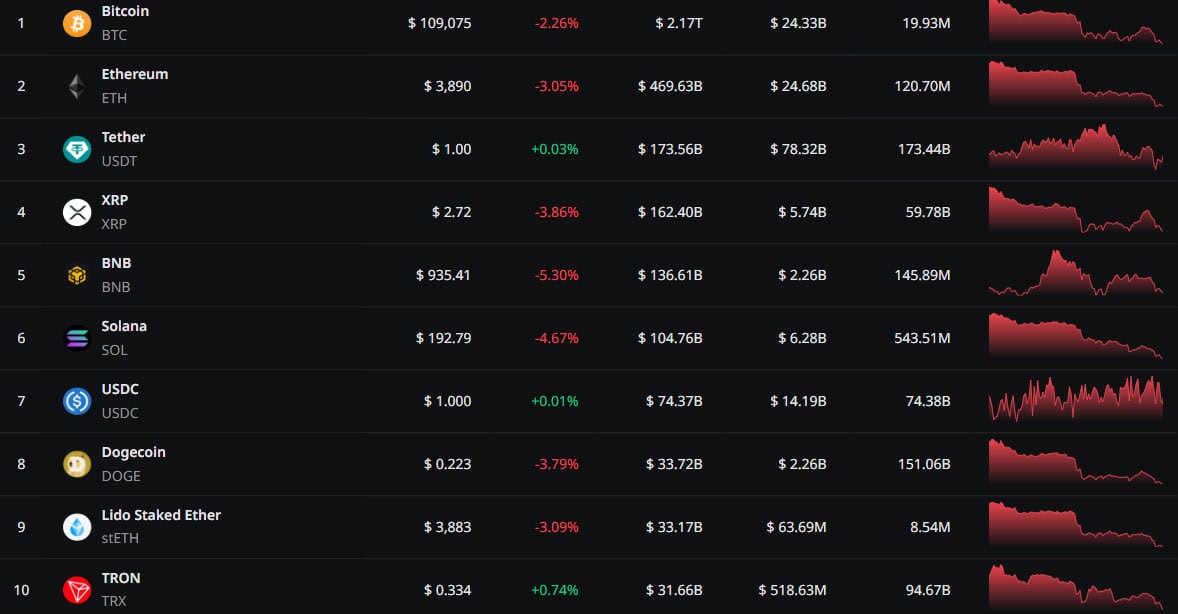

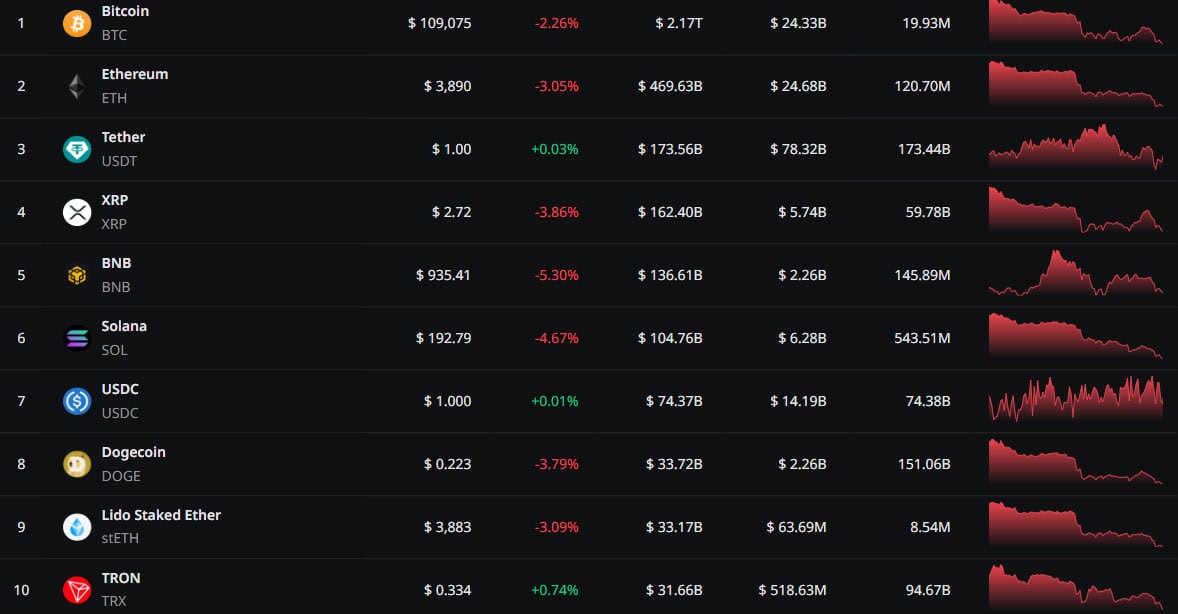

Since the beginning of the week, 22 September, bitcoin has been showing a decline. At first, its price exceeded $114,500, but already on 25 September, the value of the asset fell below $109,000.

The situation with altcoins is no better. Most have moved into the “red zone”, and the top 10 assets by market capitalisation have sagged most significantly with the BNB coin — by 5.3%.

Against this background, the dominance indicator of the first cryptocurrency is growing. It exceeded the 59% mark for the first time in more than a month.

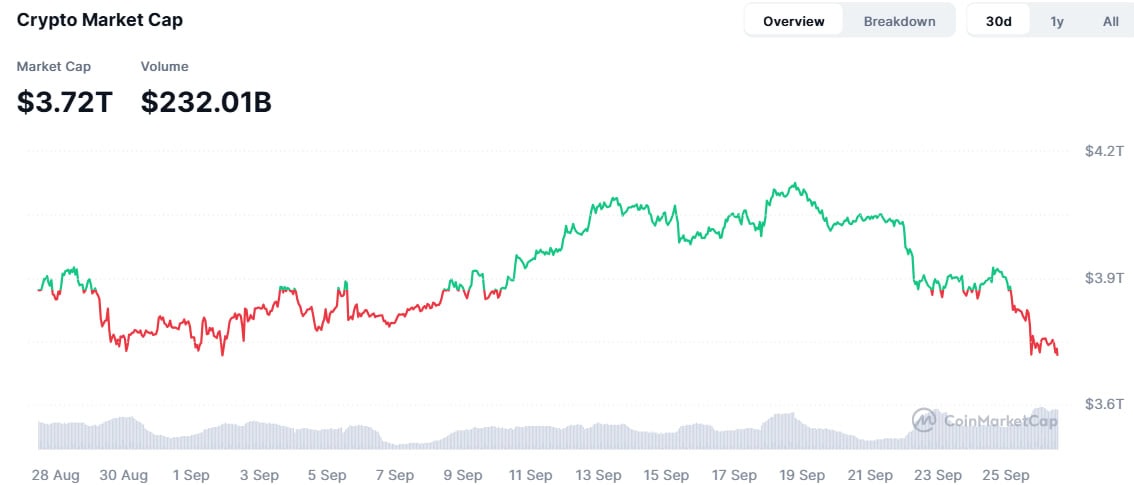

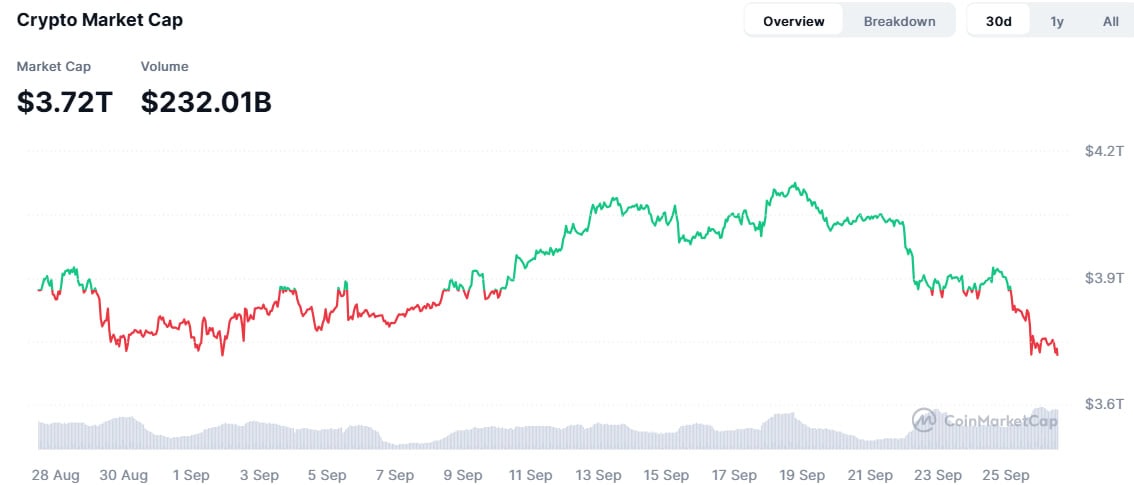

Cryptocurrency market capitalisation has fallen by more than 5% and is around $3.7 trillion at the time of writing.

In addition, spot bitcoin and Ethereum-ETFs are showing negative dynamics on a week-to-week basis. In four days, between 22 and 25 September, outflows totalled around $484 million and $547 million respectively, according to SoSoValue data.

Incrypted’s editorial team gathered the opinions of experts regarding the current state of the crypto market, who analysed how likely the beginning of the bearish cycle is and whether there are still chances for the bull market to continue.

What do experts say about the current situation?

- Glassnode: the market is depleted

Glassnode noted that bitcoin’s fall after the 0.25% interest rate cut follows the classic “buy on rumours, sell on news” pattern, but the broader context indicates a growing market exhaustion.

They said the current decline is minor compared to previous cycles, but it comes after three large waves of capital inflows that increased realised capitalisation by $678 bn — almost double the previous cycle.

Long-term holders have already realised gains of 3.4 million BTC, highlighting the high level of distribution and maturity of the rally, analysts said.

At the same time, inflows into ETFs, which had previously absorbed supply, have slowed. Spot volumes have surged due to forced selling, while options markets have priced in downside risk, experts said. They added that taken together, these signals indicate that the market is lacking “fuel” and liquidity-driven fluctuations are dominating.

Analysts noted that unless demand from institutional players recovers again, the risk of a deep “cooling” will remain high, highlighting a macro structure that increasingly resembles a depletion phase.

- Miles Deutscher: hard to expect a quick trend reversal

Crypto analyst Miles Deutscher said that bitcoin and Ethereum look weak, and it’s hard to expect a quick trend reversal now because of the current dynamics.

Gold has absorbed much of the liquidity, which Deutscher said could be positive for the former cryptocurrency in the long term, but in the short term it is holding back its growth.

He also suggested that the likelihood of a prolonged market cycle is increasing, and did not rule out that a new peak could occur closer to 2026.

Deutscher advised using a DCA strategy for strong assets that he believes will remain relevant a year from now, and to focus the rest of his time and energy on finding promising narratives and deals that are available now.

- Matrixport: traders are preparing for a big move

Matrixport said derivatives traders are preparing for a possible big move in the market. They said some are signalling the simultaneous fragility and opportunity of the market. Key onchain levels and derivatives indicators are near thresholds that have historically preceded significant moves, while the “crypto reserve” theme is losing momentum, the statement said.

They also noted new patterns in open interest and volatility that could indicate the next phase of the cycle is different from the previous one.

Options traders are already taking positions near the critical level around $110,000, they said. The experts noted that excessive use of leverage this year could lead to an early cycle disruption.

- PlanB: bitcoin will grow as long as they print money

The PlanB analyst noted that, whether one likes it or not, the value of bitcoin is closely linked to the scarcity of its supply. He emphasised that as long as fiat money is printed, the price of the asset will rise.

- Santiment: “buying on the dip” does not yet signal a bottom

According to Santiment experts, bitcoin’s 8.8% drop from its record high of $123,800 has disappointed traders, but the surge in retail investors’ confidence in “buying on the dip” does not yet signal the day.

Analysts emphasised: prices usually move against mass expectations, and a significant rebound requires a prolonged prevalence of short positions.

Experts believe that “buying on the dip” can be profitable, especially in the DCA format because of the multiple levels of limit buying, which reduces risk and reaps rewards regardless of further market movement.

- Peter Schiff: what will break the “bitcoin bubble”?

Peter Schiff, a well-known cryptosceptic and head of Euro Pacific Capital, said that bitcoin is not living up to expectations. He noted that compared to gold, the first cryptocurrency is now 20 percent below its record high in August, indicating a bear market.

Schiff also emphasised that Ethereum has fallen below $4,000, and despite the asset being added to companies’ reserves, it is in an “official bearish trend”, down 20% from its August high.

He also noted the rise in the price of silver amid bitcoin’s decline. According to Schiff, he previously expected that it was gold that could “burst the bitcoin bubble,” but now it seems that silver may be the reason.

- CoinDesk analyst: the market usually rises in the last quarter of the year

CoinDesk technical analyst Omkar Godbole reminded that historically Q4 has been the strongest period for bitcoin, especially in October and November, and Ethereum traditionally performs well at the end of the year.

Whale movements amid market decline

CryptoQuant said that short-term bitcoin holders are exiting positions en masse — during the week they recorded losses of more than $2.2bn. Experts also noted strong selling pressure on Ethereum.

However, Santiment reported that whales bought about 30,000 BTC during the week, indicating that key players continue to accumulate. According to their data, key holders continue to accumulate bitcoin, with wallets with 10-10,000 BTC adding more than 56,000 BTC since 27 August, and bitcoin volume on exchanges down by more than 31,000 BTC, limiting further selling pressure.

Other whale movements:

- in seven days, the OTC whale bought 60,333 ETH worth about $238.7 million at an average price of about $4230, but is now suffering losses of more than $16 million;

- in two days, 15 wallets received 406,117 ETH (roughly $1.6bn) from Kraken, Galaxy Digital, BitGo and FalconX;

- a newly created wallet has withdrawn 1,524 BTC ($171 million) from exchanges in the last three days.