In the current cycle, a trending crypto asset may come to light not as a result of several years of development and careful preparation, but from a simple publication in a social network. Moreover, this is not an exaggeration. Believe.app was launched in April 2025 with just such a proposal.

In a matter of weeks, the platform became one of the most popular launchpads in the Solana network. The capitalization of its token Launch Coin (LAUNCHCOIN) in the period from May 12 to 15, 2025 increased tenfold, reaching $319 mln, according to CoinMarketCap.

The emergence of Believe has largely intensified user interest in the concept of Internet Capital Markets (ICM) — a crowdfunding model where investors directly interact with a project via a blockchain platform. Almost any idea, product, or development can be tokenized.

Incrypted’s editorial team analyzed the growing popularity of Believe.app and the ICM concept gaining momentum.

I Want to Believe

The Believe.app platform is the result of the transformation of Clout.me, a SocialFi project launched by entrepreneur Ben Pasternak. It initially allowed users to issue tokens based on their personal brands. However, the platform faced criticism pretty soon: speculation, lack of a scalable idea, and reliance on personal recognition.

Despite this, Pasternak had no plans to let up, and rebranded in April 2025. The team announced the launch of Believe.app, a new version of the launchpad focused on tokenizing ideas rather than brands from specific people. Anyone can now create a token for a project, app, or even a meme by simply posting a tweet mentioning a Believe account.

The system works on a bonding curve model. This means that smart contracts algorithmically determine the price of an asset depending on the volume of tokens already issued through this mechanism. Once the asset reaches a capitalization of $100,000, it gets access to liquidity on the Meteora platform.

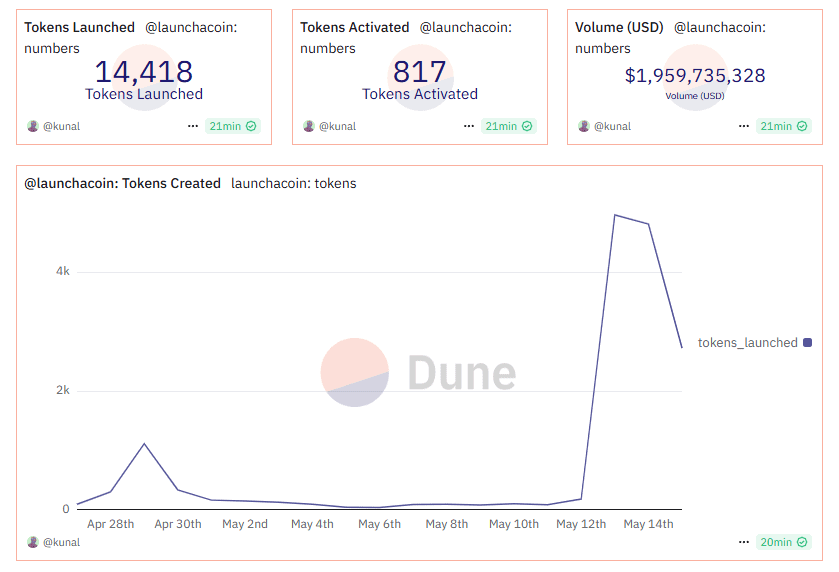

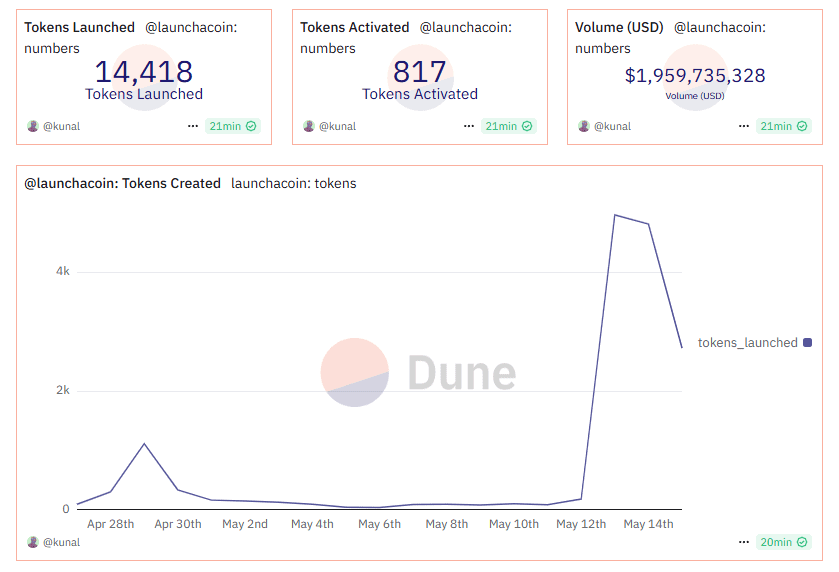

The project gained serious momentum in a short period of time:

The platform’s flagship token — Launch Coin — grew more than 20 times between May 12 and May 15, reaching a peak capitalization of $354 million. The token was created on Clout.me and was previously called PASTERNAK.

The Believe launchpad itself is actively used not only by fans of meme coins, but also by creators of various projects. For example, the DUPE token was launched by the developers of the Dupe.com aggregator, BUDDY is associated with the CreatorBuddyX AI assistant, and NOODLE is an asset of a game similar to the well-known “snake”.

All you need to create a token is a valid X account and a suitable project. The user tags the Believe account in conjunction with a post that mentions their idea or product. Developers, in turn, track mentions of their own account in publications and select interesting proposals.

If the platform representatives find a promising idea or project, they create a corresponding token with the help of the launchpad. Thus, any proposal can potentially be transformed into a tokenized asset. For that to happen, though, you need to create something that has the potential to capture the team’s attention.

“At Believe, we’re creating a new way to fund the future — where attention becomes capital, and anyone with a good idea can get funded by the community, fast. Whether you’re an individual builder, a disparate team, or just someone with a dream, we’re excited to help you get started,” the website says.

The main difference between the platform and pump.fun or LaunchLab appears to be the bet on projects that interest users. While other launchpads offer the opportunity to create literally any token that often lacks utility, Believe emphasizes ideas that can offer the community something meaningful.

But where do the roots of Believe.app and the very concept of tokenizing any idea grow from? The answer to this question lies in the acronym ICM, which we will discuss next.

What is Internet Capital Markets?

Internet Capital Markets (ICM) is a concept to create decentralized, open markets where capital is available to everyone and barriers to investment are minimal.

Unlike a public offering (IPO) or venture capital funding, ICM allow access to capital with “minimal effort.” In essence, an app, idea, or concept becomes an asset that can be bought, sold or backed.

Part of the crypto community has described ICM as a “decentralized IPO” where investments are not built on legal agreements, but on community attention and engagement. Anyone can become an early investor by simply purchasing a token and giving the project the opportunity to receive investment directly.

Some compare this concept to an initial coin offering (ICO). However, in the case of an ICM, the creation of a token is theoretically not the main goal, as has often been the case with ICO. The main focus is on the realization of a project that can benefit the community, and the launch of the asset is seen as a financing tool.

In reality, this is a rather thin line where the wording may not correspond to reality.

Technologically, ICM at this stage are realized through the Solana blockchain. Its performance (up to 50,000 TPS), low fees and interoperability make the network suitable for such transactions, according to many analysts.

According to Multicoin Capital managing partner Kyle Samani, Solana is already capable of handling up to 10% of Nasdaq’s daily volume. Its architecture allows thousands of assets to be launched and traded without network congestion, which is critical for ICM ecosystems, he emphasized.

The main feature of the concept, if you look at various social media and media statements, is the influence of internet culture. In essence, it is not just quick access to capital, but a kind of “faith market”.

Under the guise of this idea, both tokenization of projects aimed at real benefit like SuperFriend (a chatbot for communicating with code) and the launch of tokenization for solutions focused on user entertainment are being “packaged”. As a result, the market is driven largely by behavioral economics and trends rather than strict financial models.

The popularity of the ICM concept can be indirectly evidenced by the fact that the Believe.app ecosystem has received its own category on the CoinGecko website.

Moreover, analysts point to the possibility of the trend spreading to other blockchains. According to them, L2 solutions on the Ethereum network and specialized AI projects may launch their own versions of ICM infrastructures.

Two Camps

Internet Capital Markets is one of the most debated topics in the industry at the moment. Some call it a new paradigm of early investment, while others call it a crypto bubble and a banal disguise for meme coins.

According to Blockworks, Believe.app ranks third in terms of token launches among Solana launchpads. For example, on May 14, more than 5,000 new assets appeared on the platform, which accounted for about 14% of the share of the entire launch market in the mentioned period.

Some users even admit that Believe.app will manage to squeeze leaders like pump.fun. In their opinion, such growth is the result of not only convenience, but also the social design of the project.

“A lot of this may be unsustainable, but right now Believe.app is gaining momentum. Over $5 million in revenue minutes in the last 24 hours, with another $5 million paid out to creators,” said Delphi Research analyst Simon Shockey.

However, there is another side to the story. Influencer under the nickname DannyCrypt and The Nifty project partner Ryan Hof point to an oversupply of tokens, as well as the platform’s vulnerability to scams. Although they like the concept itself, its current form raises a lot of questions among users and analysts alike.

In addition, although the U.S. Securities and Exchange Commission (SEC) and other regulators have not yet addressed the topic of ICM, many users believe that such an investment scheme will sooner or later attract the attention of the authorities. Already now in social network X one can find opinions that Believe is balancing on the edge of the permissible, and any reaction of regulators can dramatically change the rules of the game.

Nevertheless, even skeptics admit that among the hundreds of “noisy” projects, there may be worthy startups that could not expect to get funding otherwise.

“A combination of crowdfunding, IPOs and meme coins, but frictionless, fun and online,” said Signum Capital investment director Ash Lew.

Believe.app and the Internet Capital Markets phenomenon have come to reflect a new phase of experimentation in the industry. We are seeing a new kind of marketplace taking shape in real time that offers a direct investment model for a wide range of ideas and products. From classic Web2 applications to artificial intelligence and blockchain-based developments, from premium furniture duplication search platforms to GameFi projects.

At the current stage, ICM can hardly replace traditional markets, but they have already proved that the Internet community is ready for new forms of financing when it comes to promising ideas.