At the beginning of October 2025, both bitcoin and Ethereum registered positive momentum. On a weekly chart, the former is up more than 10%, while the latter is up 15.6%, according to TradingView.

Bitcoin, in particular, is trying to consolidate above $120,000 at the time of writing:

Ethereum fell into the area below $4500, consolidated in it and is now trying to re-cross this resistance level:

This is in line with the broader dynamics in the crypto market as a whole. All the largest assets in terms of capitalization have seen growth. BNB stands out among them, with the coin’s value jumping by more than 6% on the daily chart.

The volume of liquidations on futures contracts on crypto assets exceeded $385 million. These are mostly short positions.

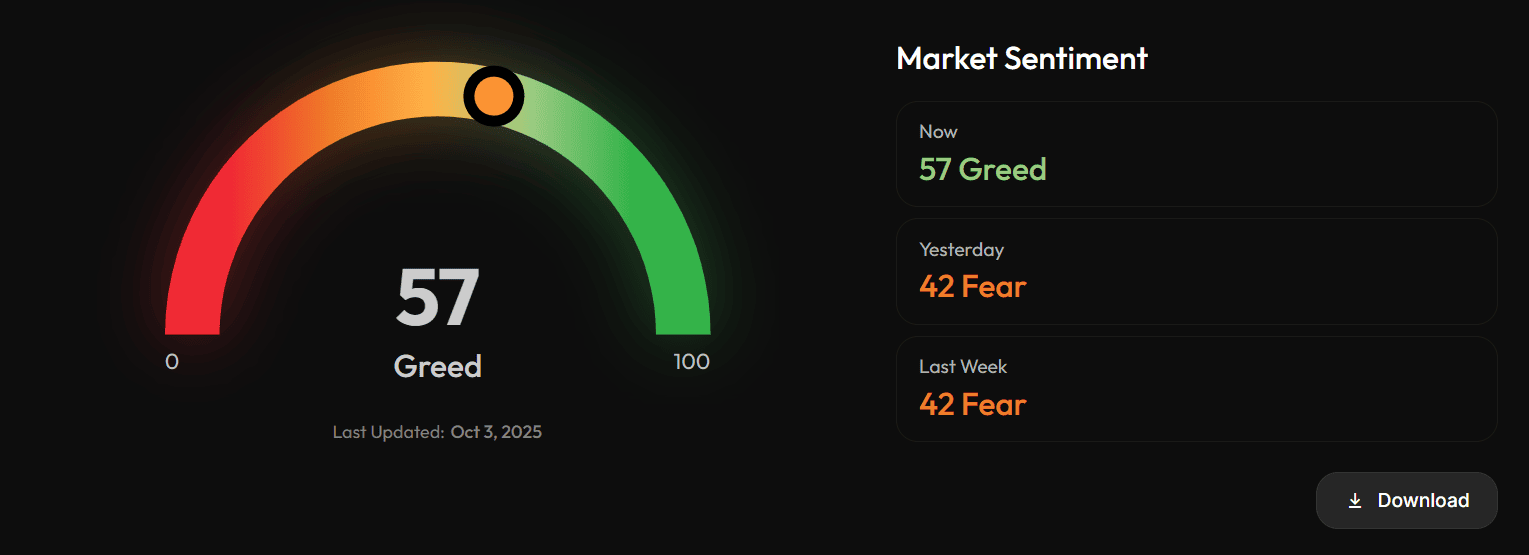

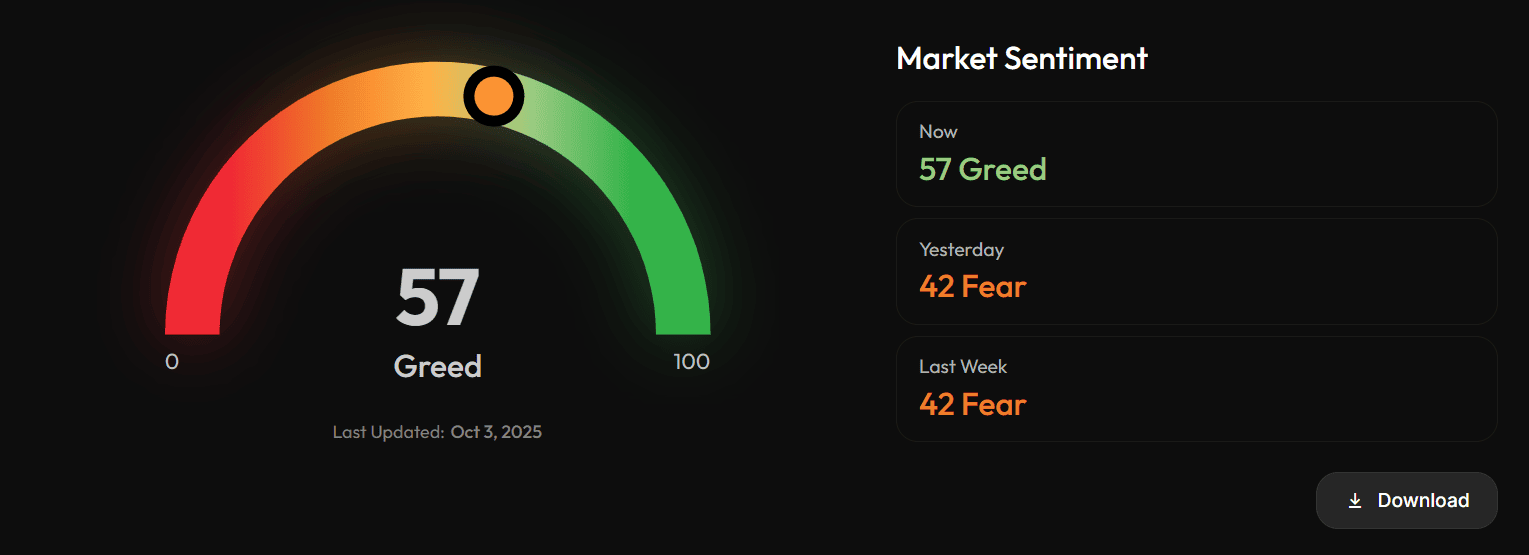

Over the past 24 hours, the Fear and Greed Index on the crypto asset market jumped 15 points. It indicates a change in sentiment and the tendency of investors to buy rather than sell.

According to experts, the main catalyst for changes in the cryptocurrency and stock market is the shutdown. Earlier, we reported on the US government shutdown for an indefinite period of time on October 1, 2025.

At that moment, this macroeconomic factor led to a sag in the prices of crypto assets, indices and stocks. However, they later began to rise. In a commentary for The Block, John Haar, managing director of Swan Bitcoin, explained it this way:

“Over the longer term, given record high levels of global debt and pressure on fiat currencies, bitcoin is increasingly seen as a liquid non-sovereign reserve asset. We are seeing a shift from speculative trades to strategic allocations and believe this will push prices higher.”

In addition, the S&P 500 index rose 1.5% for the week, while gold gained 3%. Meanwhile, the yield on three-month U.S. Treasury bonds, one of the most popular bonds, hit a new low since October 2022.

Also note that October is often a positive month for the crypto market, given the statistics of previous years.