.post-accordion-wrapper .accordion-content {

max-height: 0;

overflow: hidden;

}

According to ARK Invest, the stablecoin sector is one of the fastest-growing segments of the crypto industry. In 2024, transaction volumes with “stable coins” hit $15.6 trillion — roughly 119% of Visa’s and 200% of Mastercard’s annual processing volumes.

According to Fedor Chmilev, co-founder of Resolv Labs, these figures show that stablecoins have become the first real product of the crypto industry to achieve genuine market fit.

At the same time, Resolv Labs CEO Ivan Kozlov believes we’re just at the beginning:

“There won’t be just one type of stablecoin. We’ll see tokenized hedge funds, tokenized money market funds, tokenized DeFi strategies — all carrying the same convenient feature of being pegged to the U.S. dollar. In essence, we’re witnessing the rise of an entirely new cohort of financial instruments.”

One such solution was developed by Resolv Labs itself. The Incrypted editorial team explored how the Resolv protocol works and what the project brings to its users.

Types of Stablecoins and How They Differ

There are many varieties of stablecoins. One way to classify them is by the type of collateral they use. In simple terms, these assets can be backed by either real-world holdings or digital assets.

USDT and USDC — the two largest by market capitalization at the time of writing — fall into the first category.

Collateral for the second category can come in two forms:

- project-related assets, such as governance tokens;

- external assets, like third-party cryptocurrencies.

A notorious example of the first approach was Terra (LUNA), which attempted to build its stability model around its own cryptocurrency. After the project’s collapse, Ethereum founder Vitalik Buterin published an эссе arguing that if a stablecoin’s security depends on an external asset, it is generally far more reliable.

Kozlov agrees:

“In Terra (LUNA), the project relied on a project-linked token to stabilize its price, which could either be minted or burned. In small-scale scenarios, this system is somewhat stable, but it fails at larger scales. Within certain deviations, it works, but fundamentally, it’s essentially self-issuance tied to its own asset.

In the delta-neutral model we use, as well as in projects like Ethena and a few others, there’s a crucial difference: the collateral consists of the most liquid assets with the most developed markets — namely Ethereum, Bitcoin, and Solana.”

According to Kozlov, in Resolv’s model, even if Ethereum’s price drops to zero or skyrockets to $100,000, there’s no problem because the position is fully hedged.

How Resolv Works?

Resolv Labs’ approach revolves around tokenizing a market-neutral portfolio composed of:

- on-chain assets;

- derivative positions that hedge price risks.

“We call this new approach a truly delta-neutral (True Delta-Neutral; TDN) stablecoin, unlike pseudo-delta-neutral strategies,” the project blog states.

The Resolv protocol uses six tokens:

USR — a stablecoin collateralized with Ethereum and Bitcoin. It can be minted or redeemed at a 1:1 ratio. In addition to full collateral, a liquidity-based insurance fund of ETH and BTC makes USR overcollateralized. Its price is fixed at $1. While the token itself does not generate yield, it can be staked to earn rewards.

RLP (Resolv Liquidity Pool) — the insurance fund token. Its value reflects the amount of ETH and BTC backing one RLP. The token’s price can fluctuate, and the asset is designed to protect USR from market and counterparty risks.

stUSR — the yield-bearing version of USR. Its value mirrors that of USR, while the number of stUSR tokens increases over time through staking rewards. Assets can be unlocked at any time at a 1:1 ratio without a waiting period.

wstUSR — a wrapped version of stUSR. Unlike stUSR, the token quantity remains fixed; instead, the value of each token grows via staking rewards.

RESOLV — the protocol’s utility token, including governance mechanisms and incentives for long-term user participation. The total supply is capped at 1 billion, allocated as follows:

- 10% for early community participants who helped launch Resolv (unlocked at TGE, with short-term vesting for the largest wallets);

- 40.9% reserved for the ecosystem and community (up to 10% unlocked at TGE, the remainder vested over 24 months);

- 26.7% reserved for the team and contributors (1-year cliff, then linear vesting over 30 months);

- 22.4% reserved for investors (1-year cliff, then linear vesting over 24 months).

stRESOLV — a token granting governance rights and rewards for staking, as well as boosts in the Resolv Points system (explained below). It cannot be purchased; it can only be received from another wallet or by converting RESOLV into stRESOLV. Converting stRESOLV back into RESOLV requires a 14-day waiting period, with no fees charged by Resolv.

The main features of the Resolv protocol can be summarized as follows:

First, users can mint and redeem USR in exchange for the supported assets. Second, the protocol continuously maintains a sufficient level of collateral by hedging ETH and BTC prices through short perpetual futures positions.

Additionally, Resolv maintains a liquid insurance pool that accumulates excess collateral. In the event of adverse market movements, the RLP absorbs potential losses, helping to preserve USR’s stability.

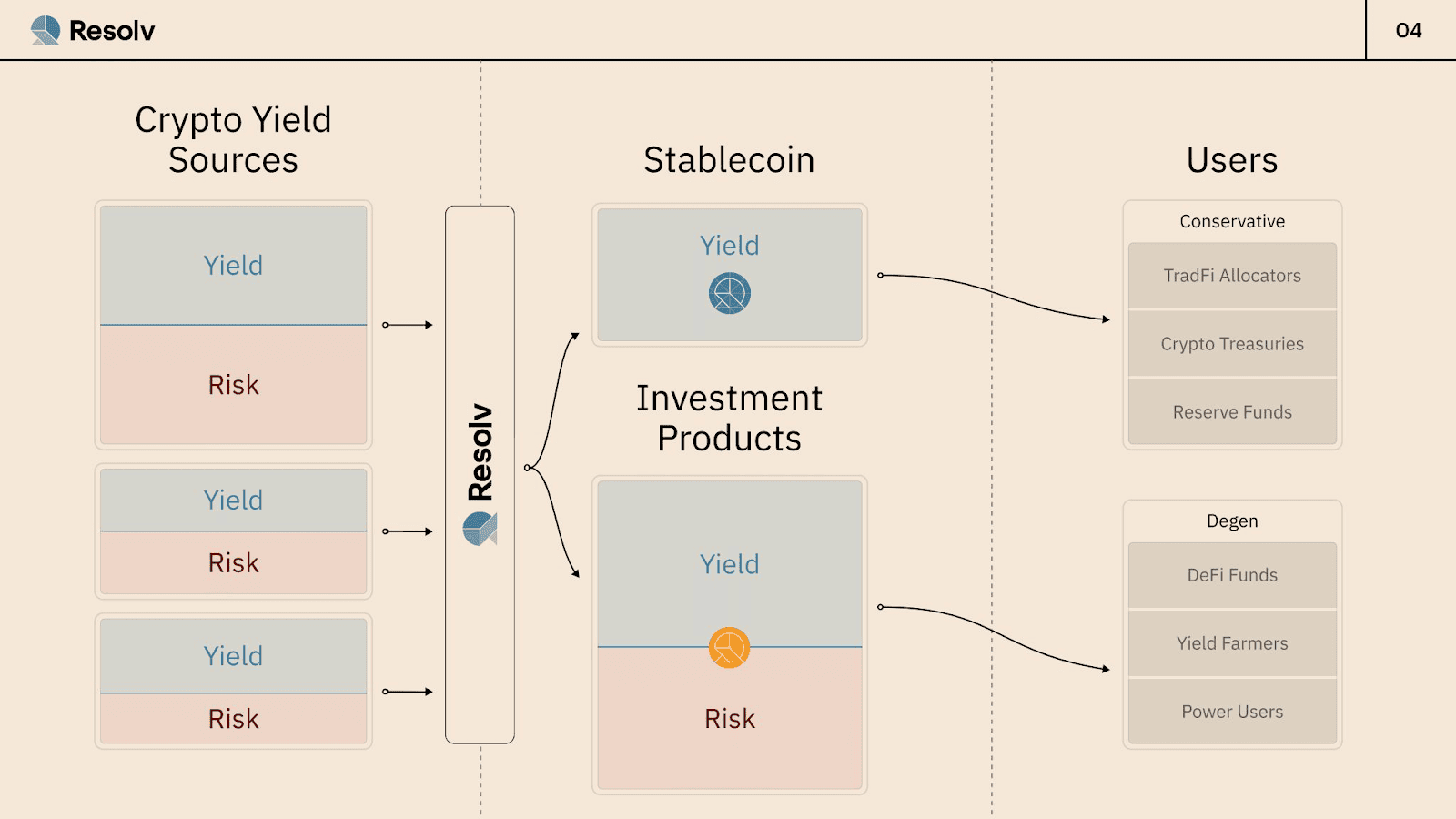

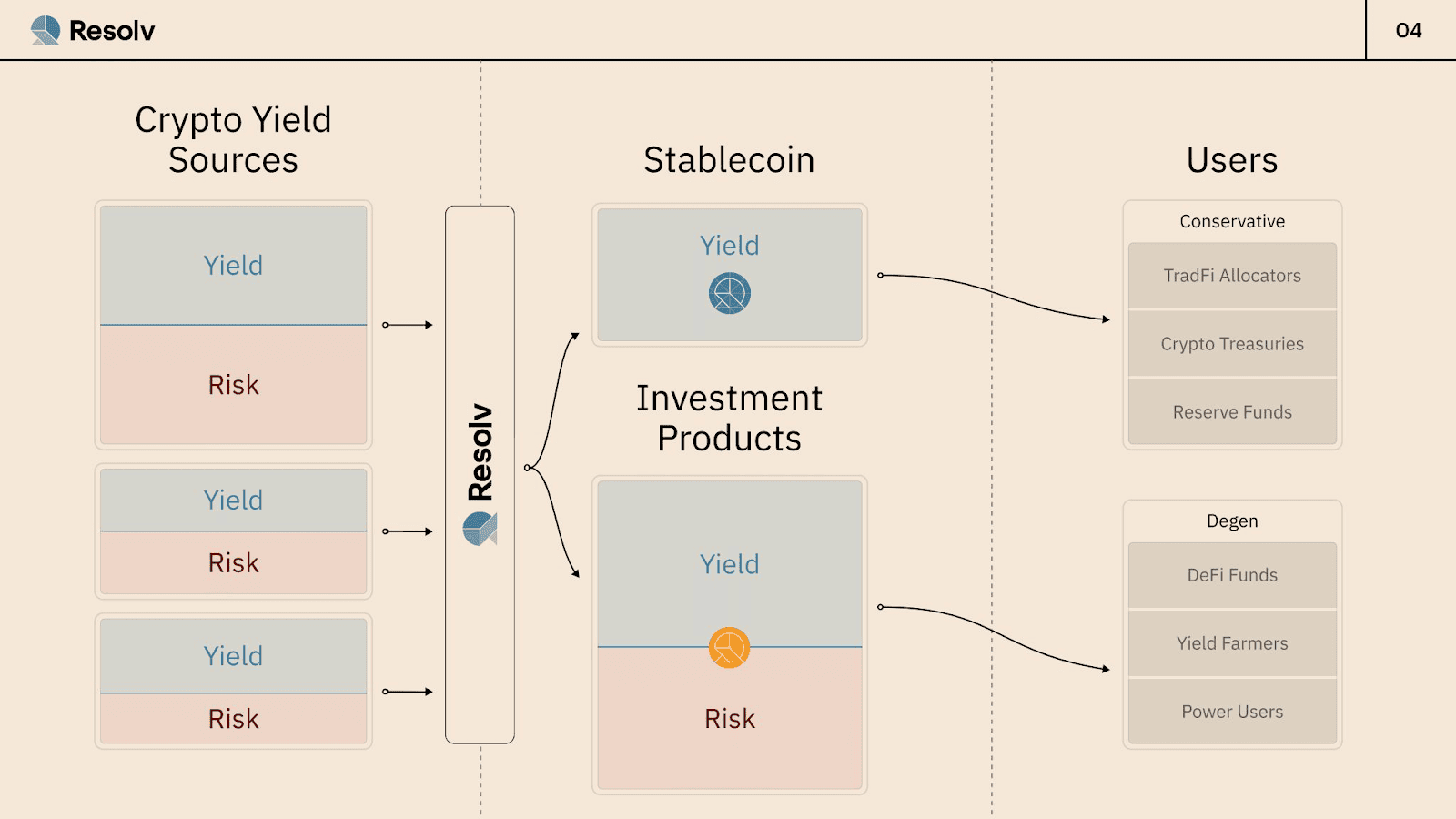

Two-Tranche Structure

Resolv employs a two-tranche structure. The USR stablecoin serves as the senior tranche, while the second component, RLP, acts as the junior tranche and functions as a “safety buffer.” In the event of a drop in reserve value, RLP absorbs losses first, providing additional protection for USR holders.

In traditional finance, a tranche refers to a portion of a financial instrument that is divided according to risk level, return, or maturity. Each tranche has its own characteristics, allowing investors to choose the option that best fits their goals and risk appetite.

In a multi-tranche structure, payments and losses are distributed sequentially: senior tranches receive payments first, followed by junior tranches. In the case of losses, they are absorbed by the junior tranches, protecting senior tranches up to a certain limit.

Despite its advantages, a tranche structure can be complex, especially for less experienced investors. Misjudging risks or lacking sufficient information can lead to significant losses, as seen during the 2007–2008 financial crisis.

.post-accordion-wrapper .accordion-content {

max-height: 0;

overflow: hidden;

}

In Resolv, USR and RLP can only be minted and redeemed by “whitelisted users.” These users can deposit supported assets into the protocol to issue USR (earning 5–6% APY) and RLP (earning 20–30% APY).

Which Assets, Custodians, and Exchanges Does Resolv Work With?

At the time of writing, users can mint USR and RLP against Bitcoin, USDC, USDT, USCC, Ethereum, as well as WBTC, wstETH, weETH, wbETH, and apxETH tokens.

Resolv partners with two custodians — Ceffu and Fireblocks. Through their services, the protocol distributes liquidity across four exchanges: Binance, Hyperliquid, Deribit, and Bybit.

According to the team, Resolv’s architecture offers several key advantages:

- independence from fiat currency;

- efficient capital utilization;

- low price volatility;

- high “built-in” yield;

- scalability;

- risk segregation;

- a trust-minimized design that operates without intermediaries.

What Drives Resolv’s Yield?

The Resolv collateral pool generates income through Ethereum staking and hedging, creating returns for stUSR holders.

Locked USR and RLP form a system that provides scalable yield for different categories of users:

- stUSR offers returns comparable to Ethena (sUSDe) and Sky (sUSDS), while benefiting from the RLP insurance fund for additional security;

- stUSR consistently outperforms treasury-backed stablecoins like USDY;

- RLP, as a moderate-risk, high-yield instrument, has significantly exceeded these benchmarks, giving active users the opportunity to earn extra profits from the protocol.

Competition

Resolv operates in the still-developing, yet already highly competitive, niche of yield-bearing stablecoins.

Key Competitors of Resolv.

USDe by Ethena: A similar delta-neutral stablecoin, but without a junior tranche. Ethena’s large market capitalization stems from its first-mover advantage. Resolv, on the other hand, offers RLP with targeted risk absorption and higher yield.

Traditional Stablecoins (e.g., USDC): Centralized issuers, unlike Resolv, do not provide native yield.

LSD-Based Stablecoins (Liquid Staking Derivatives), e.g., eUSD by Lybra: ETH staking provides stable, but limited, returns. Resolv’s approach, leveraging funding through perpetual futures, can outperform in bullish markets but carries higher volatility.

Stablecoins Using Other Hedging or Lending Strategies: Resolv’s distinguishing feature is its two-token model.

Despite the large number of projects in the yield-bearing stablecoin space, Kozlov asserts, that they currently compete only weakly with each other.

Resolv Points System

Resolv rewards users with points for various activities within the protocol. Each action earns a base payout.

Boosts increase the base rewards for specific activities. They are calculated as percentages of the base payout and added on top.

All users automatically receive an Epoch Boost. There are several epochs, with the boost decreasing in each new epoch — meaning early users receive higher boosts.

Formula:

Total Points = Base Payout ? (1 + Boost1 + Boost2 + … + BoostN)

The Resolv Points program is divided into multiple seasons, which align with RESOLV token distribution rounds. Each season is unique, differing in:

- duration;

- mechanics;

- allocation;

- airdrop schedule.

The first season ended in May 2025. The second runs from May 9 to September 9, 2025. During this season, the team aims to expand Resolv’s user base and promote its product suite. The airdrop allocation for the second season will be at least 4% of the total token supply.

Base points rates:

- 20 points per day for holding 1 USR

- 5 points per day for holding 1 stUSR

- 20 points per day for holding 1 RLP

- Other.

Daily income boosts:

- +25% for owning a Resolv Blueprint NFT

- +20% for referring a friend

- +10% for users who participated in Season 1

- +10% for users who contributed to the first $100M TVL

- Up to +100% for users who stake RESOLV

Delta-Neutral ? Risk-Free

A delta-neutral structure provides portfolio stability in dollar terms. However, reliance on price hedging also increases exposure to counterparty risk, negative funding, and liquidity risk.

Counterparty Risk

Resolv integrates with both centralized and decentralized exchanges for futures hedging. However, a centralized exchange can go bankrupt, and a DEX protocol could be attacked.

We’ve seen what happened with FTX — even major platforms can collapse during sharp price movements and cascading liquidations.

Resolv mitigates risk through three mechanisms:

- Collateral is held outside centralized exchanges, integrated with institutional custodians;

- Futures liquidity sources are diversified, with counterparty limits enforced at the protocol level;

- Risk is isolated in a protective layer (RLP), so an exchange default does not affect USR, the “stablecoin” layer.

Liquidity Risk

When users redeem tokens to reclaim their assets, Resolv closes the corresponding futures positions.

In extreme market scenarios, however, futures liquidity may be insufficient, leading to significant slippage as volumes can dry up during cascading liquidations.

During such events, minting and burning tokens may incur higher costs. For example, a user might need more Ethereum to mint USR simply because the average transaction price differs from the current market rate.

The protective layer (RLP) may also lack enough liquidity to cover losses.To mitigate this, Resolv uses a capital adequacy ratio. If RLP liquidity falls to a level where USR collateral drops below 110 %, the protocol temporarily halts the issuance of new stablecoins (while redemptions remain active) to maintain proper collateralization. RLP redemptions are also paused until the ratio returns to its baseline. Meanwhile, RLP holders can still sell their tokens on secondary markets if they wish to exit their positions.

Negative Funding Rates

Negative funding rates on futures positions can offset Ethereum staking profits and even cause losses for Resolv.

Even highly liquid ETH and BTC futures can experience sharp funding rate fluctuations when significant price movements create a gap between spot and futures prices. Such conditions can lead to losses in delta-neutral strategies.

According to Resolv’s team, it would take 60–90 days of extremely low funding rates to fully deplete the RLP protective layer. Such prolonged drops have never occurred, thanks to arbitrage mechanisms.

Arbitrageurs could exploit these conditions to earn double-digit, risk-free returns. Even in the event of a significant funding rate decline, only the RLP layer would be affected — USR, as a stablecoin, would retain full collateralization.

4/ The Role of RLP

The Resolv Liquidity Pool (RLP) acts as an insurance layer, absorbing protocol risks like liquidation losses and negative funding rates to protect USR holders. RLP offers higher yields to users willing to underwrite these risks.

— boy ?? (@tollyvx) June 7, 2025

Resolv Labs has already raised over $10 million in investment. The funding round was led by Cyber.Fund and Maven11, with participation from Coinbase Ventures, SCB Limited, Arrington Capital, and Animoca Ventures.

Support from these well-known funds provides the project with credibility and resources for growth.

Resolv offers an alternative approach to stablecoin architecture, based on risk segregation across two layers — drawing on Kozlov’s experience with structured products in traditional finance.

Two years after its launch, Resolv serves over 50 000 users, reflecting a strong product-market fit.

How Resolv navigates different market cycles — maintaining both dollar parity and sustainable yield — will determine whether it becomes a key DeFi instrument or a cautionary tale.