Between 23 August and 30 August 2025, Incrypted recorded 35 investment rounds. Of these, 23 disclosed the details of the funding raised, raising $820.5 million. These include both classic venture capital deals and deals to raise capital through the issue of securities and mergers, as well as accelerators.

Classic venture rounds

During this period, 15 projects received funding from investment companies. In particular, these are:

- $58 million — Rain. The fintech platform that offers infrastructure for issuing bank cards with support for settlements in stablecoins has completed a Series B round. It was led by Sapphire Ventures with participation from Dragonfly, Galaxy Ventures, Endeavor Catalyst, Samsung Next, Lightspeed, and Norwest. It brought the project’s total funding to $88.5 million.

- $40 million was provided by M0. The stablecoin platform received these funds as part of a Series B round with the participation of Polychain, Ribbit Capital, and the Catalyst Fund managed by Endeavor. The total funding amounted to $100 million. M0 is a universal stablecoin platform focused on flexibility, security, and scalability. It offers the infrastructure for launching such assets pegged to the dollar.

- 20 million to OrangeX. The global centralised cryptocurrency exchange announced the completion of an investment round led by Kryptos and also involving SCI Ventures, NGC Capital, and Phase Capital. The company received the funding in the first half of 2025, but has only announced it now. According to the release, the funding will be used to develop the project and obtain new licences.

- $20 million — aPriori. Monad, a liquid staking protocol on the Monad blockchain, has closed a strategic round with the participation of HashKey Capital, Pantera Capital, Primitive Ventures, IMC Trading, GEM, Gate Labs, Ambush Capital, and Big Brain Collective. The project features the use of MEV to increase the profitability of staking and non-custodial storage of funds.

- $15 million — Hemi Network. The project, which is positioned as the largest programmable layer based on bitcoin, closed an investment round led by YZi Labs (formerly Binance Labs), Republic Digital, and HyperChain Capital, as well as with the participation of Breyer Capital, Big Brain Holdings, Crypto.com, and others. The project team claims to be able to provide EVM-level programmability using its own virtual machine.

- 15 million — The Clearing Company. The forecasting platform announced that it has raised $15 million in a seed round of funding led by Union Square Ventures. Other participants included Haun Ventures, Variant, Coinbase Ventures, Compound, Rubik, Cursor Capital, Asylum, and a number of private investors. The startup was founded by former Polymarket and Kalshi employees.

- $13 million — Swarm Network. The decentralised AI protocol announced funding totalling $13 million. Of this amount, $10 million was received in the form of licences to manage agents, separate NFTs that provide owners with remuneration. Another $3 million came in the form of strategic funding from Sui, Ghaf Capital, Brinc, Y2Z, and Zerostage.

- 10 million — MAGNE.AI. The company has closed a strategic funding round backed by Castrum Capital, DuckDAO, TB Ventures, and Becker Ventures. The funds will be used to develop a smartphone designed to combine Web3 and AI.

- 6.75 million — Hyperbot Network. The project received a strategic injection from Pop Culture Group. The solution is a tool for trading contracts on the blockchain based on artificial intelligence, designed to analyse large amounts of data, intelligently execute transactions and copy them in one click.

- 6.7 million — Kira. The payment infrastructure provider received these funds as part of the seed round. Investors included Blockchange Ventures, Vamos Ventures, Stellar Blockchain, Grit Ventures, Credibly Neutral Ventures, and others. The funds will be used to expand the firm’s regional presence.

- 5.5 million — Metafyed. The RWA platform announced the completion of the round with the support of such counterparties as Block Tides, Positive Venture DAO, Omni Chain Ventures, Chain Valley Capital, and Zero2Launch. The project is a platform for tokenised private lending and asset-backed investments focused on small businesses primarily in Asia.

- 5 million — Multipli.fi. Profitability Protocol raised the funds in a strategic round without disclosing details of the investors. The funds will be used to expand profitable institutional-level products for assets such as bitcoin and tokenised gold. According to the release, the project team plans to launch its own token by the end of 2025.

- 5 million — Moonveil. The Web3 gaming ecosystem has announced that it has received funding from Unicorn Verse. The funding will be used to empower the community and strengthen the position of the MORE token.

- 4.5 million — Credit Coop. The project has closed a seed round led by Maven 11 and Lightspeed Faction, as well as with the participation of Coinbase Ventures, Signature Ventures, Veris Ventures, TRGC, and dlab. It is an innovative platform for decentralised private lending secured by future cash flows.

- $420,000 — Trepa. The project team has announced the completion of a pre-seed round led by Colosseum and with the participation of Ignight Capital and a number of business angels. This is a Web3 platform that rewards users for participating in various online activities. The project’s goal is to create a motivational ecosystem in the blockchain field.

Several other projects have attracted funding but have not disclosed details.

In particular, YZi Labs announced a strategic investment in USD.AI. The project developers aim to create a stablecoin platform that scales with global computing needs. The platform offers loans secured by physical AI hardware, allowing companies to obtain financing using, for example, GPUs.

The EdgeX Labs project received an undisclosed amount of investment from KuCoin Ventures. The funds will be used to build EdgeX’s global edge network and develop its large-scale ecosystem of AI agent-based applications. The studio’s infrastructure allows agents to work without the use of the cloud, the team noted.

The Panora team announced the completion of the funding round without disclosing the amount and its details. Frictionless Capital, Aptos Labs CEO Avery Ching, and Aptos Labs Head of Development Greg Nazario participated in the round. This is a superapp and execution layer based on the Aptos network.

Polymarket, a platform for betting on events in crypto assets, has received an undisclosed amount from 1789 Capital. The latter’s partner, Donald Trump Jr, joined the project as an advisor.

The Centrifuge platform announced a strategic infusion from the Opportunistic Digital Assets Fund, managed by Republic Digital. The funding will be used to accelerate the development of a product aimed at enabling the transferability, composability, and liquidity of RWAs.

Maven 11 and other investors have invested in the Gondor project. The structure of the round, its terms and amount were not disclosed. The solution team is building an infrastructure for prediction markets that will allow the frozen capital to be used for other products.

Global cross-border payments platform Tazapay has announced the completion of its B round with participation from Peak XV Partners, Ripple Labs, Circle Ventures, Norinchukin Capital, and GMO VenturePartners, as well as a number of existing investors. The funding will be used for licensing and expansion of the project’s presence.

The IoTeX project received funding from Animoca Brands. The latter has become a network validator and ecosystem project. IoTeX is a platform that combines AI, blockchain, and hardware devices. According to the developers, the platform allows models to access data from the physical world and monetise it.

ME Group has reported the completion of the Pre-Series A round led by Fenbushi Inc and Hashkey Capital, as well as Solowin Holdings. The studio is a developer of a Web3 information platform.

The DeAgentAI project received funding from Valkyrie Fund. According to the release, the team of this solution is working on the world’s first neural network of agent-based artificial intelligence in the field of Web3.

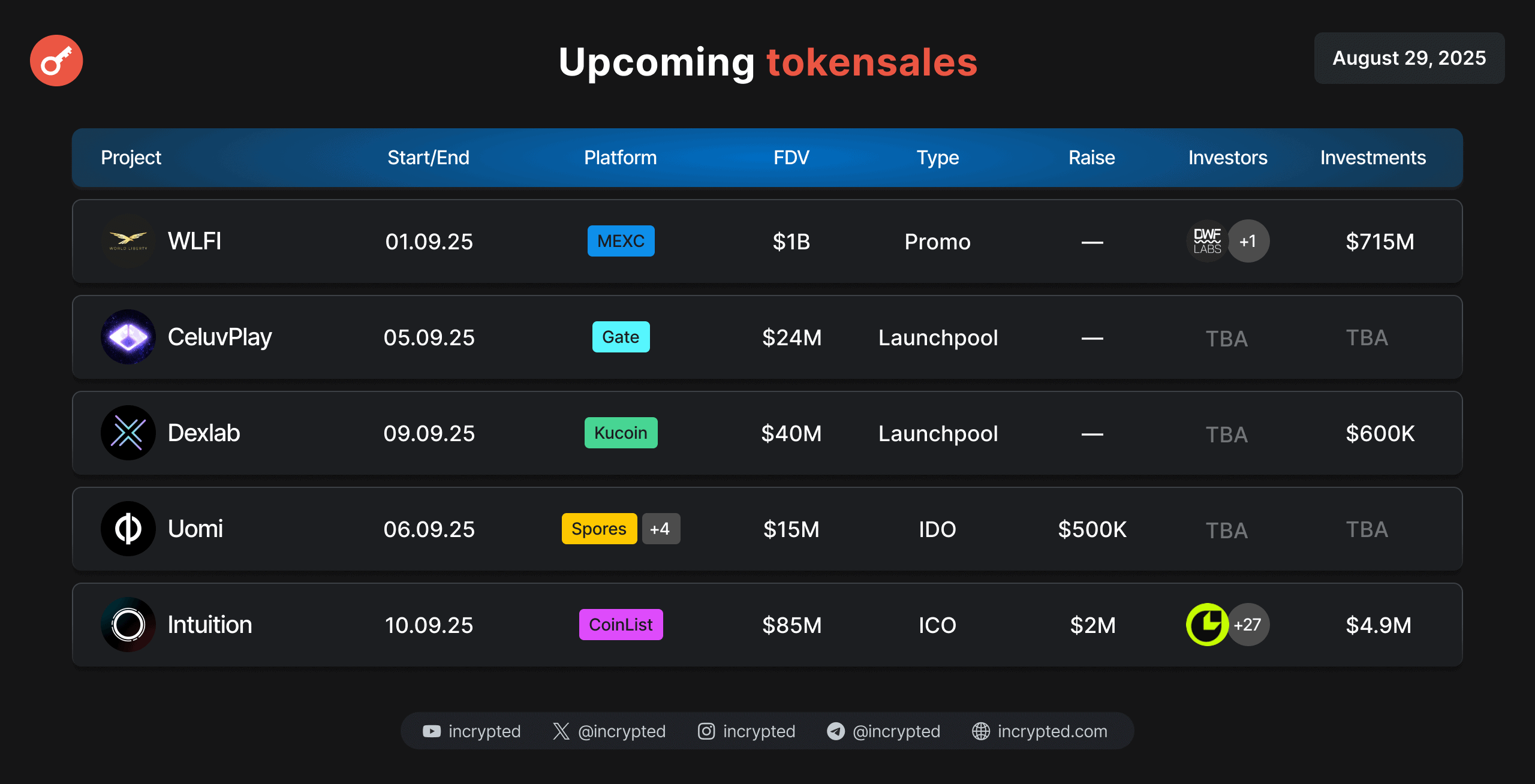

Tokensales

There were no completed tokensales this week. To find out more about current and upcoming token sales, please follow the updates to the relevant section on our website. We also maintain a dedicated Telegram channel.

Corporate placements and deals

This week, the following institutions announced capital raising by issuing securities and/or other financial products:

- $400 million — Sharps Technology. The company raised this capital through a private placement of shares. The funds will be used to create a reserve based on Solana (SOL). Following the news, the company’s stock price jumped by more than 47%.

- $125 million — DeFi Development Corp. The company raised this capital through the sale of shares and the exercise of warrants. Since the beginning of the year, the firm has raised more than $370 million. The new funds will be used to increase the Solana-based reserve and earnings per share.

- 35 million — Labs Companies. The US startup, which develops technologies for enhancing human capabilities through AI, has filed a Form D with the US Securities and Exchange Commission (SEC) to issue debt securities for the specified amount. The purpose and names of the buyers were not specified.

- $23.3 million — AMBTS. The company, launched earlier by the Dutch firm Amdax, announced an investment of €20 million. This is only the first part of the round. It is expected to close in September 2025 with a valuation of €30 million. All funds will be used to buy bitcoins.

- 5 million — The Smarter Web Company. The technology company listed on the London Stock Exchange has announced the placement of 1.9 million shares worth 3.6 million pounds (about $5 million). The company operates a bitcoin treasury, but the statement does not specify what the new capital will be used for.

- 5 million — Crypto Blockchain Industries. The company has raised €5 million from institutional investors to strengthen its bitcoin acquisition strategy. Part of the funds, $1.2 million, was invested in mining, and $0.5 million was invested in CEA Industries. The remaining funds will be used to purchase bitcoins.

Mergers and acquisitions

on 26 August 2025, the Stargate project team announced that the LayerZero Foundation’s purchase offer had been accepted. As part of the deal, StargateDAO was dissolved, and STG tokens can be converted into ZRO at a fixed rate. At the same time, the team stated that the consequences for Stargate users will be minimal.

Also this week, the Arcana Network solution was acquired by Avail. According to the release, Arcana’s Chain Abstraction SDK and wallet will become the core of the Avail Nexus solution, giving users access to cross-chain transactions without bridges and unified liquidity.

Accelerators, grants, and DAO funding

on 23 August, YZi Labs announced the list of projects participating in the EASY Residency Season 1 incubator. There are 16 projects in total, including: AMMO, APRO, Bitway, Byte A.I., ComplyGen, Freebeat.AI, Hubble AI, and Robata. According to the company, EASY Residency is not just a grant programme, but an ecosystem that supports projects at all stages, from mentoring to the formation of strategic partnerships.

on 27 August, Sonic Labs announced the injection of 120,000 S tokens (approximately $40,000) as part of its Innovator Fund initiative into the Fly (formerly Magpie Protocol) project. This is a decentralised trading platform focused on personalised strategies and trading automation in Web3.

The most active investors

YZi Labs, Endeavor Catalyst, Pantera Capital, HashKey Capital, and Republic were the most active investors this week, according to CryptoRank.

What was in focus this week?

Between 23 and 30 August 2025, projects from such sectors as blockchain services, blockchain infrastructure, CeFi, DeFi, GameFi, and others received funding.

As a reminder, last week, the amount of funds raised in the sector totalled $2.48 billion. Follow Incrypted to keep abreast of changes in investor sentiment and major market players.