On July 17, 2025, the price of Ethereum (ETH) soared above the $3400 mark, reaching a high for more than seven months.

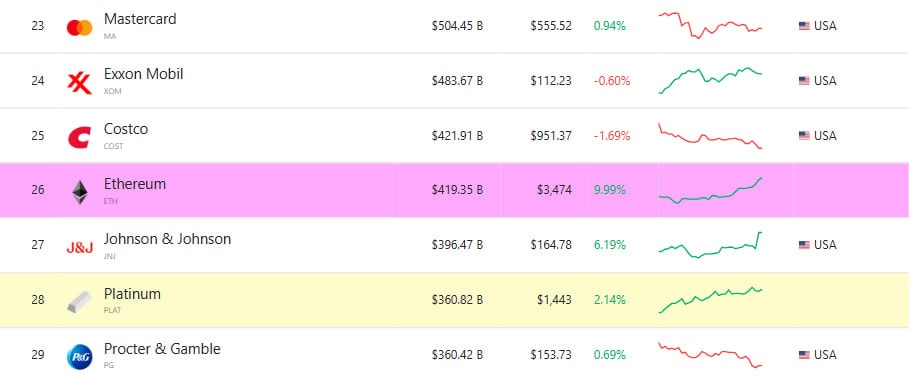

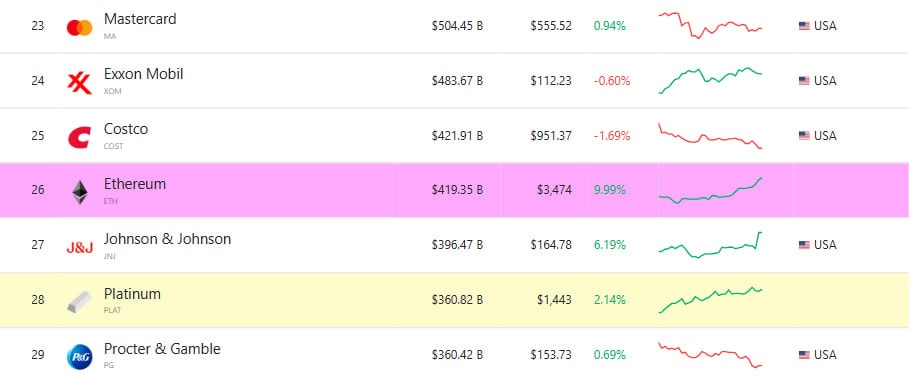

Since the beginning of July, the asset has shown a growth of about 45%, and its capitalization has reached almost $420 billion.

In addition, Ethereum climbed to 26th place in the global ranking of the largest assets by market capitalization, according to Companies Market Cap.

Google searches for the term “Ethereum” have also increased, hitting their highest level since early February 2025.

What do the experts say?

Santiment analysts recorded that the market value of Ethereum has increased by 50% since June 22, 2025, reaching the highest values since the end of January 2025. The number of active Ethereum wallets has exceeded 152 million — the highest among all cryptocurrencies, the experts said.

In addition, the price surge attracted the attention of the community: the level of discussions in social networks reached the maximum since May 2024, when the market showed similar growth rates, Santiment data shows.

Amid Ethereum’s dominance, interest in altcoins has also surged, along with new ambitious price targets. Santiment noted that after bitcoin’s all-time high update and FOMO wave, the excitement has shifted to Ethereum — with predictions of growth to the $4,000 mark circulating on X (formerly Twitter), Reddit and Telegram.

Note, Ethereum’s rise has been accompanied by buying by major players. Many companies and whales have been spending significant amounts of money to acquire the asset and move large amounts of cryptocurrency. Here’s some of it:

- on July 17, World Liberty Financial purchased over 3,007 ETH worth $10 million;

- whale withdrew 88,292 ETH worth more than $298 million from the Kraken exchange in a week;

- SharpLink Gaming accumulated 111,609 ETH worth $343.38 million in eight days;

- three Whales cumulatively acquired 11,513 ETH worth $38.79 million;

- a new wallet withdrew 68,141 ETH worth more than $205 million from FalconX in four days;

- an address believed to be affiliated with Fenbushi Capital withdrew 4,000 ETH worth $12.93 million from the Binance exchange;

- BitMine has announced that it holds $1 billion worth of Ethereum.

In addition, Ethereum’s growth came amid significant inflows into asset-based exchange-traded funds (ETFs). On July 16, the indicator set a historical maximum — $726.74 million came into ETFs. Since the beginning of July, the inflow into Ethereum funds amounted to about $2.3 billion.

BTC Markets crypto analyst Rachel Lucas said in a comment to The Block that Ethereum is increasingly seen as a long-term asset for institutional players rather than just a trading tool. She noted:

“Bitcoin’s dominance is waning — and historically this is a precursor to the altcoin season. Add to this a reduction in supply through steaking, institutional buying and favorable macroeconomic conditions — and we have the stage set for a powerful altcoin cycle.”

Against the backdrop of Ethereum’s growth, reports of a possible altcoin cycle have begun to circulate online. In particular, a trader under the pseudonym misterrcrypto published an image that describes the phases of the cryptocurrency market during the “bull” cycle. According to him, bitcoin grows rapidly at first, followed by Ethereum, which begins to surpass it. Next, large altcoins “shoot up”, and at the end, the alt season begins — everything is growing and euphoria reigns.

LVRG research director Nick Ruck added that Ethereum’s current growth is also supported by the growing number of public companies investing in the coin as a treasury asset.

Eugene Gaevoy, CEO of market maker Wintermute, noted that there is almost no Ethereum available for sale on their OTC platform right now.

Earlier, BitMEX exchange co-founder and Maelstrom investment director Arthur Hayes said that the time has come for Ethereum.

Recall that in July 2025, bitcoin showed significant growth and set a new all-time high at above $123,000. Editorial Incrypted collected the opinions of experts who explained the reasons for the rapid rally of the first cryptocurrency. Read more in the material: