In June 2025, the Plasma project raised $1 billion in deposits in two stages in preparation for the public sale of the XPL token. This is one of the fastest and largest launches in the crypto market in recent years. At the same time, the tokens have not even been distributed to participants yet.

The Incrypted team broke down why Plasma has attracted so much interest, what makes the XPL cryptocurrency special, and how the project managed to raise $1 billion.

Born for Stablecoins

The Plasma project originated as an attempt to create an infrastructure that can address the weaknesses of existing blockchains when dealing with stablecoins. According to the team, it is a tier one solution with built-in bitcoin bridging, EVM compatibility, and an architecture focused on USDT payments with zero fees.

“While Plasma is technically an L1 blockchain with its own consensus mechanism, our bitcoin bridge and design philosophy aligns it with the first cryptocurrency ecosystem, making it what is considered a side chain to bitcoin,” the project documentation reads.

Founded by Paul Fax (co-founder of Alloy) and Christian Angermeier (atai Life Sciences), Plasma has received early support from Tether head Paolo Ardoino, platforms Bitfinex and Bybit, and venture player Founders Fund. This has sparked speculation among some users that the project is part of Tether’s broader strategy to take over payment infrastructure in emerging markets.

According to Delphi Digital, Plasma uses a special split-block architecture. One layer is used for gas-payment smart contracts, while the other is exclusively for USDT transfers with zero fees. Although not yet implemented, this feature illustrates the team’s intention to prioritize payment flows.

PlasmaBFT’s consensus mechanism is optimized for speed, and the ability to anchor bitcoin state differences provides resilience to failures and censorship without being tied to validators. All of this makes Plasma a technically independent blockchain, but compatible with the Ethereum Virtual Machine (EVM), according to documentation.

The project is also actively building business relationships: Morpho, Aave, Sky (formerly MakerDAO), Curve, and Ethena are among the announced integrations. In addition, the Plasma team emphasizes real-world use cases. An example of this is the cooperation with the African platform Yellow Card and other fintech companies in emerging economies.

This essentially emphasizes the project’s strategy of moving beyond the traditional crypto market and indicates its focus on specific payment needs of users.

Active support from Ardoino, who is the CEO of Tether and CTO of Bitfinex, the USDT-centricity and the push towards emerging markets has led some in the community and media to characterize Plasma as a kind of “pocket blockchain” of Tether. And while the project does focus on a specific stablecoin, there is no evidence of any direct dependence on the USDT issuer’s management.

Unlimited Appetite

The native XPL token is central to the Plasma ecosystem. It is used in consensus mechanism, governance, staking, and interaction with DeFi tools. Although USDT transfers are done with zero fees, XPL is used to pay gas for smart contract transactions and other fee-based transactions on the network.

The overall tokenomics model has yet to be fully disclosed, but there is 10% of the offering for public sale at a fully diluted valuation (FDV) of $500 million.

The tokensale itself was realized through Sonar, a platform from Echo that allows the sale to take place without intermediaries. The process took place in several stages.

Starting from June 9, users were given the opportunity to deposit stablecoins (USDT, USDC, USDS or DAI) into special vaults on the Aave and Sky platforms via the Plasma website. The amount of guaranteed allocation was determined by a formula that took into account the length of time the funds were blocked. The earlier the deposit was made and the longer it was held, the more points (units) were awarded to the participant.

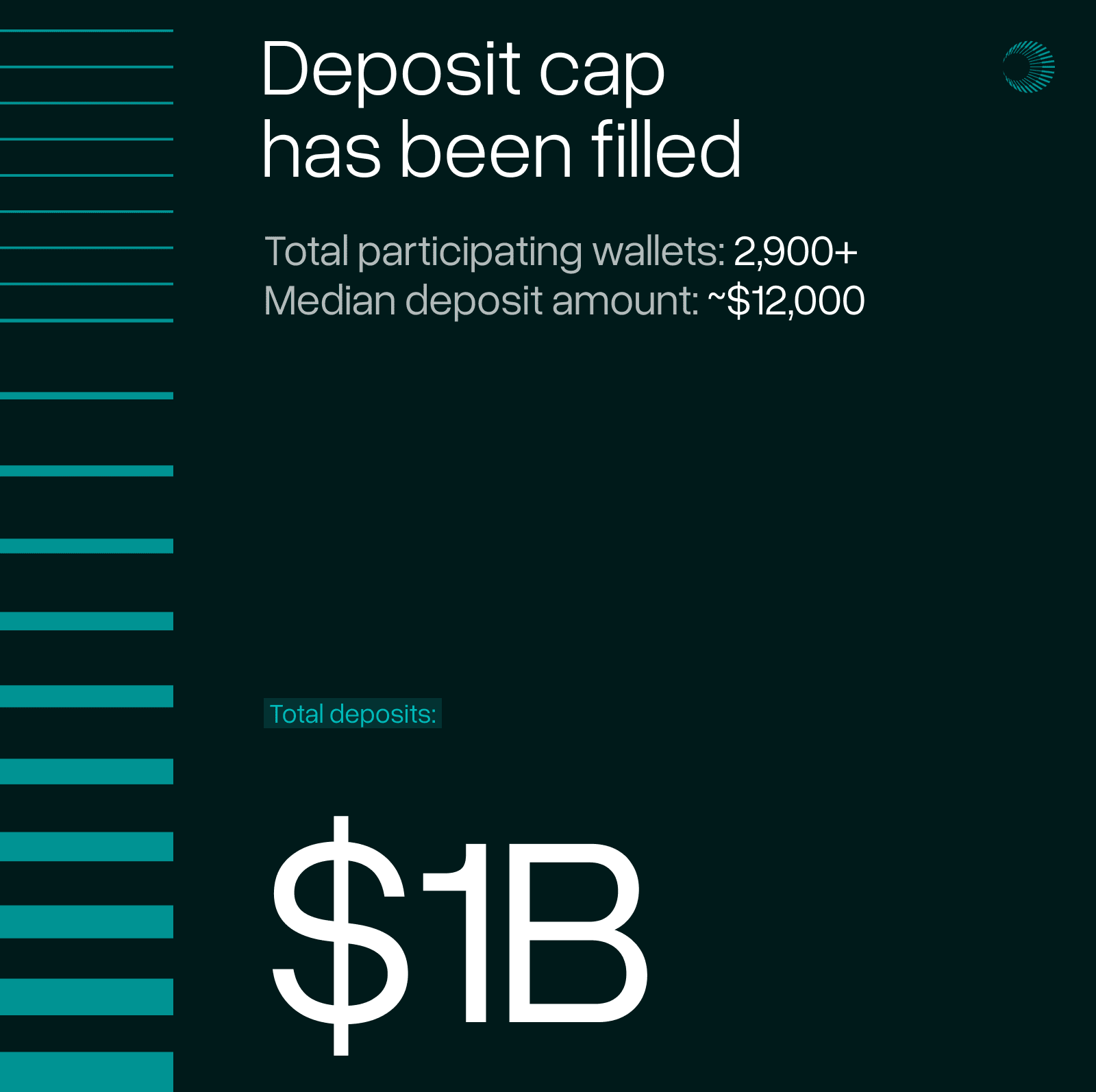

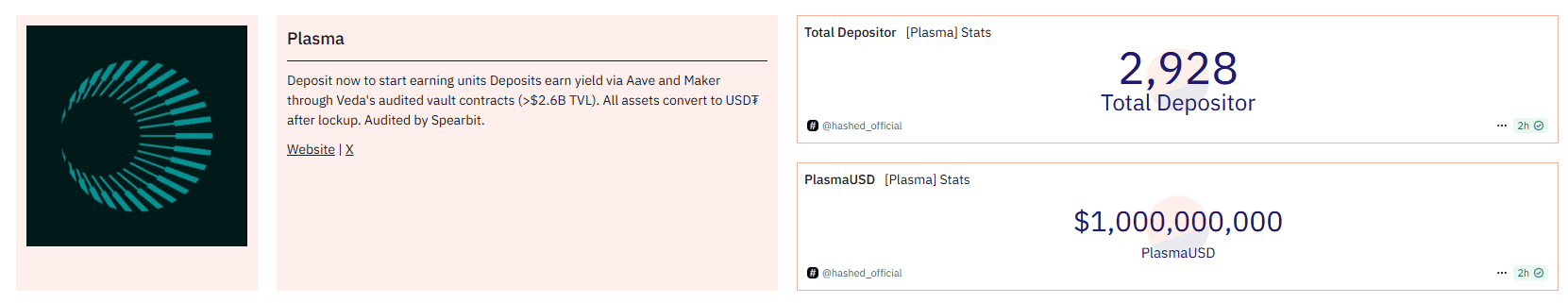

In the first “round” of the tokensale, Plasma raised $500 million in 5 minutes with the participation of 1108 wallets, and the median deposit amounted to about $35,000. However, the developers later increased the limit to $1 billion and held an extended fundraiser, which was announced just an hour before the start. The limit filled in 30 minutes. A total of 2,929 wallets participated in the two rounds.

As the team explained, deposits are not a token sale — they only entitle you to participate. At the end of the blockchain period, the stablecoins in the vaults are converted to USDT on Ethereum.

“At the end of the deposit period, all stablecoins in the vault are converted to USDT on the Ethereum blockchain. The assets are then transferred to Plasma as USDT0 via a bridge based on LayerZero. The same vault contracts will be deployed in the beta version of the Plasma mainnet. Users will be able to withdraw USDT0 to Plasma using their vault tokens on Ethereum,” the project’s documentation says.

All funds remain with users and will be moved to the mainnet. Allocation will depend on the accumulated units. The distribution of XPL tokens is still to come, it will take place at $50 million at the previous valuation.

This model of tokensale, according to some users, is an alternative to airdrop and closed rounds to a more transparent distribution system. Participants know the “rules of the game” in advance and influence the size of the allocation not just with their wallet, but with their time and loyalty.

Criticism, support, and market rates

The impressive deposit collection result has drawn the community’s attention to tokensale. According to Etherscan, the top ten wallets accounted for 40% of the total volume of the first phase. Meanwhile, one participant spent over $100,000 in commissions alone to deposit 10 mln USDC. Such cases have raised questions about the fairness of the distribution procedure.

A CoinFund investor under the nickname 0xDiplomat compared Plasma to the Stable project and noted a key difference: the former has real capital backing from Bitfinex and Tether, while Stable relies only on Ardoino’s status as an advisor. He also emphasized that Plasma has the advantage of a bitcoin-bridged L1 architecture and more extensive infrastructure.

An analyst and host of the 0xResearch podcast under the nickname salveboccaccio stated that Plasma could take up to 30% of global USDT transaction volume, displacing Tron, the current segment leader. He emphasized that the success of the project will depend on the level of activity in real payment scenarios and the ability to attract emerging markets.

In turn, a trader under the nickname 0xG00gly called stablecoins “the future of digital money” and noted that Plasma could become a global settlement layer for them. In his opinion, this market will inevitably move into the trillion-dollar zone, and the infrastructure to match that scale is needed.

Betting on Stablecoins

According to the previously mentioned Delphi Digital report, the stackablecoin market is a fast-growing sector that has already reached $230 billion, with huge potential in real-world usage scenarios:

Delphi analysts emphasize that even capturing 0.1% of global payment turnover can bring billions of dollars in capitalization to a network like Plasma.

The project is betting on transforming stablecoins from a derivative instrument into a primary settlement layer. By the volume of USDT issuance (about $155 billion), the scale of use in developing countries, and the support from Tether and Bitfinex — it does have a chance to capture some traffic from Tron. It could also carve out a niche for a more structured, EVM-compatible solution, according to Delphi Digital.

In addition, the Plasma team is already preparing for the next steps. They plan to launch a beta version of the mainnet, bridge and the implementation of a zero commission model. If the technical promises are fulfilled, the project could indeed become an L1 network built for a specific payment function.

In all likelihood, Plasma is a bet that stablecoins will finally transform from a tool of traders to a full-fledged pillar of the global economy. Tether’s support, institutional attention and tokensale result confirm the market’s confidence.

However, the high competition in the sector and the need to realize technical promises make the future of the project both promising and requiring close attention.