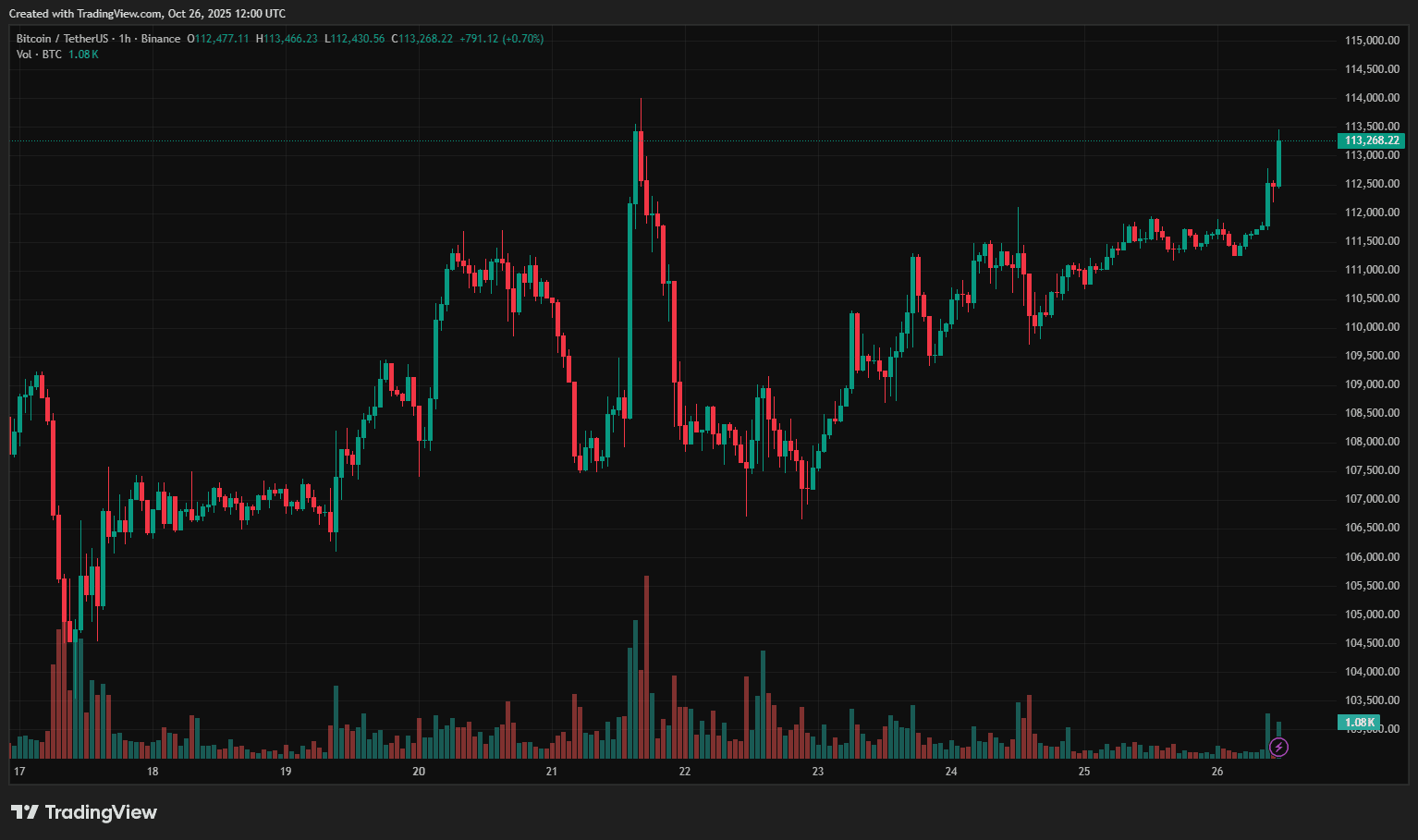

All week bitcoin was trading in the range of $106,000-$114,000. on October 21, the price of the asset momentarily soared to $114,000, and the next day it fell to $106,000. By the end of the week, the sideways movement continued. At the time of writing, the first cryptocurrency is trading close to $113,300, according to TradingView.

- Bitcoin value predictions: peak in a few years and short-term correction

Cryptoanalyst PlanB commented on predictions regarding the peak of bitcoin price, noting that it may come not in 2025, but in 2026-2028. The expert disagrees with the opinion of traders who believe that the local maximum was already at $126,000 and expect a drop below $100,000 in 2026.

PlanB noted that the four-year halving cycle affects the market, but it is a mistake to make forecasts based on it only. The Stock-to-Flow model shows the average of an asset’s price over the cycle, not its peak or bottom. In his opinion, the timing of the peak will depend on the fundamental phase transformation of the market, which has not yet taken place in the current cycle.

Standard Chartered, however, predicts that bitcoin could lose some value in the short term. The bank’s head of digital assets Jeff Kendrick expects the price to fall below $100,000 due to geopolitical tensions between the US and China, adding that this decline will be the last before a new phase of growth.

- BitMine head: bitcoin could fall 50% despite ETF boom

BitMine CEO Tom Lee warned that despite record attention from institutional investors and the launch of spot ETFs, bitcoin’s volatility remains high and the price could fall by 50% again. He said that even amid claims of the crypto market’s “maturity,” bitcoin continues to amplify stock swings: “If the S&P falls 20%, bitcoin could fall 40%.” He added that the stock market has made progress over the past six years, but remains prone to major pullbacks.

Market Analysis

- Galaxy Digital: crypto market remains strong despite severe collapse

The cryptocurrency market remains fundamentally strong despite the crash on the night of October 11, 2025, which resulted in the liquidation of more than $19 billion in futures positions, said Galaxy Digital’s head of research Alex Thorne. He noted that the temporary “cooling” does not affect long-term growth drivers, especially in the field of artificial intelligence, where large companies and the U.S. government are actively investing.

Thorne also emphasized that bitcoin retains the role of “digital gold” and can win amid growing distrust in the fiscal and monetary policies of governments. This makes the first cryptocurrency resilient to fluctuations in traditional markets and macroeconomic uncertainty.

- CryptoQuant: investors do not believe in the resumption of the bullish trend despite the growth of bitcoin

According to CryptoQuant, the crypto market is entering a new phase of mistrust: after the fall and partial recovery, investors are not yet ready to believe in a new trend. One of the key signals is the negative fundings on Binance.

Experts noted that long-term distrust can become “fuel” for sharp growth: liquidation of shorts can cause short-sweeps and push the bitcoin price to liquidity zones around $113,000-$126,000. Similar dynamics have already been seen in September 2024 and April 2025 after sharp drawdowns, and now the market is showing a similar pattern, although open interest in bitcoin has decreased by $12 billion over the week.

- Glassnode: traders go into defense mode after bitcoin crash

The crypto market has entered the defense phase, Glassnode reports, based on several technical and onchain metrics. Experts called bitcoin’s fall from $115,000 to $104,000 in four days a quick market cleansing that knocked out weaker participants and triggered a defensive rotation across the market. While the price has partially recovered, sentiment remains cautious and this is reflected in the current positioning of traders.

- CryptoQuant: traders are returning to spot positions after the collapse

After a wave of liquidations on the night of October 11, 2025, market participants have started to return to spot trading en masse, CryptoQuant said. According to them, this may indicate a shift to more cautious investment strategies.

Cryptocurrency exchange Binance maintains its leadership in the spot market: the volume of bitcoin transactions on the platform exceeded $180 trillion, while in September the average daily volumes were $3-5 billion, and now stabilized in the range of $5-10 billion per day. Analysts believe that a return to spot instruments could help further structural recovery of the market.

- Movements of whales

Three major wallets actively bought up Ethereum on the dips, acquiring more than 23,000 ETH in total. Among the transactions: one of the whales withdrew 12,000 ETH (about $46 million) from Binance, while another withdrew 8,500 ETH from OKX ($32 million). Also, the RadiantCapital hacker converted a significant amount of DAI into WETH.

In addition, whales continue to accumulate Chainlink (LINK). One wallet withdrew more than 62,000 LINKs (about $1.07 million) from OKX, and in five months has cumulatively collected more than 1.1 million LINKs worth $19 million). Another major player withdrew more than 66,000 LINK ($1.14 million) from Kraken and has accumulated more than 300,000 LINK ($5.34 million) in the past 30 days.

Analysts also note that addresses with balances between 100,000 and 1 million LINK are steadily increasing their positions. In addition, LINK traders’ average 30-day return below -5% typically signals a potentially profitable entry point.

Donald Trump pardons former Binance CEO Changpeng Zhao

US President Donald Trump signed an executive order pardoning former Binance cryptocurrency exchange CEO Changpeng Zhao (CZ), who served four months in prison. Trump himself noted that he did not personally know Zhao, but he allegedly received recommendations from many decent people. According to Trump, Zhao was behind bars as part of the Biden administration’s campaign to crack down on the cryptocurrency industry.

Coinbase and other platforms ran into problems due to a glitch in Amazon Web Services

on October 20, a number of platforms, including Coinbase, experienced access issues due to a massive glitch in Amazon Web Services (AWS). The glitch occurred in the US-EAST-1 region due to errors in the DynamoDB service, which also affected AWS support.

Zoom, Signal, Slack, Canva, Roblox, Reddit, Hulu, EA, Xbox Network, as well as some financial institutions – Barclays, Lloyds and Bank of Scotland — were affected by the problems. Coinbase users were temporarily unable to log into their accounts, although the situation has since started to normalize.

The nof1.ai team launched a cryptoasset trading competition among six AI models

On October 17, nof1.ai unveiled Alpha Arena, a platform for a real trading competition of six AI models, each starting at $10,000. Most of the models are showing profits, albeit small. The first season of the competition will end on November 3.

The number of USDT stablecoin users has surpassed 500 million users

Tether, the issuer of the USDT steiblcoin, announced that the number of users of the token has exceeded 500 million people, or about 6.25% of the world’s population. According to CEO Paolo Ardoino, this is “probably the biggest financial inclusion achievement in history.” Tether noted that it’s talking about real people, not just cryptocurrency wallets, which shows the widespread use of USDT.

Furthermore, Ardoino added that Tether expects to earn $15 billion by the end of the year.

The first spot Solana-ETF will enter the Hong Kong market on Oct. 27

The Hong Kong Securities and Futures Commission (SFC) has approved a spot Solana-ETF from ChinaAMC that will begin trading on the Hong Kong Stock Exchange on October 27, 2025. The fund is called ChinaAMC Solana ETF and will invest directly in Solana, making it a spot exchange-traded product.

The management fee is 0.99%, the minimum lot is 100 shares, and trading will be in U.S. dollars, Hong Kong dollars and Chinese yuan. This is the first spot Solana-ETF in the Hong Kong market and in Asia as a whole.

Melania Trump and Javier Milay have been named as defendants in a memcoin fraud lawsuit

A class action lawsuit has been filed in the US alleging that First Lady Melania Trump and Argentine President Javier Milay are allegedly indirectly involved in promoting the fraudulent memcoins LIBRA and MELANIA. The plaintiffs believe that Benjamin Chou, founder of startup Meteora, was behind the projects and coordinated the actions of other participants.

Polymarket has confirmed the launch of the POLY token and airdrop

Betting platform Polymarket plans to launch its own POLY token and airdrop amid growing demand for prediction markets. This was revealed by the company’s marketing director Matthew Modabber.

Earlier this month, Polymarket co-founder Shane Coplan had already hinted about a future token. Modabber confirmed that the token will indeed appear, and with it will come airdrop.

Additionally, Bloomberg said that Polymarket wants to raise new funding with a valuation of up to $15 billion.

Other news:

- Media: democrats will meet with cryptocurrency executives to regulate the sector;

- NYDIG: Stablecoins are not pegged to the dollar and can lose value;

- VanEck has applied to launch an ETF based on Lido’s stETH;

- Coinbase acquired Echo for nearly $375 million for onchain fundraising;

- OpenAI unveiled the ChatGPT Atlas browser;

- KDA token collapsed about 60% amid Kadena shutdown;

- Amazon plans to replace more than 600,000 workers with robots;

- senator Warren criticized the GENIUS stebacco legislation;

- Ternopil resident lost more than $28,000 due to fake investments;

- WSJ: FalconX will buy 21Shares and is planning an IPO;

- Kalshi and Polymarket become official NHL partners;

- Google achieved confirmed quantum superiority with Quantum Echoes algorithm;

- Bunni stock exchange halted operations after hacker attack;

- Changpeng Zhao criticized the idea of tokenized gold;

- Poltava City Council deputy suspected of hiding more than UAH 200 mln in cryptocurrencies;

- Bloomberg: JPMorgan will allow bitcoin and Ethereum to be used as collateral for loans.

What’s in store for Incrypted?

The Incrypted team has prepared a market overview:

The editorial team deconstructed the discussion regarding criticism of Buterin and Ethereum Foundation and analyzed the statements of some participants:

Learned what caused the price rally of privacy-related assets:

Incrypted’s editorial team figured out how Fibonacci circles work, how they differ from other analysis tools, and how to integrate this tool into a trading strategy:

The team researched which professions and activities in cryptocurrencies and AI are the most promising:

Analyzed a16zcrypto’s report — State of Crypto 2025:

Airdrops

Guides and activities:

Updates:

In addition…

- Gathered the key blockchain and crypto asset investments for you in one piece.

- We regularly update Incrypted cryptocalendar, where you will find a lot of interesting events and announcements.