.post-accordion-wrapper .accordion-content {

max-height: 0;

overflow: hidden;

}

Despite the rapid expansion of DeFi, many tools and earning strategies still remain the privilege of centralized exchange (CEX) users — derivatives most of all.

Earlier this year, Hyperliquid struck a serious blow to that monopoly by rolling out a decentralized derivatives platform. Now, Pendle Finance is carrying the torch forward with its own innovation in the yield-trading space.

On August 6, 2025, the Pendle team introduced Boros — a product that turns perpetual futures funding rates into a tradable market of their own. For traders, this unlocks entirely new opportunities for hedging and profit-making without relying on centralized exchanges.

At Incrypted, we explored how Boros works, the role it plays within the Pendle ecosystem, and why it could be the very tool that draws institutional players deeper into crypto.

What is Boros and Why Does It Matter?

Boros is a platform for tokenizing and trading funding rates. In essence, the service takes the cash flows that were once “baked into” futures contracts and turns them into a standalone financial instrument.

Funding rates are regular payments between holders of long and short positions in the futures market. Their purpose is to bridge the gap between the price of a futures contract and its underlying spot asset.

If the futures contract trades above the spot price, the funding rate is positive — meaning long position holders pay short position holders. Conversely, if the futures price is below the spot price, the rate becomes negative, and payments flow in the opposite direction.

.post-accordion-wrapper .accordion-content {

max-height: 0;

overflow: hidden;

}

Funding rates can have a significant impact on trader behavior and are factored into profit forecasting. Moreover, there are delta-neutral strategies that allow traders to earn solely from these payments, without relying on the asset’s price movements. This is the approach employed by platforms like Ethena.

On the crypto market, the use of delta-neutral strategies has been limited by several factors:

- high volatility: Even for large-cap assets like Bitcoin, funding rates can change extremely rapidly.

- liquidity fragmentation: Each exchange effectively acts as its own futures market, so funding rates often vary across platforms.

These challenges make it difficult to develop effective strategies. In traditional finance, they are addressed with interest rate swaps, which allow fixed payments to be converted into floating ones (or vice versa) based on market expectations. Until now, nothing like this existed in DeFi.

Boros fills this gap by tokenizing funding rates. Each YU token (Yield Unit) represents the expected funding rate for a futures position. For example, one YU-BTCUSDT token corresponds to the funding payments for a contract of one Bitcoin.

Boros separates funding payments from the futures themselves, turning them into a tradable standalone asset, which enables users to:

- hedge risks: Arbitrage funds or platforms like Ethena can lock in payments and avoid exposure to rate fluctuations.

- optimize strategies: Using YU tokens, traders can manage their funding costs more efficiently.

- speculate on rates: YU allows earning from rising or falling funding rates without opening a futures position.

Some experts argue that Boros has effectively brought interest rate swaps to the blockchain — opening a potentially very attractive market for DeFi.

According to Coinglass, in August 2025, the daily open interest for crypto futures ranged between $175–220 billion, with an annualized funding rate of about 10%. This means roughly $17–22 billion within perpetual contracts could potentially be tokenized through Boros.

How Boros Works?

At the time of writing, Boros operates as a decentralized application (dApp) on the Arbitrum One network. The platform receives real-time funding rate data from centralized exchanges via oracles. From the user’s perspective, Boros is accessible through the Pendle interface, neatly organized in its own dedicated tab.

Trading is executed through an order book, with order prices expressed as the expected annual funding rate for a given asset (explained in detail below). Orders are filled when matching conditions are met.

Additional liquidity is provided by automated Vaults, which pool assets from liquidity providers.

These vaults act as market makers, executing market orders while participants earn a share of trading fees along with additional incentives in PENDLE tokens. Moreover, liquidity providers’ stakes can grow if trading is successful.

Overall, the Boros model is similar to Pendle’s mechanism but operates with a single token.

YU Tokens and Trading

The main trading asset on Boros is the Yield Unit (YU). Its price is tied to the annualized yield of a contract until maturity, also referred to as the implied APR. This reflects the market’s expectations for the asset’s profitability and is calculated using the same formula employed in Pendle’s main protocol.

In contrast, there is the underlying APR, which represents the current funding rate on the futures market. This rate fluctuates according to the calculation method on the corresponding derivatives platform.

Each YU token is linked to a specific asset and supported exchange. For example, one YU-ETHUSDT Binance represents the yield of a 1 ETH futures position on the Binance exchange.

The existence of tokens tied to specific exchanges is linked to the previously mentioned problem of funding rate fragmentation. Depending on which platform provides the data, the profitability of a position and its responsiveness to market changes can vary. This should be taken into account when opening a position.

For example, Binance calculates funding rates every 8 hours, while Hyperliquid does so hourly.

Potentially, this opens up arbitrage opportunities between different crypto exchanges.

.post-accordion-wrapper .accordion-content {

max-height: 0;

overflow: hidden;

}

Based on this understanding, a trader can open a position as follows:

- long YU — you pay the implied (fixed) rate and receive the floating rate until the contract matures. The position is profitable if the underlying rate exceeds the fixed rate.

- short YU — you pay the underlying (floating) funding rate and receive the fixed rate. The position is profitable if the underlying rate falls below the fixed rate.

Payouts are calculated at the same frequency as the funding rate updates on the corresponding derivatives platform. For example, holding a token tied to Binance means profits or losses are updated every 8 hours, with collateral adjusted accordingly.

As with Pendle’s yield tokens, each YU has a maturity date that coincides with the contract’s expiration. As this date approaches, the token’s value gradually decreases, reaching zero on the day of maturity.

Traders can also exit a position early by selling their YU tokens. This allows them to speculate on funding rate forecasts. For instance, if the market anticipates a significant rise in rates, this expectation is reflected in the YU’s price. The holder can potentially earn more from selling the position than from simply holding it and collecting the ongoing payouts.

Traders should understand that funding rate–linked tokens are complex derivative instruments. Volatility in these markets can be significantly higher than on spot markets, and predicting it is much more challenging.

For example, when opening a long YU position, a user anticipates an increase in the funding rate. For this to happen, the price of futures contracts must:

— stay above the asset’s spot price, and

— continue rising after the Boros position is opened.

In practice, even if futures continue to grow relative to the spot price, a slowdown in the rate of growth can make a long YU position unprofitable. This is particularly important when taking a long position while the funding rate is already high.

The complex pricing, which depends on the dynamics of multiple markets simultaneously, increases risk and requires a deep understanding not only of the industry but also of derivative mechanics.

.post-accordion-wrapper .accordion-content {

max-height: 0;

overflow: hidden;

}

Risks for Liquidity Providers

The presence of vaults allows users to earn passive income on Boros by contributing their tokens to provide liquidity. However, this form of earning comes with a specific risk.

Unlike classic AMM pools, where impermanent loss is driven by changes in asset prices, in Boros it is caused by fluctuations in funding rates. This is because vault participants effectively take a long position in the corresponding YU token.

Therefore, if the implied rate decreases relative to the entry point, the vault incurs a loss, reducing each provider’s share. These losses can, however, be fully or partially offset by protocol incentives.

To mitigate systemic risk, Boros launched in a limited mode — maximum leverage is capped at 3x, and there is a ceiling on open positions. At the time of writing, the limits are 163 BTC and 8,353 ETH for the Bitcoin and Ethereum markets, respectively. The team plans to gradually increase these limits in the future.

Boros and Pendle

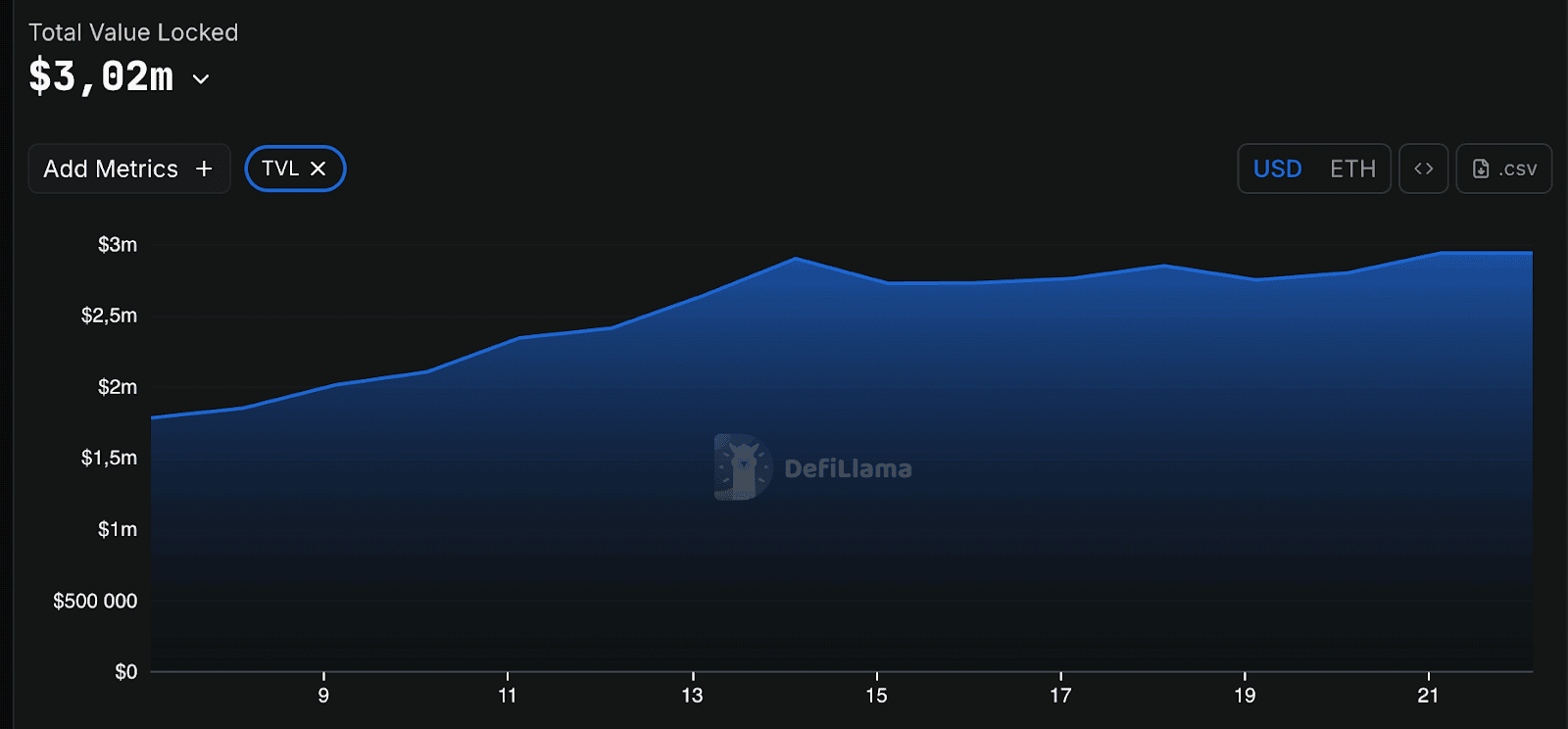

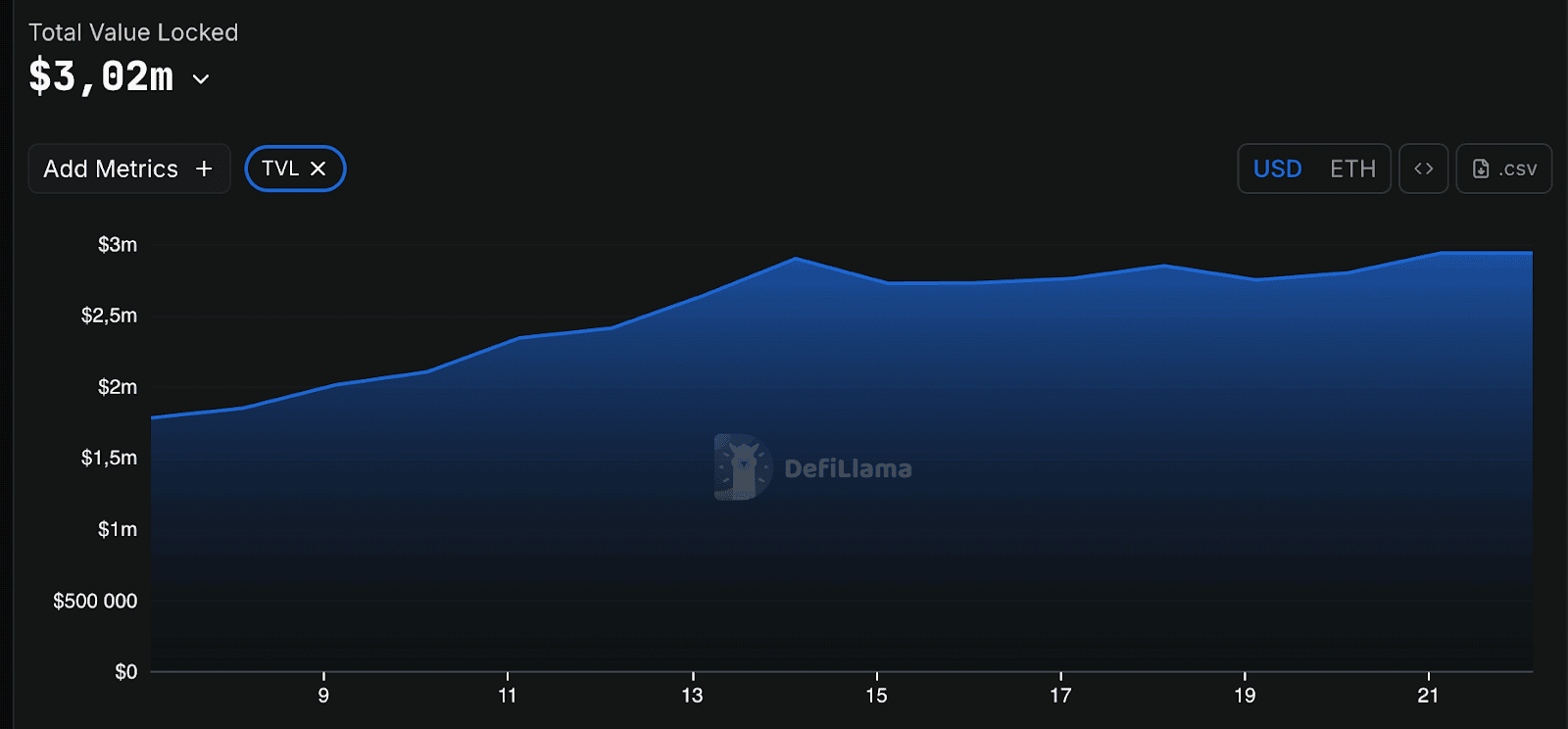

The launch of Boros coincided with strong growth in Pendle’s metrics. In the first two weeks of Boros’s operation, the platform’s Total Value Locked (TVL) increased by 350,000 ETH (approximately $2.5 billion). In August, the protocol also recorded its highest revenue since January 2025, with up to 80% distributed to vePENDLE holders.

Indirectly, the increase in TVL and trading activity may indicate strong demand for the new product, although it cannot be ruled out that the Boros launch coincided with other growth drivers for Pendle.

Additionally, on the first day after launch, users contributed $1.75 million to Boros liquidity pools, and by the time of writing, this figure had risen to $3 million.

It is also worth noting that the protocol launched with a $10 million open interest cap and 1.2x leverage. However, just a week later, the team increased the limits and maximum leverage in response to high demand.

Moreover, Boros is included in Pendle’s 2025 roadmap. The team points out that the funding rate market alone could provide trading volumes for the new product an order of magnitude higher than the main protocol, simply because the derivatives market is ten times larger than the spot market.

At the same time, Pendle may expand into other variable-yield markets, including traditional ones such as mortgages. This is indirectly confirmed by the same roadmap, which includes plans for the launch of the Citadels platform. The platform is aimed at institutional investors and is expected to provide them with tools to operate in regulated markets.

It is likely that cross-integration of solutions will occur in the future — Boros could become the foundation for new interest rate markets in regulated sectors, with access provided via Citadel. In this sense, the service can also be seen as another step toward bridging traditional finance and crypto markets.

Community members note that the new product expands Pendle’s capabilities in another way — while the main platform focuses on on-chain assets, Boros opens access to off-chain yield trading. Previously, these capital flows were managed exclusively by centralized crypto exchanges.

Very significant launch by @pendle_fi.

Combined with Pendle’s existing PT/YT mechanism for on-chain yields, Boros now covers off-chain yields (CEX funding rates).

Perps traders will be able to lock in funding rate costs.

Could be very useful for @ethena_labs one day, who… https://t.co/OOmNt6oqDu

— Aylo (@alpha_pls) August 6, 2025

Considering potential partnerships and future yield, Boros could significantly strengthen Pendle’s market position. The impact is reflected in PENDLE token prices, which rose by more than 20% following the launch of the new product.

However, when assessing Boros’ potential, it’s important to note that funding rate trading is a product for advanced traders and institutional players. Without an active influx of professional participants, the market may remain too niche, limiting both trading volumes and liquidity.

It is also worth noting that, for now, Boros only uses Binance funding rates and only for Bitcoin and Ethereum. This provides a relatively safe “sandbox”, which is also constrained by the platform’s limits. How sustainable and effective the service will be when integrating with new exchanges and assets remains to be seen.

Overall, Boros is a pioneer exploring new DeFi instruments. It likely also marks another path through which the crypto industry can connect with traditional markets, while maintaining openness and transparency.